Answered step by step

Verified Expert Solution

Question

1 Approved Answer

40) WHICH OF THE FOLLOWING STATEMENTS REGARDING THE STATEMENT OF CASH FLOW IS TRUE? a) The statement of cash flows analyses change in conservative balance

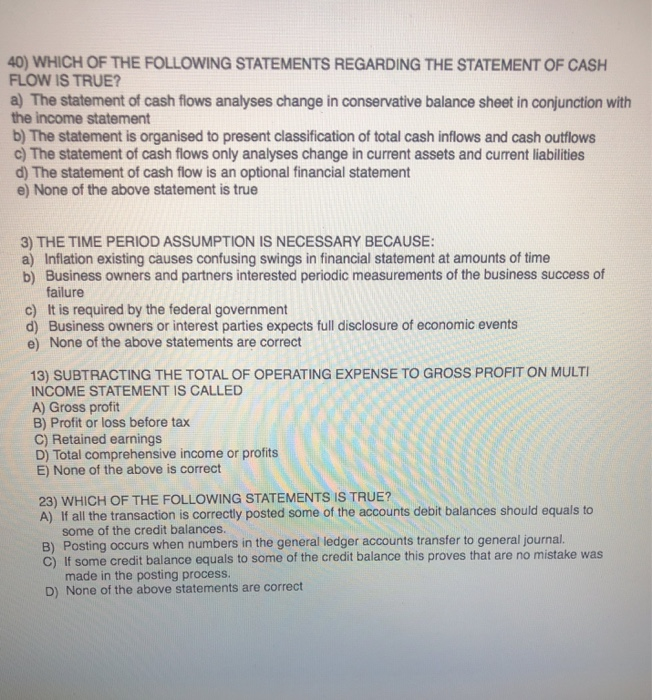

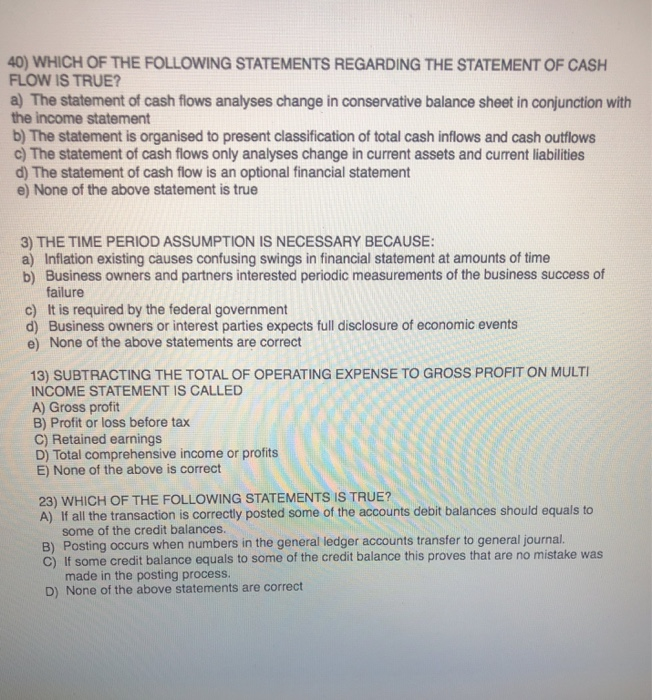

40) WHICH OF THE FOLLOWING STATEMENTS REGARDING THE STATEMENT OF CASH FLOW IS TRUE? a) The statement of cash flows analyses change in conservative balance sheet in conjunction with the income statement b) The statement is organised to present classification of total cash inflows and cash outflows c) The statement of cash flows only analyses change in current assets and current liabilities d) The statement of cash flow is an optional financial statement e) None of the above statement is true 3) THE TIME PERIOD ASSUMPTION IS NECESSARY BECAUSE: a) Inflation existing causes confusing swings in financial statement at amounts of time b) Business owners and partners interested periodic measurements of the business success of failure c) It is required by the federal government d) Business owners or interest parties expects full disclosure of economic events e) None of the above statements are corredt 13) SUBTRACTING THE TOTAL OF OPERATING EXPENSE TO GROSS PROFIT ON MULTI INCOME STATEMENT IS CALLED A) Gross profit B) Profit or loss before tax C) Retained earnings D) Total comprehensive income or profits E) None of the above is correct 23) WHICH OF THE FOLLOWING STATEMENTS IS TRUE? A) If all the transaction is correctly posted some of the accounts debit balances should equals to some of the credit balances. B) Posting occurs when numbers in the general ledger accounts transfer to general journal. C) If some credit balance equals to some of the credit balance this proves that are no mistake was made in the posting process. D) None of the above statements are correct

40) WHICH OF THE FOLLOWING STATEMENTS REGARDING THE STATEMENT OF CASH FLOW IS TRUE? a) The statement of cash flows analyses change in conservative balance sheet in conjunction with the income statement b) The statement is organised to present classification of total cash inflows and cash outflows c) The statement of cash flows only analyses change in current assets and current liabilities d) The statement of cash flow is an optional financial statement e) None of the above statement is true 3) THE TIME PERIOD ASSUMPTION IS NECESSARY BECAUSE: a) Inflation existing causes confusing swings in financial statement at amounts of time b) Business owners and partners interested periodic measurements of the business success of failure c) It is required by the federal government d) Business owners or interest parties expects full disclosure of economic events e) None of the above statements are corredt 13) SUBTRACTING THE TOTAL OF OPERATING EXPENSE TO GROSS PROFIT ON MULTI INCOME STATEMENT IS CALLED A) Gross profit B) Profit or loss before tax C) Retained earnings D) Total comprehensive income or profits E) None of the above is correct 23) WHICH OF THE FOLLOWING STATEMENTS IS TRUE? A) If all the transaction is correctly posted some of the accounts debit balances should equals to some of the credit balances. B) Posting occurs when numbers in the general ledger accounts transfer to general journal. C) If some credit balance equals to some of the credit balance this proves that are no mistake was made in the posting process. D) None of the above statements are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started