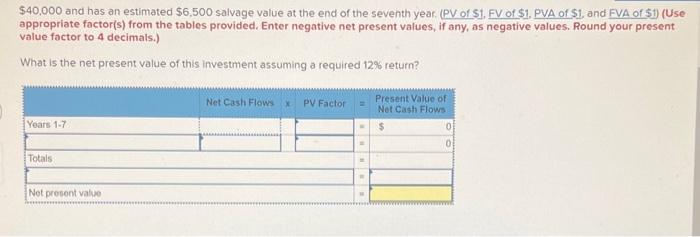

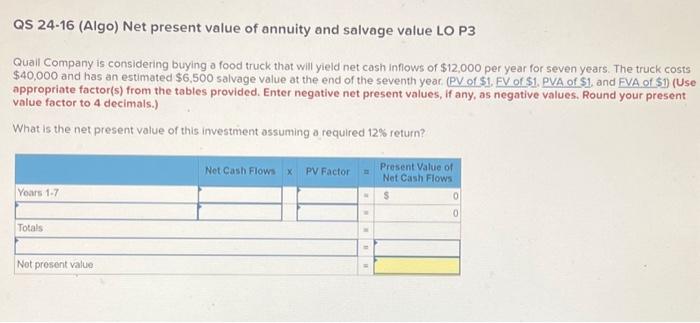

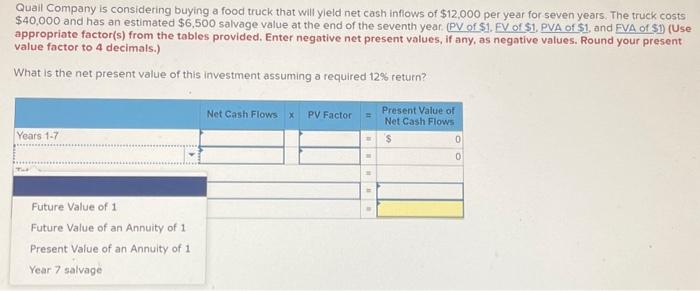

$40,000 and has an estimated $6,500 salvage value at the end of the seventh year. (PV of $1, FV of $1, PVA of $1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided. Enter negative net present values, if any, as negative values. Round your present value factor to 4 decimals.) What is the net present value of this investment assuming a required 12% return? QS 24-16 (Algo) Net present value of annuity and salvage value LO P3 Quail Company is considering buying a food truck that will yield net cash inflows of $12,000 per year for seven years. The truck costs $40,000 and has an estimated $6,500 salvage value at the end of the seventh year. (PV of $1, EV of $1, PVA of $1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided. Enter negative net present values, if any, as negative values. Round your present value factor to 4 decimals.) What is the net present value of this investment assuming a required 12% return? Quail Company is considering buying a food truck that will yleld net cash infiows of $12,000 per year for seven years. The truck costs $40,000 and has an estimated $6,500 salvage value at the end of the seventh year. (PV of $1. EV of $1, PVA of $1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided, Enter negative net present values, if any, as negative values. Round your present value factor to 4 decimals.) What is the net present value of this investment assuming a required 12% return? $40,000 and has an estimated $6,500 salvage value at the end of the seventh year. (PV of $1, FV of $1, PVA of $1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided. Enter negative net present values, if any, as negative values. Round your present value factor to 4 decimals.) What is the net present value of this investment assuming a required 12% return? QS 24-16 (Algo) Net present value of annuity and salvage value LO P3 Quail Company is considering buying a food truck that will yield net cash inflows of $12,000 per year for seven years. The truck costs $40,000 and has an estimated $6,500 salvage value at the end of the seventh year. (PV of $1, EV of $1, PVA of $1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided. Enter negative net present values, if any, as negative values. Round your present value factor to 4 decimals.) What is the net present value of this investment assuming a required 12% return? Quail Company is considering buying a food truck that will yleld net cash infiows of $12,000 per year for seven years. The truck costs $40,000 and has an estimated $6,500 salvage value at the end of the seventh year. (PV of $1. EV of $1, PVA of $1, and FVA of $1 ) (Use appropriate factor(s) from the tables provided, Enter negative net present values, if any, as negative values. Round your present value factor to 4 decimals.) What is the net present value of this investment assuming a required 12% return