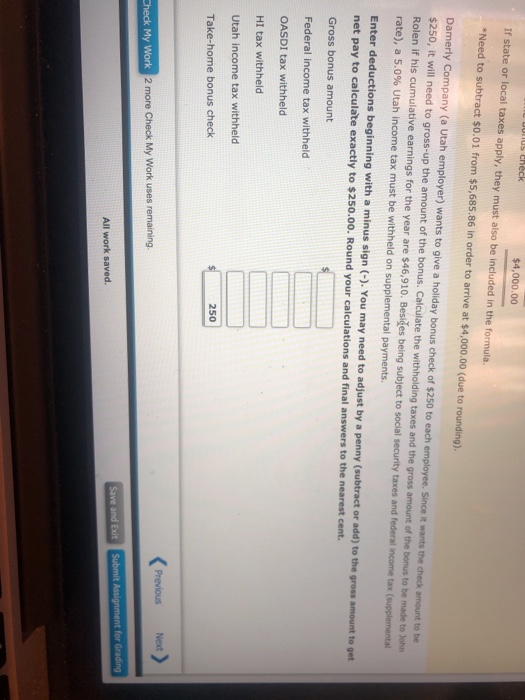

$4,000.00 If state or local taxes apply, they must also be included in the formula Need to subtract $0.01 from $5,685.86 in order to arrive at $4,000.00 (due to rounding). Damerly Company (a Utah employer) wants to give a holiday bonus check of $250 to each employee. Since it wants the check amount to be $250, it will need to gross-up the amount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to John Rolen if his cumulative earnings for the year are $46,910. Besiges being subject to social security taxes and federal income tax (supplemental rate), a 5.0% Utah income tax must be withheld on supplemental payments. Enter deductions beginning with a minus sign (-). You may need to adjust by a penny (subtract or add) to the gross amount to get net pay to calculate exactly to $250.00. Round your calculations and final answers to the nearest cent. Gross bonus amount Federal income tax withheld OASDI tax withheld HI tax withheld Utah income tax withheld Take-home bonus check 250 Next Previous 2 more Check My Work uses remaining All work saved. $4,000.00 If state or local taxes apply, they must also be included in the formula Need to subtract $0.01 from $5,685.86 in order to arrive at $4,000.00 (due to rounding). Damerly Company (a Utah employer) wants to give a holiday bonus check of $250 to each employee. Since it wants the check amount to be $250, it will need to gross-up the amount of the bonus. Calculate the withholding taxes and the gross amount of the bonus to be made to John Rolen if his cumulative earnings for the year are $46,910. Besiges being subject to social security taxes and federal income tax (supplemental rate), a 5.0% Utah income tax must be withheld on supplemental payments. Enter deductions beginning with a minus sign (-). You may need to adjust by a penny (subtract or add) to the gross amount to get net pay to calculate exactly to $250.00. Round your calculations and final answers to the nearest cent. Gross bonus amount Federal income tax withheld OASDI tax withheld HI tax withheld Utah income tax withheld Take-home bonus check 250 Next Previous 2 more Check My Work uses remaining All work saved