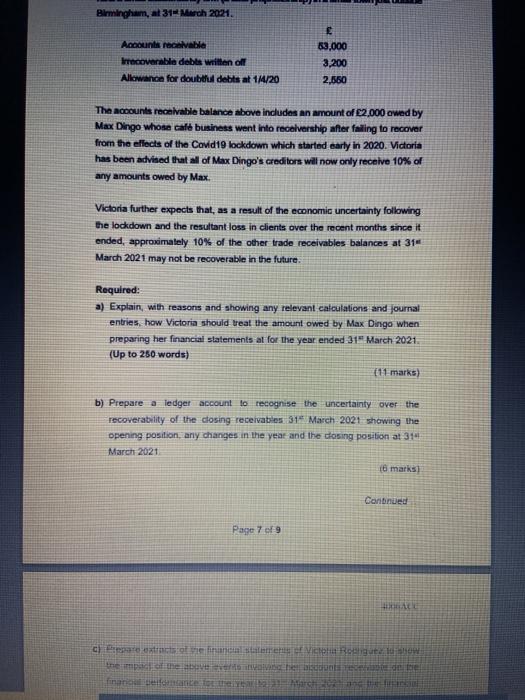

4006ACC c) Prepare extracts of the financial statements of Victoria Rodriguez to show the impact of the above events involving her accounts receivable on the financial performance for the year to 31" March 2021 and the financial position at the year-end. (& marks) (TOTAL 25 MARKS] Birmingham, al 31 March 2021. Accounts receivable recoverable debis written oll Allowance for doubt debts at 11/20 83,000 3,200 2.560 The accounts receivable balance above includes an amount of 2,000 owed by Max Dingo whose cate business went into receivership after failing to recover from the effects of the Cavid 19 lockdown which started early in 2020. Victoria has been advised that all of Max Dingo's creditors will now only receive 10% of any amounts owed by Max Victoria further expects that, as a result of the economic uncertainty following the lockdown and the resultant loss in clients over the recent months since it ended, approximately 10% of the other trade receivables balances at 314 March 2021 may not be recoverable in the future. Required: a) Explain, with reasons and showing any relevant calculations and journal entries, how Victoria should treat the amount owed by Max Dingo when preparing her financial statements al for the year ended 31 March 2021 (Up to 250 words) 11 marks) b) Prepare a ledger account to recognise the uncertainty over the recoverability of the closing receivables 31 March 2021 showing the opening position, any changes in the year and the closing position at 31 March 2021 16 marks Connue Page 7 of 9 care extractoren Victor Relat them the ashe is the financu deformance to Chico 4006ACC c) Prepare extracts of the financial statements of Victoria Rodriguez to show the impact of the above events involving her accounts receivable on the financial performance for the year to 31" March 2021 and the financial position at the year-end. (& marks) (TOTAL 25 MARKS] Birmingham, al 31 March 2021. Accounts receivable recoverable debis written oll Allowance for doubt debts at 11/20 83,000 3,200 2.560 The accounts receivable balance above includes an amount of 2,000 owed by Max Dingo whose cate business went into receivership after failing to recover from the effects of the Cavid 19 lockdown which started early in 2020. Victoria has been advised that all of Max Dingo's creditors will now only receive 10% of any amounts owed by Max Victoria further expects that, as a result of the economic uncertainty following the lockdown and the resultant loss in clients over the recent months since it ended, approximately 10% of the other trade receivables balances at 314 March 2021 may not be recoverable in the future. Required: a) Explain, with reasons and showing any relevant calculations and journal entries, how Victoria should treat the amount owed by Max Dingo when preparing her financial statements al for the year ended 31 March 2021 (Up to 250 words) 11 marks) b) Prepare a ledger account to recognise the uncertainty over the recoverability of the closing receivables 31 March 2021 showing the opening position, any changes in the year and the closing position at 31 March 2021 16 marks Connue Page 7 of 9 care extractoren Victor Relat them the ashe is the financu deformance to Chico