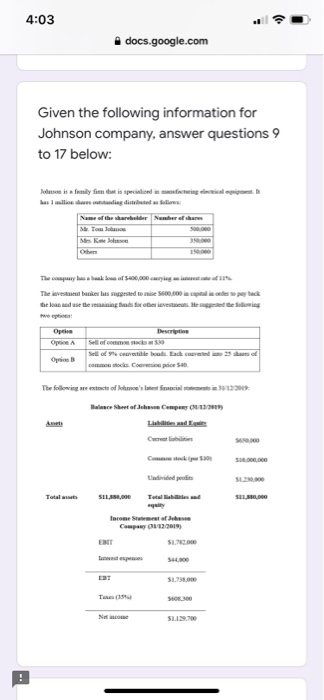

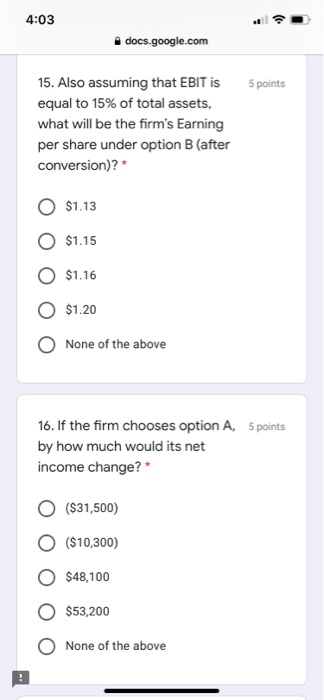

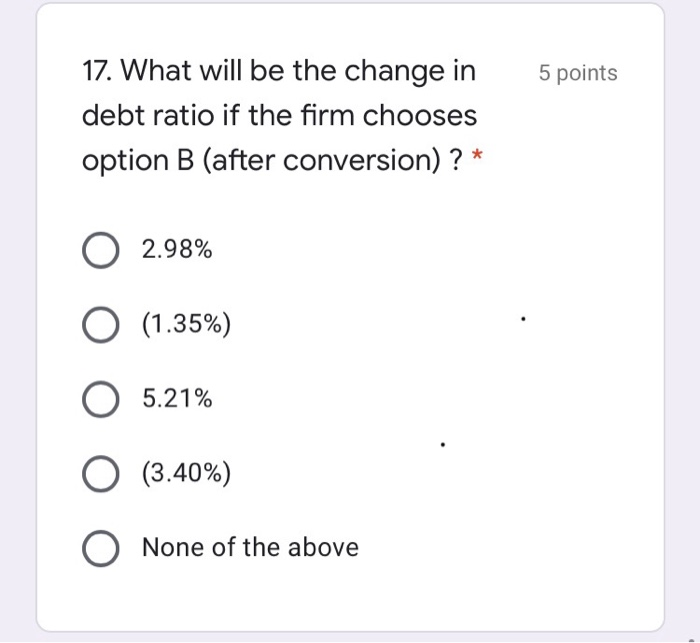

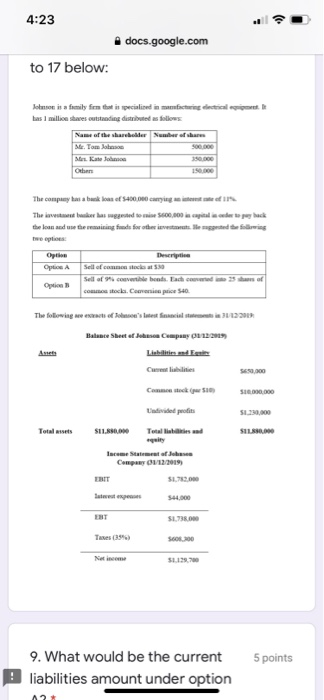

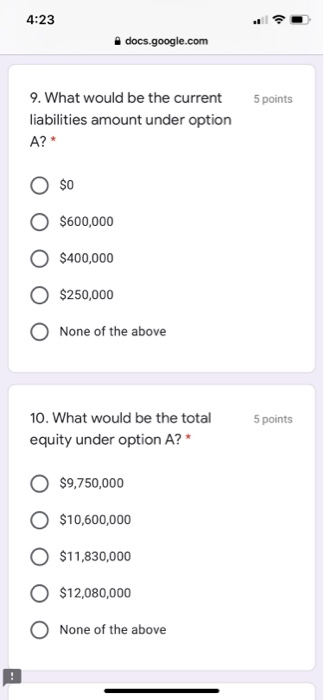

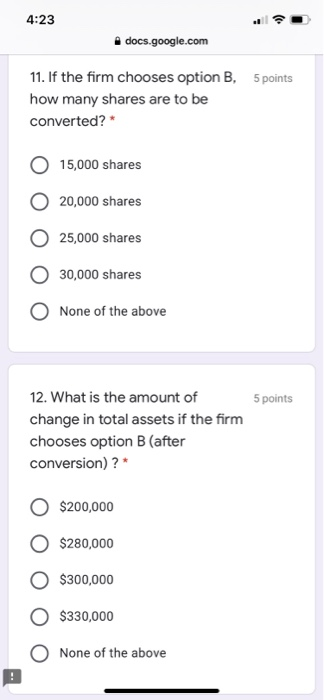

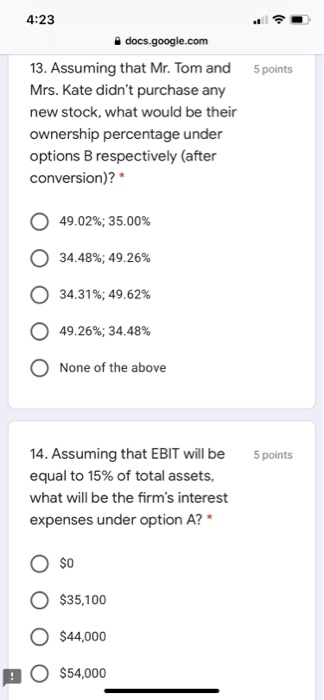

4:03 docs.google.com Given the following information for Johnson company, answer questions 9 to 17 below: Johnson is a family for that is specialized in mangas Mimilan dan aaling in a stan der Tom Jone Mis one The company has a bank of S400,000 The veste banke las suggested to me 500.000 de capital de pe back the land use the coming to the west Hesteding Opcie Desert Orice Sellom 520 Selecevoile black cat 3 com ocks. Copies The following are extract of he's testfic 3123009 Balce Sheet of Compu Come 530 quity Income Statement of Just Compey 2015 EBIT $170.000 51.738.000 Net SL22 4:03 docs.google.com 5 points 15. Also assuming that EBIT is equal to 15% of total assets, what will be the firm's Earning per share under option B (after conversion)? $1.13 $1.15 O $1.16 $1.20 None of the above 16. If the firm chooses option A, 5 points by how much would its net income change? ($31,500) ($10,300) $48,100 $53,200 None of the above 5 points 17. What will be the change in debt ratio if the firm chooses option B (after conversion) ? * 2.98% O (1.35%) O 5.21% O (3.40%) None of the above 4:23 docs.google.com to 17 below: Jose is a family firm that is pecialized in manufacturing trials has 1 million shares outstanding distributed as follows Name of the shareboller Sumber of shares Me Tomo Mies Kate Job Other The company has a bank loan of S400.000 yigien The lowest banker baserted to maine 600.000 la capital in de top back the loan and use the remaining funds for the investeed hearing Option Descripti Opice Sell of connect 530 Sell of ich beached com ocks. Cena prie 40 The following season's latest film 31/12 Balance Sheet CO2 Comme (5 SUB.000.000 Total $11.880,000 Total liabilities and SILSSO,000 Company 01/12/2019 $1.732.000 51.738.000 Tunes (396) 31.123.700 5 points 9. What would be the current liabilities amount under option 4:23 docs.google.com 5 points 9. What would be the current liabilities amount under option A?* $0 $600,000 $400,000 $250,000 None of the above 5 points 10. What would be the total equity under option A?* $9,750,000 $10,600,000 $11,830,000 $12,080,000 None of the above 4:23 docs.google.com 11. If the firm chooses option B, 5 points how many shares are to be converted?* 15,000 shares 20,000 shares 25,000 shares 30,000 shares None of the above 5 points 12. What is the amount of change in total assets if the firm chooses option B (after conversion) ?* $200,000 $280,000 $300,000 $330,000 None of the above 4:23 5 points docs.google.com 13. Assuming that Mr. Tom and Mrs. Kate didn't purchase any new stock, what would be their ownership percentage under options B respectively (after conversion)?* 49.02%; 35.00% 34.48%; 49.26% 34.31%; 49.62% 49.26%; 34.48% None of the above 5 points 14. Assuming that EBIT will be equal to 15% of total assets, what will be the firm's interest expenses under option A?* $0 $35,100 $44,000 $54,000