Answered step by step

Verified Expert Solution

Question

1 Approved Answer

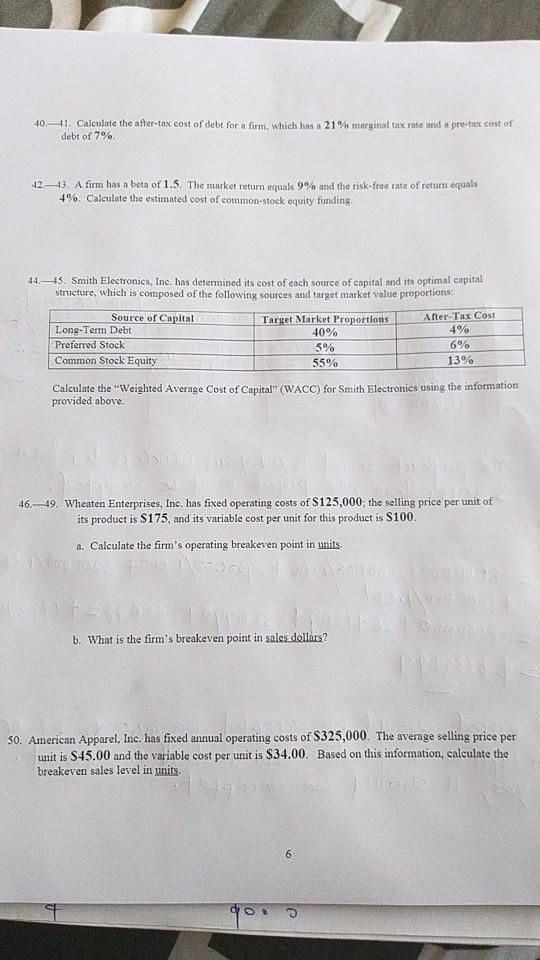

40-41. Calculate the after-tax cost of debt for a firm, which has a 21% marginal tax rate and a pre-tax cost of debt of

40-41. Calculate the after-tax cost of debt for a firm, which has a 21% marginal tax rate and a pre-tax cost of debt of 7%. 42-43. A firm has a beta of 1.5. The market return equals 9% and the risk-free rate of return equals 4%. Calculate the estimated cost of common-stock equity funding. 44-45. Smith Electronics, Inc. has determined its cost of each source of capital and its optimal capital structure, which is composed of the following sources and target market value proportions: Source of Capital Long-Term Debt Preferred Stock Common Stock Equity Target Market Proportions 40% 5% 55% After-Tax Cost 4% 6% 13% Calculate the "Weighted Average Cost of Capital" (WACC) for Smith Electronics using the information provided above. 46-49. Wheaten Enterprises, Inc. has fixed operating costs of $125,000; the selling price per unit of its product is $175, and its variable cost per unit for this product is $100. a. Calculate the firm's operating breakeven point in units. b. What is the firm's breakeven point in sales dollars? 50. American Apparel, Inc. has fixed annual operating costs of $325,000. The average selling price per unit is $45.00 and the variable cost per unit is $34.00. Based on this information, calculate the breakeven sales level in units. 00 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started