Answered step by step

Verified Expert Solution

Question

1 Approved Answer

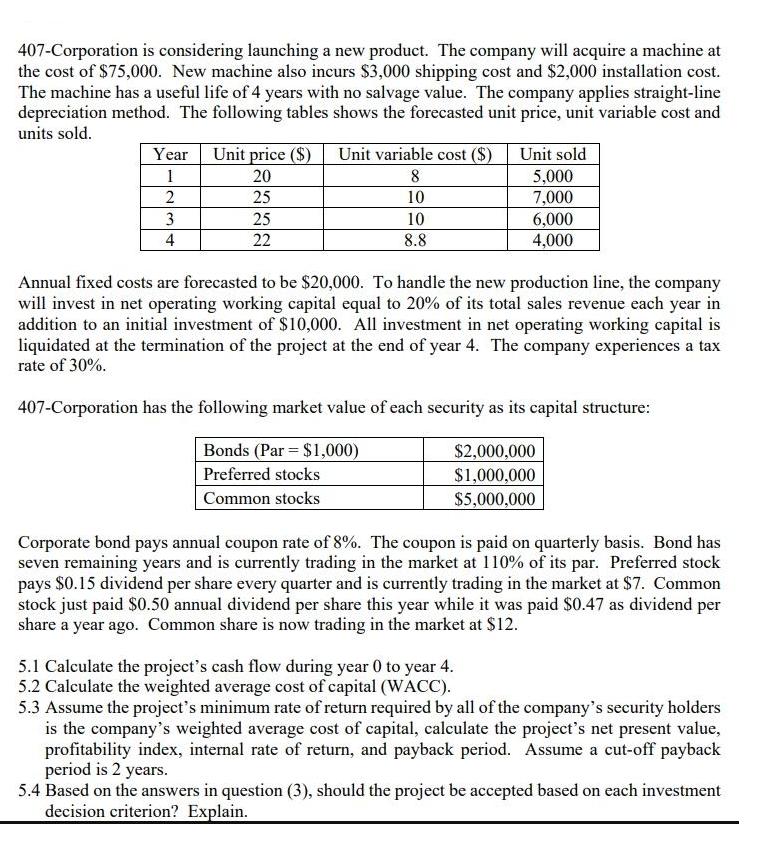

407-Corporation is considering launching a new product. The company will acquire a machine at the cost of $75,000. New machine also incurs $3,000 shipping

407-Corporation is considering launching a new product. The company will acquire a machine at the cost of $75,000. New machine also incurs $3,000 shipping cost and $2,000 installation cost. The machine has a useful life of 4 years with no salvage value. The company applies straight-line depreciation method. The following tables shows the forecasted unit price, unit variable cost and units sold. Year 1 2 3 4 Unit price ($) Unit variable cost ($) 20 25 25 22 8 10 10 8.8 Unit sold 5,000 7,000 = 6,000 4,000 Annual fixed costs are forecasted to be $20,000. To handle the new production line, the company will invest in net operating working capital equal to 20% of its total sales revenue each year in addition to an initial investment of $10,000. All investment in net operating working capital is liquidated at the termination of the project at the end of year 4. The company experiences a tax rate of 30%. 407-Corporation has the following market value of each security as its capital structure: Bonds (Par $1,000) $2,000,000 $1,000,000 Preferred stocks Common stocks $5,000,000 Corporate bond pays annual coupon rate of 8%. The coupon is paid on quarterly basis. Bond has seven remaining years and is currently trading in the market at 110% of its par. Preferred stock pays $0.15 dividend per share every quarter and is currently trading in the market at $7. Common stock just paid $0.50 annual dividend per share this year while it was paid $0.47 as dividend per share a year ago. Common share is now trading in the market at $12. 5.1 Calculate the project's cash flow during year 0 to year 4. 5.2 Calculate the weighted average cost of capital (WACC). 5.3 Assume the project's minimum rate of return required by all of the company's security holders is the company's weighted average cost of capital, calculate the project's net present value, profitability index, internal rate of return, and payback period. Assume a cut-off payback period is 2 years. 5.4 Based on the answers in question (3), should the project be accepted based on each investment decision criterion? Explain.

Step by Step Solution

★★★★★

3.49 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

To answer these questions well need to follow several steps to analyze the potential investment 51 Calculate the projects cash flow during year 0 to year 4 First lets determine the initial cash outflo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started