Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4.1 blurred part line 2 (for that in which) line 3 (under the assumption) it's a question from principles of corporate finance lecture Question 4

4.1 blurred part line 2 (for that in which)

line 3 (under the assumption)

it's a question from principles of corporate finance lecture

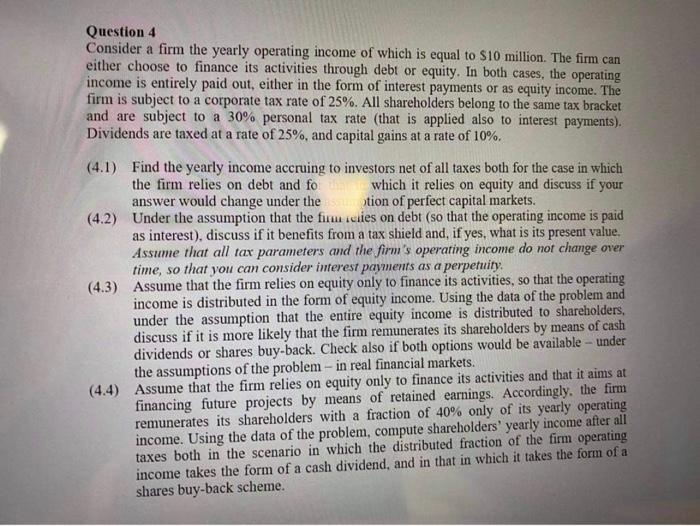

Question 4 Consider a firm the yearly operating income of which is equal to $10 million. The firm can either choose to finance its activities through debt or equity. In both cases, the operating income is entirely paid out, either in the form of interest payments or as equity income. The firm is subject to a corporate tax rate of 25%. All shareholders belong to the same tax bracket and are subject to a 30% personal tax rate (that is applied also to interest payments). Dividends are taxed at a rate of 25%, and capital gains at a rate of 10%. (4.1) Find the yearly income accruing to investors net of all taxes both for the case in which the firm relies on debt and for which it relies on equity and discuss if your answer would change under the otion of perfect capital markets. (4.2) Under the assumption that the fimm eiies on debt (so that the operating income is paid as interest), discuss if it benefits from a tax shield and, if yes, what is its present value. Assume that all tax parameters and the firm's operating income do not change over time, so that you can consider interest payments as a perpetuity. (4.3) Assume that the firm relies on equity only to finance its activities, so that the operating income is distributed in the form of equity income. Using the data of the problem and under the assumption that the entire equity income is distributed to shareholders, discuss if it is more likely that the firm remunerates its shareholders by means of cash dividends or shares buy-back. Check also if both options would be available - under the assumptions of the problem- in real financial markets. (4.4) Assume that the firm relies on equity only to finance its activities and that it aims at financing future projects by means of retained earnings. Accordingly, the firm remunerates its shareholders with a fraction of 40% only of its yearly operating income. Using the data of the problem, compute shareholders' yearly income after all taxes both in the scenario in which the distributed fraction of the firm operating income takes the form of a cash dividend, and in that in which it takes the form of a shares buy-back scheme. Question 4 Consider a firm the yearly operating income of which is equal to $10 million. The firm can either choose to finance its activities through debt or equity. In both cases, the operating income is entirely paid out, either in the form of interest payments or as equity income. The firm is subject to a corporate tax rate of 25%. All shareholders belong to the same tax bracket and are subject to a 30% personal tax rate (that is applied also to interest payments). Dividends are taxed at a rate of 25%, and capital gains at a rate of 10%. (4.1) Find the yearly income accruing to investors net of all taxes both for the case in which the firm relies on debt and for which it relies on equity and discuss if your answer would change under the otion of perfect capital markets. (4.2) Under the assumption that the fimm eiies on debt (so that the operating income is paid as interest), discuss if it benefits from a tax shield and, if yes, what is its present value. Assume that all tax parameters and the firm's operating income do not change over time, so that you can consider interest payments as a perpetuity. (4.3) Assume that the firm relies on equity only to finance its activities, so that the operating income is distributed in the form of equity income. Using the data of the problem and under the assumption that the entire equity income is distributed to shareholders, discuss if it is more likely that the firm remunerates its shareholders by means of cash dividends or shares buy-back. Check also if both options would be available - under the assumptions of the problem- in real financial markets. (4.4) Assume that the firm relies on equity only to finance its activities and that it aims at financing future projects by means of retained earnings. Accordingly, the firm remunerates its shareholders with a fraction of 40% only of its yearly operating income. Using the data of the problem, compute shareholders' yearly income after all taxes both in the scenario in which the distributed fraction of the firm operating income takes the form of a cash dividend, and in that in which it takes the form of a shares buy-back scheme Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started