Answered step by step

Verified Expert Solution

Question

1 Approved Answer

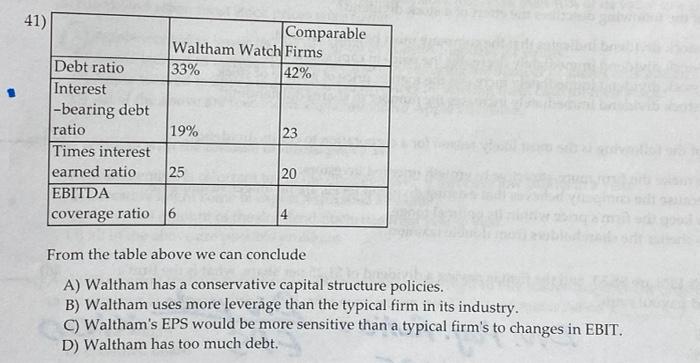

41) Debt ratio Interest -bearing debt ratio Times interest earned ratio EBITDA coverage ratio Waltham Watch Firms 33% 42% 19% Comparable 25 23 20 4

41) Debt ratio Interest -bearing debt ratio Times interest earned ratio EBITDA coverage ratio Waltham Watch Firms 33% 42% 19% Comparable 25 23 20 4 From the table above we can conclude prigo A) Waltham has a conservative capital structure policies. B) Waltham uses more leverage than the typical firm in its industry. C) Waltham's EPS would be more sensitive than a typical firm's to changes in EBIT. D) Waltham has too much debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started