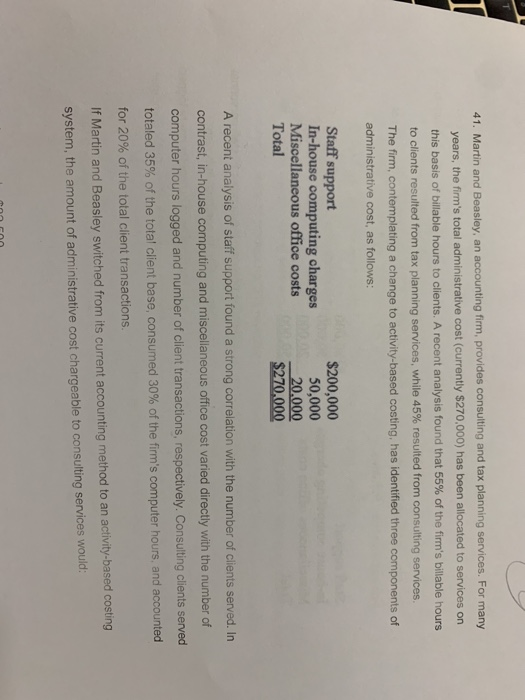

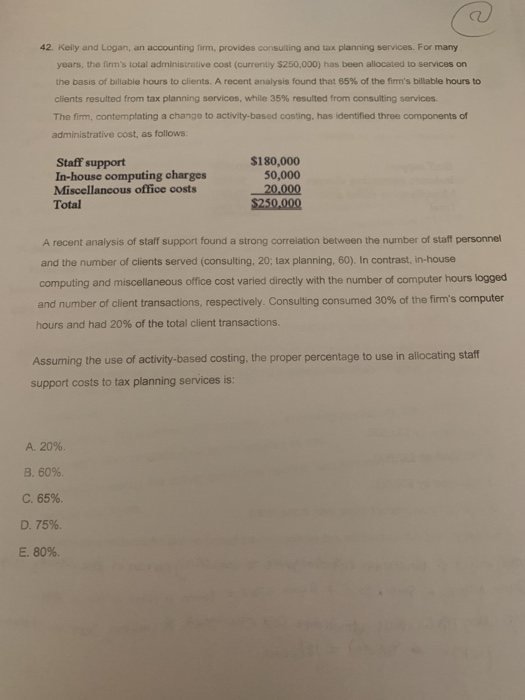

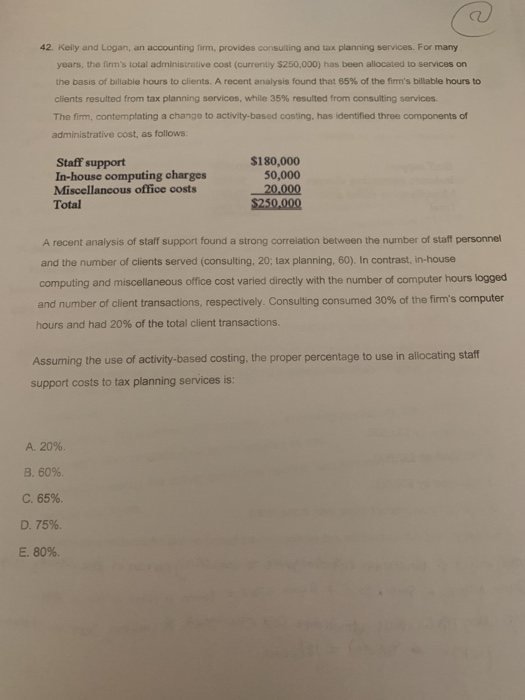

41. Martin and Beasley, an accounting firm, provides consulting and tax planning services. For many years, the firm's total administrative cost (currently $270,000) has been allocated to services on this basis of billable ours to clients. A recent analysis found that 55% of the firm's billable hours to clients resulted from tax planning services, while 45% resulted from consulting services. The firm, contemplating a change to activity-based costing, has identified three components of administrative cost, as follows: Staff support In-house computing charges Miscellaneous office costs Total $200,000 50,000 20.000 $270.000 A recent analysis of staff support found a strong correlation with the number of clients served. In contrast, in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions, respectively. Consulting clients served totaled 35% of the total client base, consumed 30% of the firm's computer hours, and accounted for 20% of the total client transactions. If Martin and Beasley switched from its current accounting method to an activity-based costing system, the amount of administrative cost chargeable to consulting services would: 42. Kelly and Logan, an accounting firm, provides consulting and tax planning services. For many years, the firm's total administrative cost (currently $250,000) has been allocated to services on the basis of billable hours to clients. A recent analysis found that 85% of the firm's billable hours to clients resulted from tax planning services, while 35% resulted from consulting services The firm, contemplating a change to activity-based costing, has identified three components of administrative cost, as follows: Staff support In-house computing charges Miscellaneous office costs Total $180,000 50,000 20.000 $250.000 A recent analysis of staff support found a strong correlation between the number of staff personnel and the number of clients served (consulting, 20; tax planning, 60). In contrast, in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions, respectively. Consulting consumed 30% of the firm's computer hours and had 20% of the total client transactions. Assuming the use of activity-based costing, the proper percentage to use in allocating staff support costs to tax planning services is: A. 20% B. 60% C. 65%. D. 75% E. 80% 41. Martin and Beasley, an accounting firm, provides consulting and tax planning services. For many years, the firm's total administrative cost (currently $270,000) has been allocated to services on this basis of billable ours to clients. A recent analysis found that 55% of the firm's billable hours to clients resulted from tax planning services, while 45% resulted from consulting services. The firm, contemplating a change to activity-based costing, has identified three components of administrative cost, as follows: Staff support In-house computing charges Miscellaneous office costs Total $200,000 50,000 20.000 $270.000 A recent analysis of staff support found a strong correlation with the number of clients served. In contrast, in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions, respectively. Consulting clients served totaled 35% of the total client base, consumed 30% of the firm's computer hours, and accounted for 20% of the total client transactions. If Martin and Beasley switched from its current accounting method to an activity-based costing system, the amount of administrative cost chargeable to consulting services would: 42. Kelly and Logan, an accounting firm, provides consulting and tax planning services. For many years, the firm's total administrative cost (currently $250,000) has been allocated to services on the basis of billable hours to clients. A recent analysis found that 85% of the firm's billable hours to clients resulted from tax planning services, while 35% resulted from consulting services The firm, contemplating a change to activity-based costing, has identified three components of administrative cost, as follows: Staff support In-house computing charges Miscellaneous office costs Total $180,000 50,000 20.000 $250.000 A recent analysis of staff support found a strong correlation between the number of staff personnel and the number of clients served (consulting, 20; tax planning, 60). In contrast, in-house computing and miscellaneous office cost varied directly with the number of computer hours logged and number of client transactions, respectively. Consulting consumed 30% of the firm's computer hours and had 20% of the total client transactions. Assuming the use of activity-based costing, the proper percentage to use in allocating staff support costs to tax planning services is: A. 20% B. 60% C. 65%. D. 75% E. 80%