-

41% of the pool had been delinquent for at least 90 days, was in foreclosure or real estate owned. Assuming that the borrowers never pay, estimate the principal write downs if the recovery rate is 70%. What is the effect on Class B? Class M2?

-

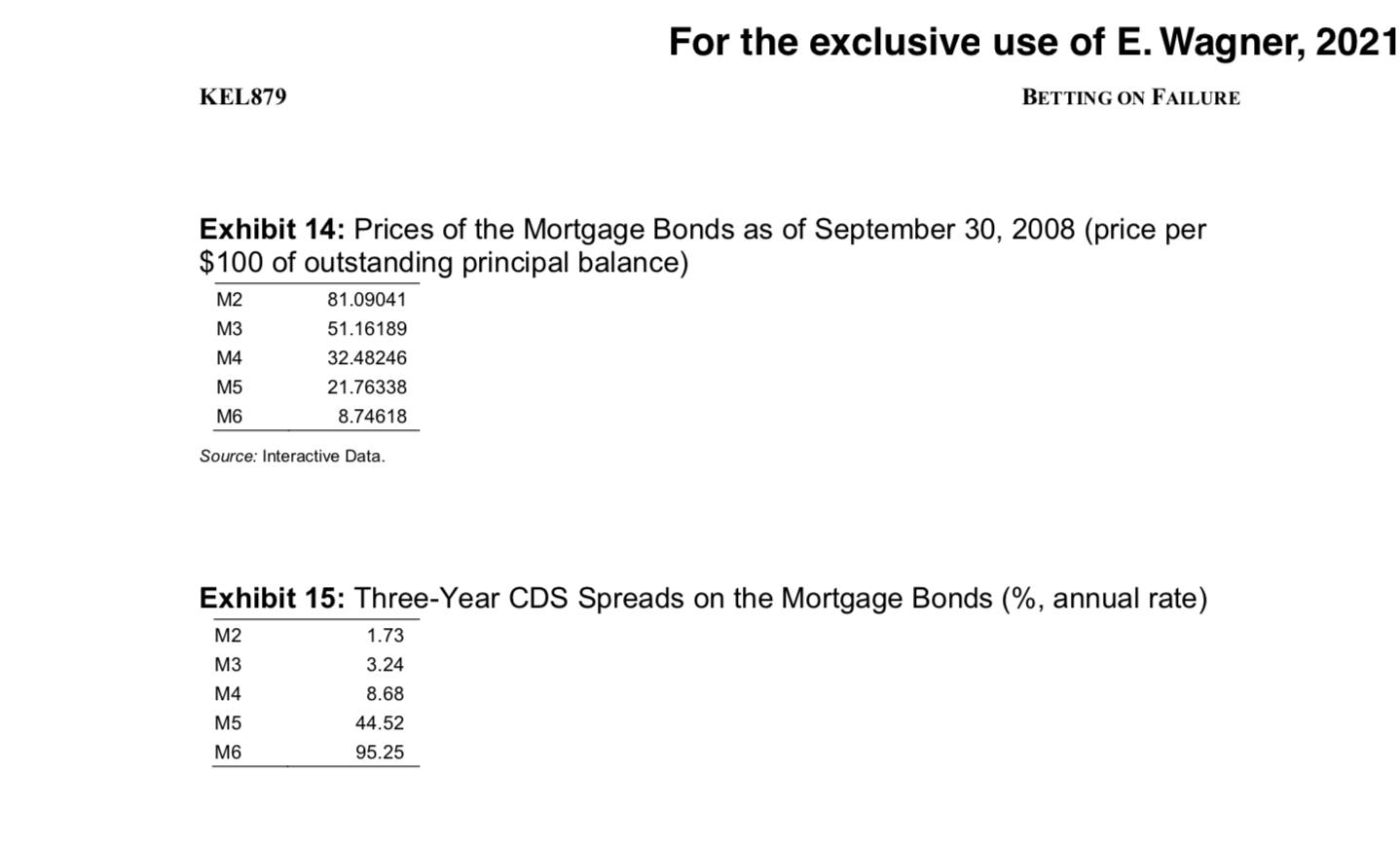

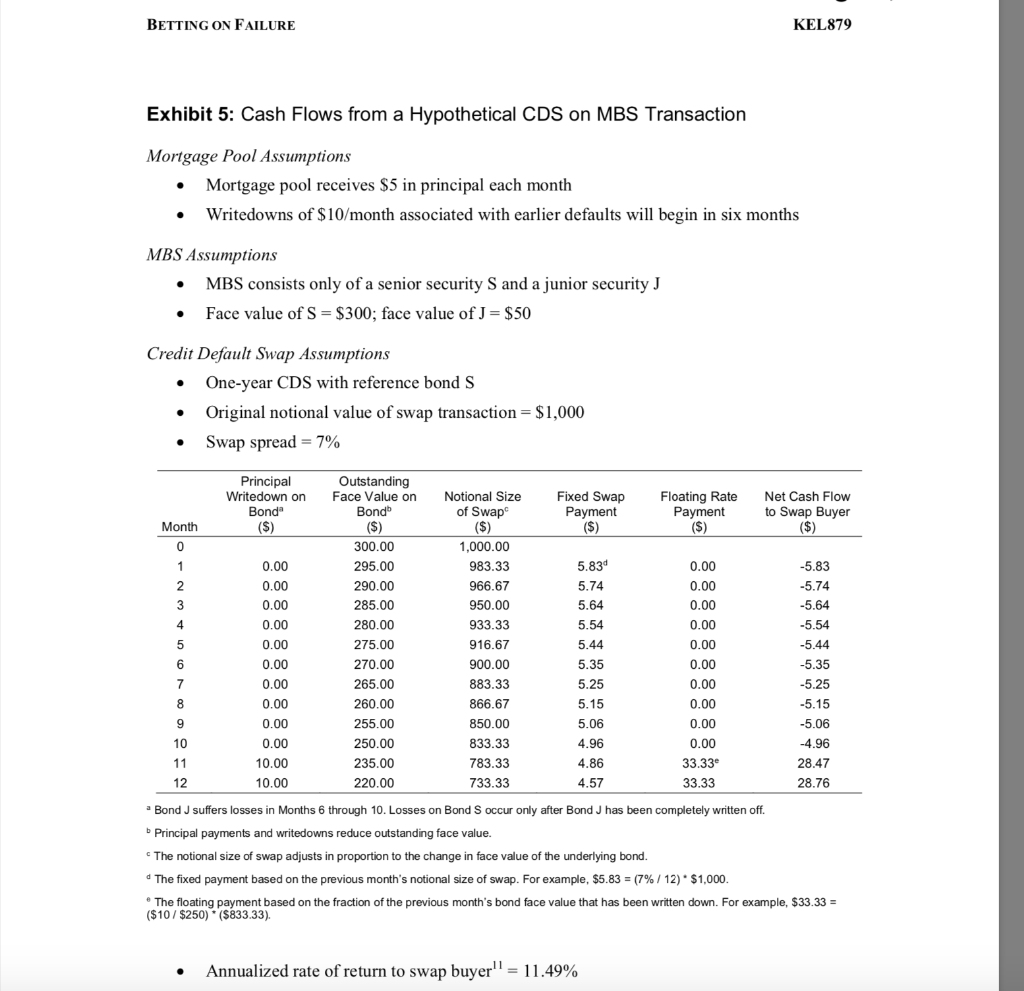

Use the prices in Exhibit 14. Assume that the losses/defaults in the previous question occur in month 12, with no other defaults in the pool. Assume the scheduled and unscheduled principal payments are the same as in September 2008 and all remaining loans prepay at the end of 12 months. What is the IRR for an investment in the M2 and M6 bonds?

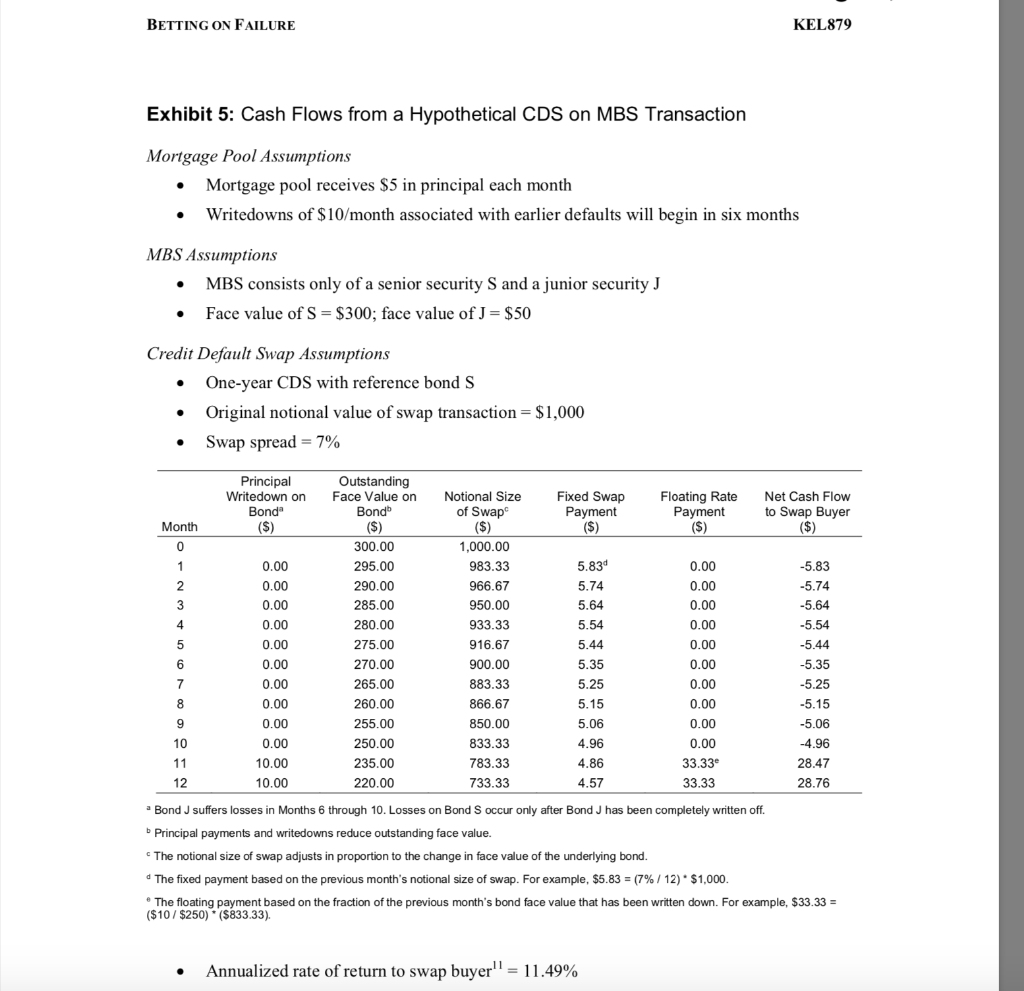

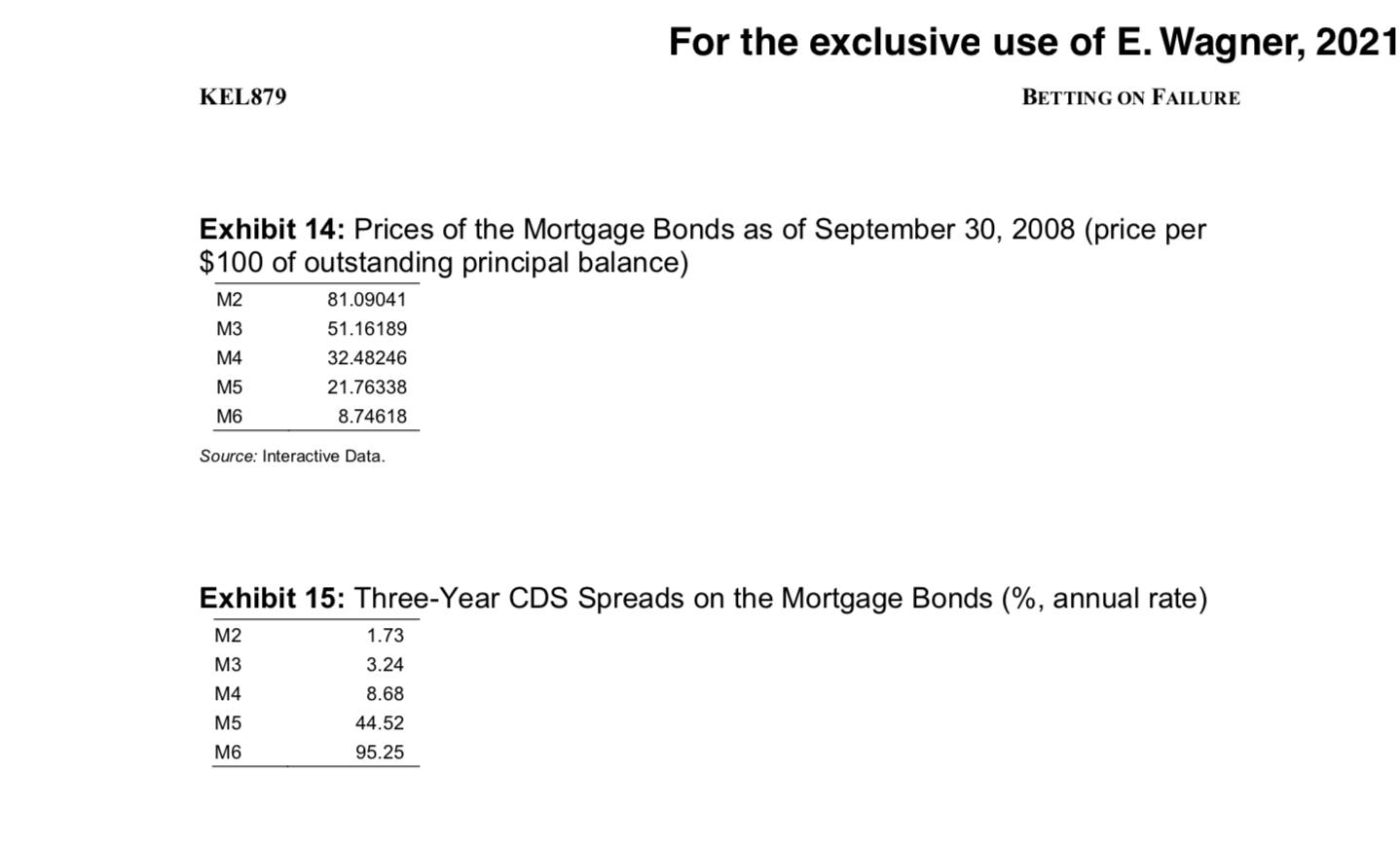

For the exclusive use of E. Wagner, 2021 KEL879 BETTING ON FAILURE Exhibit 14: Prices of the Mortgage Bonds as of September 30, 2008 (price per $100 of outstanding principal balance) M2 M3 M4 81.09041 51.16189 32.48246 21.76338 8.74618 M5 M6 Source: Interactive Data. Exhibit 15: Three-Year CDS Spreads on the Mortgage Bonds (%, annual rate) 9 M2 M3 M4 1.73 3.24 8.68 44.52 95.25 M5 M6 BETTING ON FAILURE KEL879 Exhibit 5: Cash Flows from a Hypothetical CDS on MBS Transaction Mortgage Pool Assumptions Mortgage pool receives $5 in principal each month Writedowns of $10/month associated with earlier defaults will begin in six months MBS Assumptions MBS consists only of a senior security S and a junior security J Face value of S = $300; face value of J = $50 . Credit Default Swap Assumptions One-year CDS with reference bond S Original notional value of swap transaction = $1,000 Swap spread = 7% . . Principal Writedown on Bond" ($) ) Fixed Swap Payment ($) Floating Rate Payment ) ($) Net Cash Flow to Swap Buyer ($) Month 0 1 2 3 -5.83 -5.74 -5.64 -5.54 4 Outstanding Face Value on Bondo ($) S 300.00 295.00 290.00 285.00 280.00 275.00 270.00 265.00 260.00 255.00 250.00 235.00 220.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 10.00 10.00 5 6 7 8 9 10 11 12 Notional Size of Swap ($) 1,000.00 983.33 966.67 950.00 933.33 916.67 900.00 883.33 866.67 850.00 833.33 783.33 733.33 5.834 5.74 5.64 5.54 5.44 5.35 5.25 5.15 5.06 4.96 4.86 4.57 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 33.33 33.33 -5.44 -5.35 -5.25 -5.15 -5.06 -4.96 28.47 28.76 Bond J suffers losses in Months 6 through 10. Losses on Bond S occur only after Bond J has been completely written off. Principal payments and writedowns reduce outstanding face value. The notional size of swap adjusts in proportion to the change in face value of the underlying bond. The fixed payment based on the previous month's notional size of swap. For example, $5.83 = (7%/12) * $1,000. The floating payment based on the fraction of the previous month's bond face value that has been written down. For example, $33.33 = ($10 / $250) * ($833.33). $$ . Annualized rate of return to swap buyer" = 11.49% For the exclusive use of E. Wagner, 2021 KEL879 BETTING ON FAILURE Exhibit 14: Prices of the Mortgage Bonds as of September 30, 2008 (price per $100 of outstanding principal balance) M2 M3 M4 81.09041 51.16189 32.48246 21.76338 8.74618 M5 M6 Source: Interactive Data. Exhibit 15: Three-Year CDS Spreads on the Mortgage Bonds (%, annual rate) 9 M2 M3 M4 1.73 3.24 8.68 44.52 95.25 M5 M6 BETTING ON FAILURE KEL879 Exhibit 5: Cash Flows from a Hypothetical CDS on MBS Transaction Mortgage Pool Assumptions Mortgage pool receives $5 in principal each month Writedowns of $10/month associated with earlier defaults will begin in six months MBS Assumptions MBS consists only of a senior security S and a junior security J Face value of S = $300; face value of J = $50 . Credit Default Swap Assumptions One-year CDS with reference bond S Original notional value of swap transaction = $1,000 Swap spread = 7% . . Principal Writedown on Bond" ($) ) Fixed Swap Payment ($) Floating Rate Payment ) ($) Net Cash Flow to Swap Buyer ($) Month 0 1 2 3 -5.83 -5.74 -5.64 -5.54 4 Outstanding Face Value on Bondo ($) S 300.00 295.00 290.00 285.00 280.00 275.00 270.00 265.00 260.00 255.00 250.00 235.00 220.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 10.00 10.00 5 6 7 8 9 10 11 12 Notional Size of Swap ($) 1,000.00 983.33 966.67 950.00 933.33 916.67 900.00 883.33 866.67 850.00 833.33 783.33 733.33 5.834 5.74 5.64 5.54 5.44 5.35 5.25 5.15 5.06 4.96 4.86 4.57 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 33.33 33.33 -5.44 -5.35 -5.25 -5.15 -5.06 -4.96 28.47 28.76 Bond J suffers losses in Months 6 through 10. Losses on Bond S occur only after Bond J has been completely written off. Principal payments and writedowns reduce outstanding face value. The notional size of swap adjusts in proportion to the change in face value of the underlying bond. The fixed payment based on the previous month's notional size of swap. For example, $5.83 = (7%/12) * $1,000. The floating payment based on the fraction of the previous month's bond face value that has been written down. For example, $33.33 = ($10 / $250) * ($833.33). $$ . Annualized rate of return to swap buyer" = 11.49%