Answered step by step

Verified Expert Solution

Question

1 Approved Answer

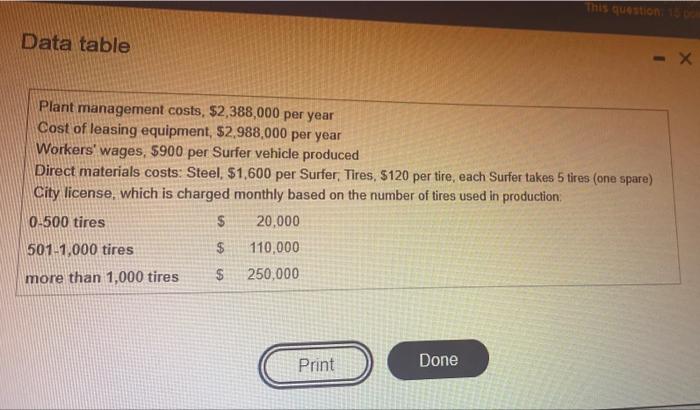

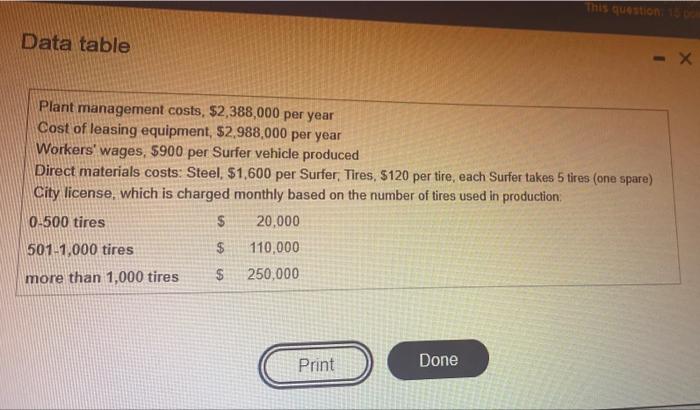

4.1 This question, iso Data table -X Plant management costs, $2,388,000 per year Cost of leasing equipment, $2,988,000 per year Workers' wages, $900 per Surfer

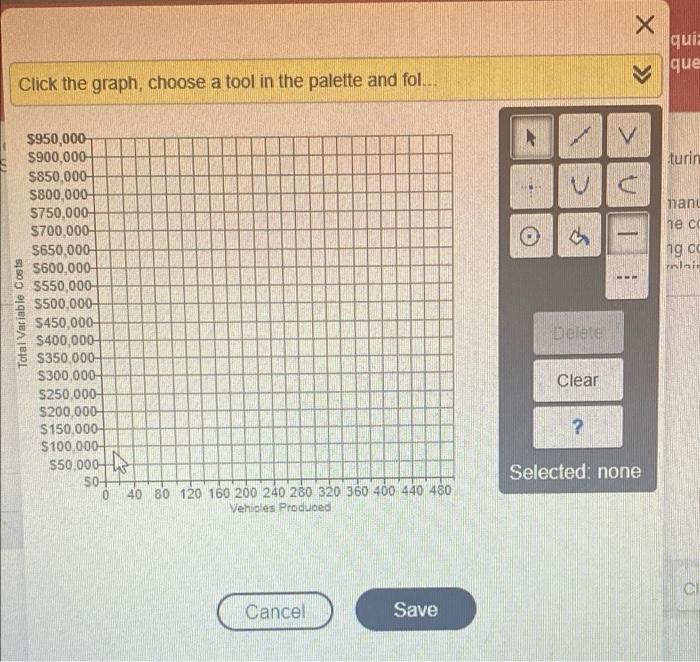

4.1

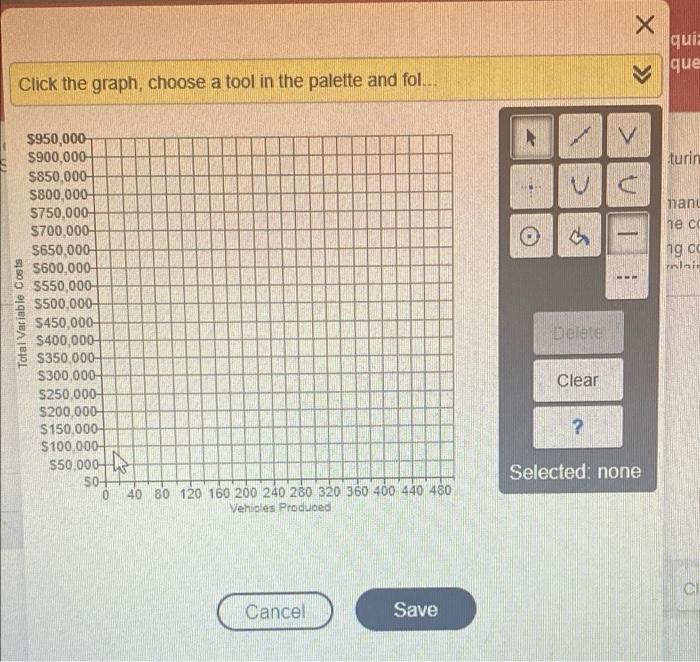

This question, iso Data table -X Plant management costs, $2,388,000 per year Cost of leasing equipment, $2,988,000 per year Workers' wages, $900 per Surfer vehicle produced Direct materials costs: Steel, $1,600 per Surfer, Tires, $120 per tire, each Surfer takes 5 tires (one spare) City license, which is charged monthly based on the number of tires used in production 0-500 tires $ 20,000 501-1,000 tires $ 110,000 more than 1,000 tires $ 250,000 Print Done X >> qui: que Click the graph, choose a tool in the palette and fol... V turin U nanu he ce O hg CC Total Variable Costs $950,000 $900,000 $850,000 $800,000 $750,000 S700,000- $650.000 S600,000 $550,000 S500,000 $450,000 S400,000 $350.000- S300,000 $250,000 $200,000 $150.000 $100,000 $50,000 h 50- 0 40 80 120 160 200 240 280 320360 400 440 480 Vehicles Produced Delete Clear ? Selected: none Cancel Save shore Motors specializes in producing one specially vehicle. It is called Surfer and is styled to say it ultiple surfboards in its back area and top mounted storage radis Seashore as the following manufacturing bots E (Click the icon to view the manufacturing costs) Heurements 1. What is the variable mandouring cost pere? What is doing month 2. Plot a graph for the variable manufacturing consecand for the cost per month How does the concept of group 3 What is the tal manducturing cost of each with 225 vehicles? How do you plan the difference in the manding eashore currently produces 170 vehides per month SA OB . OD . C sooooo 500 500 50000 500 Theaten How does the concept of relevantrance relate to your orphs? Explain This question, iso Data table -X Plant management costs, $2,388,000 per year Cost of leasing equipment, $2,988,000 per year Workers' wages, $900 per Surfer vehicle produced Direct materials costs: Steel, $1,600 per Surfer, Tires, $120 per tire, each Surfer takes 5 tires (one spare) City license, which is charged monthly based on the number of tires used in production 0-500 tires $ 20,000 501-1,000 tires $ 110,000 more than 1,000 tires $ 250,000 Print Done X >> qui: que Click the graph, choose a tool in the palette and fol... V turin U nanu he ce O hg CC Total Variable Costs $950,000 $900,000 $850,000 $800,000 $750,000 S700,000- $650.000 S600,000 $550,000 S500,000 $450,000 S400,000 $350.000- S300,000 $250,000 $200,000 $150.000 $100,000 $50,000 h 50- 0 40 80 120 160 200 240 280 320360 400 440 480 Vehicles Produced Delete Clear ? Selected: none Cancel Save shore Motors specializes in producing one specially vehicle. It is called Surfer and is styled to say it ultiple surfboards in its back area and top mounted storage radis Seashore as the following manufacturing bots E (Click the icon to view the manufacturing costs) Heurements 1. What is the variable mandouring cost pere? What is doing month 2. Plot a graph for the variable manufacturing consecand for the cost per month How does the concept of group 3 What is the tal manducturing cost of each with 225 vehicles? How do you plan the difference in the manding eashore currently produces 170 vehides per month SA OB . OD . C sooooo 500 500 50000 500 Theaten How does the concept of relevantrance relate to your orphs? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started