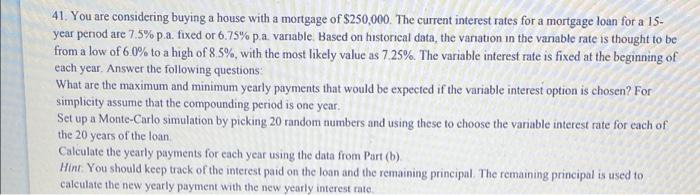

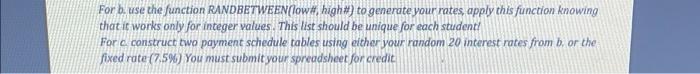

41. You are considering buying a house with a mortgage of $250,000. The current interest rates for a mortgage loan for a 15- year period are 7.5%p.a. fixed or 6.75% p.a. variable Based on historical data, the variation in the variable rate is thought to be from a low of 60% to a high of 85%, with the most likely value as 7 25%. The variable interest rate is fixed at the beginning of each year. Answer the following questions: What are the maximum and minimum yearly payments that would be expected if the variable interest option is chosen? For simplicity assume that the compounding period is one year. Set up a Monte-Carlo simulation by picking 20 random numbers and using these to choose the variable interest rate for each of the 20 years of the loan Calculate the yearly payments for each year using the data from Part (b) Hint You should keep track of the interest paid on the loan and the remaining principal. The remaining principal is used to calculate the new yearly payment with the new yearly interest rate. For be use the function RANDBETWEEN(low# high#) to generate your rates, apply this function knowing that it works only for integer values. This list should be unique for each student! For e construct two payment schedule tables using either your random 20 interest rates from b or the fixed rate (7.596) You must submit your spreadsheet for credit 41. You are considering buying a house with a mortgage of $250,000. The current interest rates for a mortgage loan for a 15- year period are 7.5%p.a. fixed or 6.75% p.a. variable Based on historical data, the variation in the variable rate is thought to be from a low of 60% to a high of 85%, with the most likely value as 7 25%. The variable interest rate is fixed at the beginning of each year. Answer the following questions: What are the maximum and minimum yearly payments that would be expected if the variable interest option is chosen? For simplicity assume that the compounding period is one year. Set up a Monte-Carlo simulation by picking 20 random numbers and using these to choose the variable interest rate for each of the 20 years of the loan Calculate the yearly payments for each year using the data from Part (b) Hint You should keep track of the interest paid on the loan and the remaining principal. The remaining principal is used to calculate the new yearly payment with the new yearly interest rate. For be use the function RANDBETWEEN(low# high#) to generate your rates, apply this function knowing that it works only for integer values. This list should be unique for each student! For e construct two payment schedule tables using either your random 20 interest rates from b or the fixed rate (7.596) You must submit your spreadsheet for credit