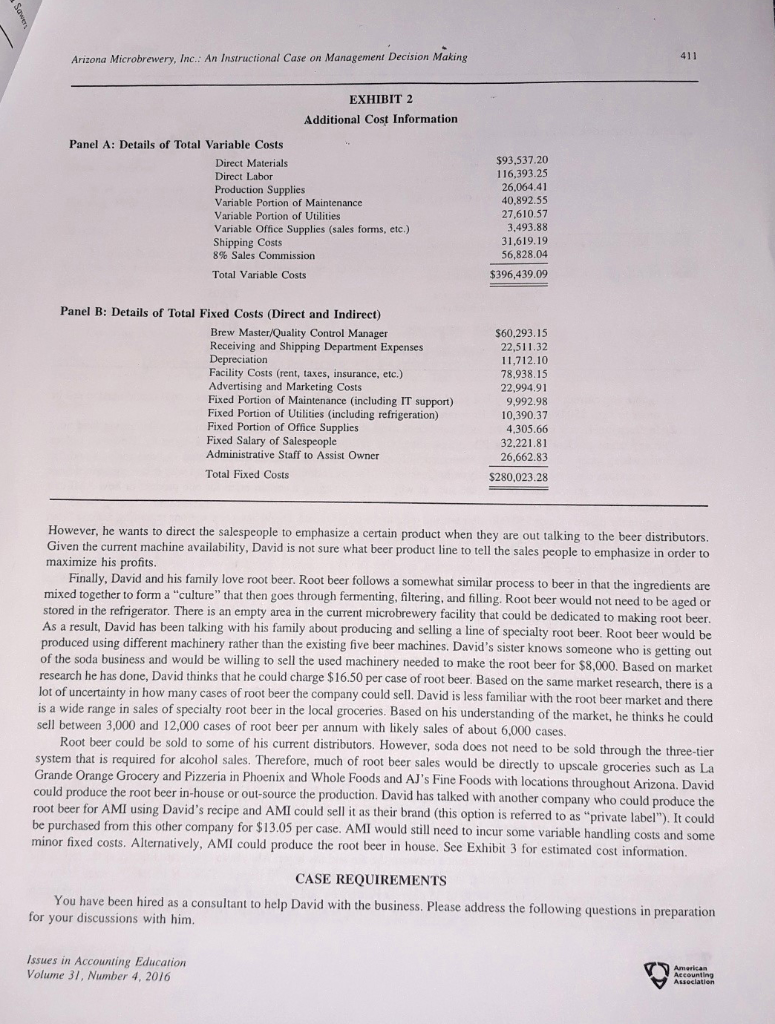

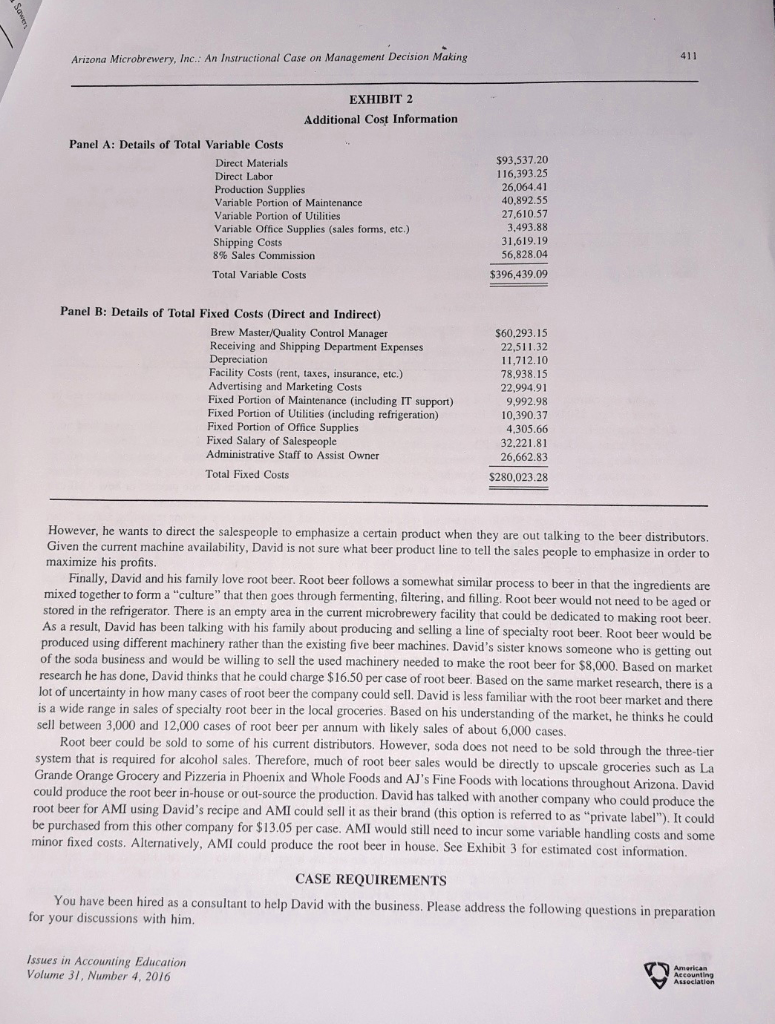

411 Arizona Microbrewery, Inc.: An Instructional Case on Management Decision Making EXHIBIT 2 Additional Cost Information Panel A: Details of Total Variable Costs $93,537.20 116,393.23 26,064.41 40,892.55 27,610.57 3,493.88 31,619.19 56,828.04 Direct Materials Direct Labor Pa Production Supplies Variable Portion of Maintenance Variable Portion of Utilities Variable Office Supplies (sales forms, etc.) Shipping Costs Total Variable Costs $396,439.09 Panel B: Details of Total Fixed Costs (Direct and Indirect) Brew Master/Quality Control Manager Receiving and Shipping Department Expenses Depreciation Facility Costs (rent, taxes, insurance, etc.) Advertising and Marketing Costs Fixed Portion of Maintenance (including IT support) Fixed Portion of Utilities (including refrigeration) Fixed Portion of Office Supplies Fixed Salary of Salespeople Administrative Staff to Assist Owner Total Fixed Costs $60,293.15 22,511.32 11,712.10 78,938.15 22,994.91 9,992.98 10,390.37 4,305.66 32.221.81 26,662.83 $280,023.28 However, he wants to direct the salespeople to emphasize a certain product when they are out talking to the beer distributors Given the current machine availability, David is not sure what beer product line to tell the sales people to emphasize in order to maximize his profits. Finally, David and his family love root beer. Root beer follow mixed together to form a "culture" that then goes through fermenting, filtering, and filling. Root beer would not need to be aged or stored in the refrigerator. There is an empty area As a result, David has been talking with his family about producing and selling a line of specialty root beer. Root beer would be produced using different machinery rather than the existing five beer machines. David's sister knows someone who is of the soda business and would be willing to sell the used machinery needed to make the root beer for $8,000. Based on research he has done, David thinks that he could charge $16.50 per case of root beer. Based on the same market research lot of uncertainty in how many cases of root beer the company could sell. David is less familiar with the root beer market and t is a wide range in sales of specialty root beer in the local groceries. Based on his understanding of the market, he thinks he could sell between 3,000 and 12,000 cases of root beer per annum with likely sales of about 6,000 cases. s a somewhat similar process to beer in that the ingredients are in the current microbrewery facility that could be dedicated to making root beer. Root beer could be sold to some of his current distributors. However, soda does not need to be sold through the system that is required for alcohol sales. Therefore, much of root beer sales would be directly to upscale groceries such as La Grande Orange Grocery and Pizzeria in Phoenix and Whole Foods and AJ's Fine Foods with locations through could produce the root beer in-house or out-source the production. root beer for AMI using David's recipe and AMI could sell it as their brand (this option is referred to as "private label") be purchased from this other company for $13.05 per case. AMI would still need to incur some variable handling costs and s minor fixed costs. Alternatively, AMI could produce the root beer in house. See Exhibit 3 for estimated cost information. three-tier out Arizona. David David has talked with another company who could produce the CASE REQUIREMENTS You have been hired as a consultant to help David with the business. Please address the following questions in preparation for your discussions with him. Issues in Accounting Education Volume 31, Number 4, 2016 Aecounting 411 Arizona Microbrewery, Inc.: An Instructional Case on Management Decision Making EXHIBIT 2 Additional Cost Information Panel A: Details of Total Variable Costs $93,537.20 116,393.23 26,064.41 40,892.55 27,610.57 3,493.88 31,619.19 56,828.04 Direct Materials Direct Labor Pa Production Supplies Variable Portion of Maintenance Variable Portion of Utilities Variable Office Supplies (sales forms, etc.) Shipping Costs Total Variable Costs $396,439.09 Panel B: Details of Total Fixed Costs (Direct and Indirect) Brew Master/Quality Control Manager Receiving and Shipping Department Expenses Depreciation Facility Costs (rent, taxes, insurance, etc.) Advertising and Marketing Costs Fixed Portion of Maintenance (including IT support) Fixed Portion of Utilities (including refrigeration) Fixed Portion of Office Supplies Fixed Salary of Salespeople Administrative Staff to Assist Owner Total Fixed Costs $60,293.15 22,511.32 11,712.10 78,938.15 22,994.91 9,992.98 10,390.37 4,305.66 32.221.81 26,662.83 $280,023.28 However, he wants to direct the salespeople to emphasize a certain product when they are out talking to the beer distributors Given the current machine availability, David is not sure what beer product line to tell the sales people to emphasize in order to maximize his profits. Finally, David and his family love root beer. Root beer follow mixed together to form a "culture" that then goes through fermenting, filtering, and filling. Root beer would not need to be aged or stored in the refrigerator. There is an empty area As a result, David has been talking with his family about producing and selling a line of specialty root beer. Root beer would be produced using different machinery rather than the existing five beer machines. David's sister knows someone who is of the soda business and would be willing to sell the used machinery needed to make the root beer for $8,000. Based on research he has done, David thinks that he could charge $16.50 per case of root beer. Based on the same market research lot of uncertainty in how many cases of root beer the company could sell. David is less familiar with the root beer market and t is a wide range in sales of specialty root beer in the local groceries. Based on his understanding of the market, he thinks he could sell between 3,000 and 12,000 cases of root beer per annum with likely sales of about 6,000 cases. s a somewhat similar process to beer in that the ingredients are in the current microbrewery facility that could be dedicated to making root beer. Root beer could be sold to some of his current distributors. However, soda does not need to be sold through the system that is required for alcohol sales. Therefore, much of root beer sales would be directly to upscale groceries such as La Grande Orange Grocery and Pizzeria in Phoenix and Whole Foods and AJ's Fine Foods with locations through could produce the root beer in-house or out-source the production. root beer for AMI using David's recipe and AMI could sell it as their brand (this option is referred to as "private label") be purchased from this other company for $13.05 per case. AMI would still need to incur some variable handling costs and s minor fixed costs. Alternatively, AMI could produce the root beer in house. See Exhibit 3 for estimated cost information. three-tier out Arizona. David David has talked with another company who could produce the CASE REQUIREMENTS You have been hired as a consultant to help David with the business. Please address the following questions in preparation for your discussions with him. Issues in Accounting Education Volume 31, Number 4, 2016 Aecounting