Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4.12. How much will $5,000 be worth in 10 with 6% interest compounded continuously? o years 4.13. How much money must you deposit now

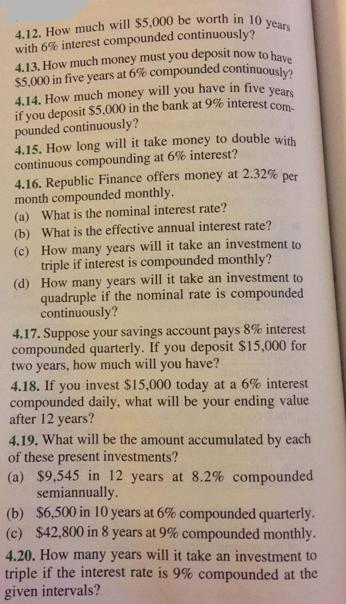

4.12. How much will $5,000 be worth in 10 with 6% interest compounded continuously? o years 4.13. How much money must you deposit now to have $5,000 in five years at 6% compounded continuously? 4.14. How much money will you have in five years if you deposit $5,000 in the bank at 9% interest com- pounded continuously? 4.15. How long will it take money to double with continuous compounding at 6% interest? 4.16. Republic Finance offers money at 2.32% per month compounded monthly. (a) What is the nominal interest rate? (b) What is the effective annual interest rate? (c) How many years will it take an investment to triple if interest is compounded monthly? (d) How many years will it take an investment to quadruple if the nominal rate is compounded continuously? 4.17. Suppose your savings account pays 8% interest compounded quarterly. If you deposit $15,000 for two years, how much will you have? 4.18. If you invest $15,000 today at a 6% interest compounded daily, what will be your ending value after 12 years? 4.19. What will be the amount accumulated by each of these present investments? (a) $9,545 in 12 years at 8.2% compounded semiannually. (b) $6,500 in 10 years at 6% compounded quarterly. (c) $42,800 in 8 years at 9% compounded monthly. 4.20. How many years will it take an investment to triple if the interest rate is 9% compounded at the given intervals?

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

412 To calculate the future value of 5000 in 10 years with 6 interest compounded continuously we can use the formula Future Value Present Value er t where Present Value 5000 initial investment r 6 006 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started