Question

4-16. Harmony reports a regular tax liability of $15,500 and tentative minimum tax of $17,550. Given just this information, what is her alternative minimum tax

4-16. Harmony reports a regular tax liability of $15,500 and tentative minimum tax of $17,550. Given just this information, what is her alternative minimum tax liability for the year? Multiple Choice

a. $0

b. $2,050

c. $15,500

d. $17,550

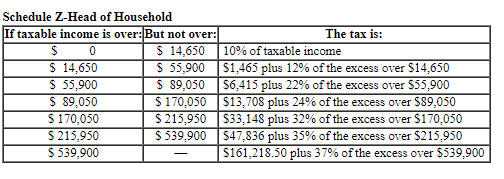

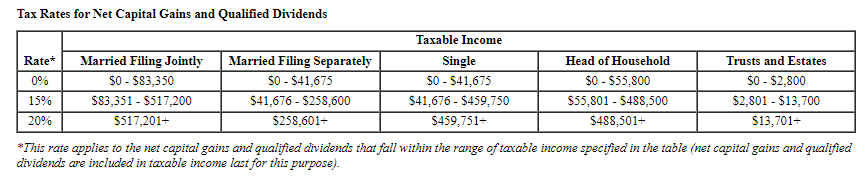

17. Angelena files as a head of household. In 2022, she reported $57,900 of taxable income, including a $13,300 qualified dividend. What is her gross tax liability? (Use the tax rate schedules, long-term capital gains tax brackets.) Note: Round your answer to the nearest whole dollar amount. Multiple Choice

a. $6,349

b. $5,374

c. $6,559

d. $5,059

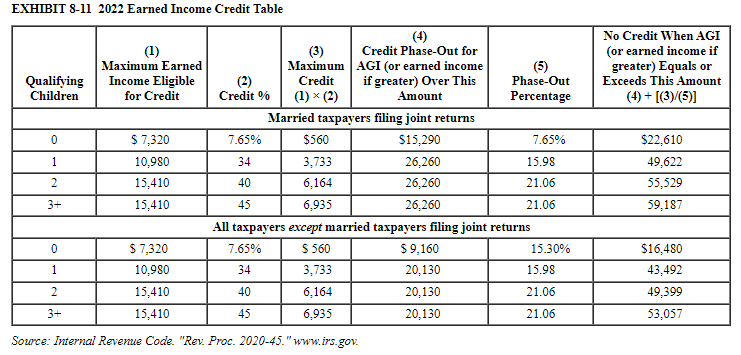

18. Carolyn has an AGI of $39,400 (all from earned income) and two qualifying children and is filing as a head of household. What amount of earned income credit is she entitled to?(Exhibit 8-11) Multiple Choice

a. $0

b. $2,106

c. $3,636

d. $3,987

e. $6,164

19. Allen Green is a single taxpayer with an AGI (and modified AGI) of $218,000, which includes $174,000 of salary, $27,400 of interest income, $10,800 of dividends, and $5,800 of long-term capital gains. What is Allens net investment income tax liability this year, rounded to the nearest whole dollar amount? Multiple Choice

a. $3,260

b. $1,672

c. $904

d. $684

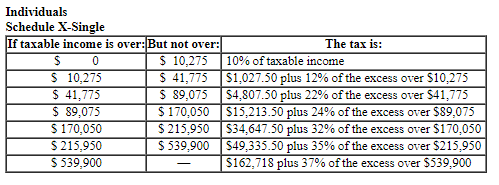

20. Miley, a single taxpayer, plans on reporting $33,175 of taxable income this year (all of her income is from a part-time job). She is considering applying for a second part-time job that would give her an additional $10,400 of taxable income. By how much will the income from the second job increase her tax liability? (Use the tax rate schedules.) Multiple Choice

a. $1,040

b. $1,248

c. $1,428

d. $2,496

Schedule Z-Head of Household \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$10 & $14,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 12% of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$89,050 & $170,050 & $13,708 plus 24% of the excess over $9,050 \\ \hline$170,050 & $215,950 & $33,148 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $47,836 plus 35% of the excess over $215,950 \\ \hline$539,900 & - & $161,218.50 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Tax Rates for Net Capital Gains and Qualified Dividends *This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified dividends are included in taxable income last for this purpose). EXHIBIT 8-11 2022 Earned Income Credit Table Source: Internal Revenue Code. "Rev. Proc. 2020-45." www. irs.gov. IndividualsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started