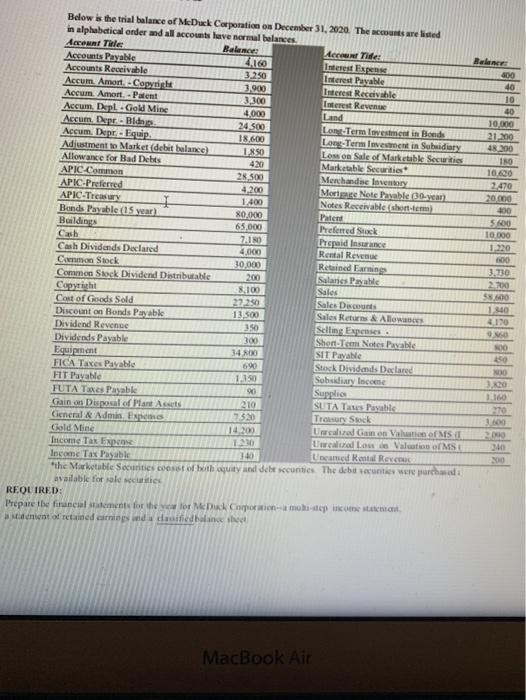

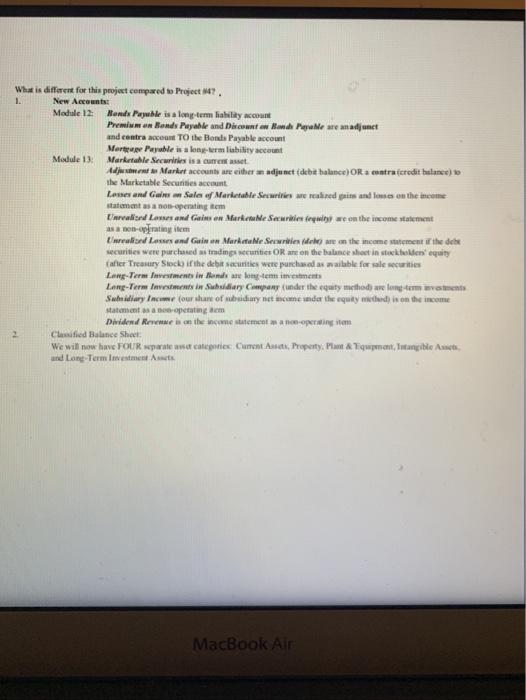

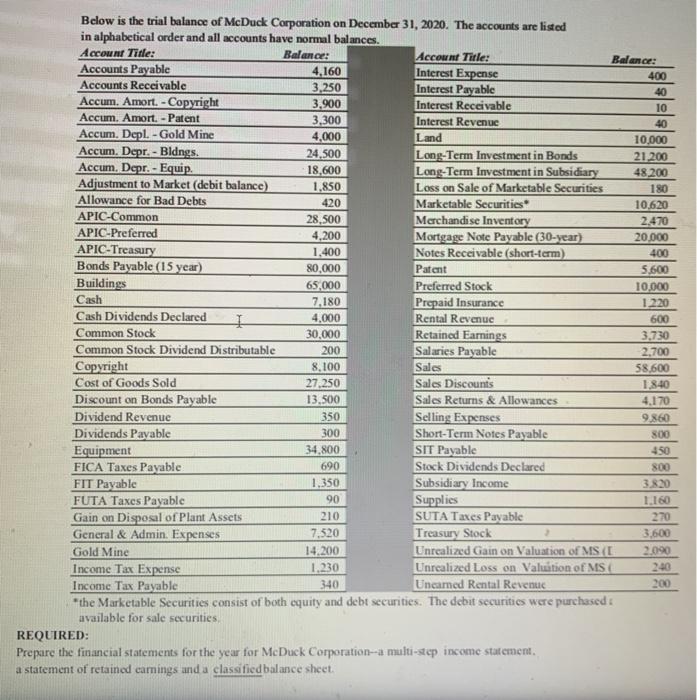

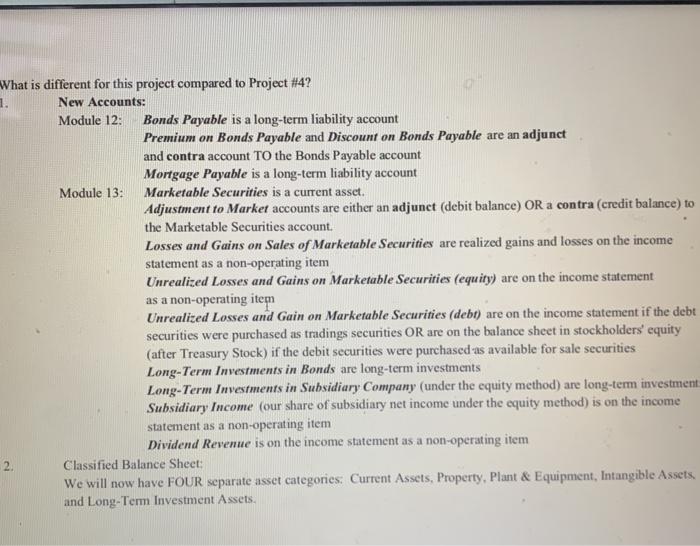

4.160 420 Below is the trial balance of McDuck Corporations on December 31, 2020. The counts are listed in alphabetical ander and all accounts have normal balances Acent Tule Balance: e Tide Accounts Payable Race Interest Expense Accounts Receivable 400 3.250 Interest Payable Accum. Amort. Copyright 40 3.900 Interest Receivable Accum. Amort-Patent 10 3,300 Interest Revenue 40 Accum. Depl.Gold Mine 4,000 Land 10 000 Accum. Depr - Bidap 24.500 Accum. Depr.- Equip Long-Term Lovestment in Bands 21 20 18.600 Long Term levement in Subsidiary 4200 Adjustment to Market (debit balance Los on Sale of Marketable Securities INO Allowance for Bad Debts Marketable Securities 10.00 APIC Common 28,500 Merchandise Inventory 2470 APIC-Preferred 4,200 Morte Nots Payable 30-year) 20.000 APIC-Treasury I 1,400 Notes Receivablettem 400 Bonds Payable 15 year) 80,000 Patent S600 Buildings 65.000 Preferred Stack 10.000 Cash 7A180 Ispaid Insurance 1.220 Cash Dividends Declared 4.000 Rental Reve 00 Como Stock 30.000 Retained Farming 3.730 Common Stock Dividend Distributable 200 Salancs Pavlic 2.700 Copyright 8,100 Sales S600 Cost of Goods Sold 27250 Sales Discount 1 340 Discount on Bonds Payable 13.500 Sales Returns & Allowances 4110 Dividend Revenge 350 Selling Expenses Dividends Payable 300 Short Term Notes Payable 00 Equipment 34 O SIT Payake 150 FICA Taxes Payable 690 Stock Dividends Declared NDO FIT Payable Subsidiary Income FUTA Tes Pasak 20 Supplies 1.160 Gain on Disposal of Plant Assets 210 SUTA Tases Payable 170 General Admin Espans 7530 Treasury Stock Gold Mine 14200 Umaired Gain on Valuation of MST 200 Income Tax Expense Uwear Louis Valuation of MS 340 Income Tax Payable Led Rental Revenu the Marketable Securities wenst of both guy and debe securities. The debe securities were prowad available for sale Hotel REQUIRED: Prepare the financatatements for the year for Me Du Corporation-a muhiepiscore tatemat sement of retained ning end died balance sheet 1.150 MacBook Air What is different for this project compared to Project N7. 1. New Accounts Module 12: Nendes Payuble is a long-term liability account Premium en Bonds Payable and Discount and Peale are an adjunct and contra de TO the Bonts Payable account Mert Payable is a long-term libility account Module 13: Marketable Securities is current asset Adjustment Market account weiber an adjunet (debe balance) OR centra (credit bulunee) the Marketable Securities at Lowes and Gale Sale of Marketable Securities we realized puits and lower on the income statement as a non-operating tem Unaond Lowes and Gales en Market Securities wewe on the income statement as a non-operating item Unrealised Lasses and Gatine Market Ne Securities del me on the income statement of the debe securities were purchased as trading securities OR are on the balance sheet in stockholde equity after Treasury Stock if the debit securities were purchased as wailable for sale securities Long-Term Investments in a long-term investments Long-Term wwwments in Saudiary Company under the equity methods are long-term west Subsidiary Income for share of obsidiary net income ide the equity meted) is on the income statements peting em Dividend Rennes on the income statement annoring tom Classified Balance Sheet We will now have FOUR spate assor categories Cument Ameti. Property. Plant & Tiquipment, Intangible Aucts, and Long Term Investment at MacBook Air Below is the trial balance of McDuck Corporation on December 31, 2020. The accounts are listed in alphabetical order and all accounts have normal balances. Account Title: Balance: Account Title: Balance: Accounts Payable 4,160 Interest Expense 400 Accounts Receivable 3,250 Interest Payable 40 Accum. Amort. - Copyright 3,900 Interest Receivable 10 Accum. Amort.- Patent 3,300 Interest Revenue Accum. Depl. - Gold Mine 4,000 Land 10.000 Accum. Depr.- Bldngs. 24,500 Long-Term Investment in Bonds 21.200 Accum. Depr. - Equip. 18,600 Long-Term Investment in Subsidiary 48.200 Adjustment to Market (debit balance) 1.850 Loss on Sale of Marketable Securities 180 Allowance for Bad Debts 420 Marketable Securities 10.620 APIC-Common 28,500 Merchandise Inventory 2.470 APIC-Preferred 4,200 Mortgage Note Payable (30-year) 20.000 APIC-Treasury 1.400 Notes Receivable (short-term) 400 Bonds Payable (15 year) 80.000 Patent 5,600 Buildings 65,000 Preferred Stock 10,000 Cash 7,180 Prepaid Insurance 1 220 Cash Dividends Declared I 4,000 Rental Revenue 600 Common Stock 30,000 Retained Earnings 3,730 Common Stock Dividend Distributable 200 Salaries Payable 2,700 Copyright 8,100 Sales 58,600 Cost of Goods Sold 27.250 Sales Discounts 1.8-40 Discount on Bonds Payable 13,500 Sales Returns & Allowances 4.170 Dividend Revenue 350 Selling Expenses 9.860 Dividends Payable 300 Short-Term Notes Payable 800 Equipment 34.800 SIT Payable 450 FICA Taxes Payable 690 Stock Dividends Declared 800 FIT Payable 1.350 Subsidiary Income 3.820 FUTA Taxes Payable 90 Supplies 1.160 Gain on Disposal of Plant Assets 210 SUTA Taxes Payable 270 General & Admin. Expenses 7.520 Treasury Stock 3.600 Gold Mine 14,200 Unrealized Gain on Valuation of MS (L 2.090 Income Tax Expense 1.230 Unrealized Loss on Valuation of MS 240 Income Tax Payable 340 Uncamed Rental Revenue "the Marketable Securities consist of both equity and debt securities. The debut securities were purchased available for sale securities REQUIRED: Prepare the financial statements for the year for McDuck Corporation--a multi-step income statement. a statement of retained earnings and a classified balance sheet. 200 What is different for this project compared to Project #4? 1. New Accounts: Module 12: Bonds Payable is a long-term liability account Premium on Bonds Payable and Discount on Bonds Payable are an adjunct and contra account TO the Bonds Payable account Mortgage Payable is a long-term liability account Module 13: Marketable Securities is a current asset. Adjustment to Market accounts are either an adjunct (debit balance) OR a contra credit balance) to the Marketable Securities account. Losses and Gains on Sales of Marketable Securities are realized gains and losses on the income statement as a non-operating item Unrealized Losses and Gains on Marketable Securities (equity) are on the income statement as a non-operating item Unrealized Losses and Gain on Marketable Securities (debt) are on the income statement if the debt securities were purchased as trading securities OR are on the balance sheet in stockholders' equity (after Treasury Stock) if the debit securities were purchased as available for sale securities Long-Term Investments in Bonds are long-term investments Long-Term Investments in Subsidiary Company (under the equity method) are long-term investment Subsidiary Income (our share of subsidiary net income under the equity method) is on the income statement as a non-operating item Dividend Revenue is on the income statement as a non-operating item . Classified Balance Sheet: We will now have FOUR separate asset categories: Current Assets, Property, Plant & Equipment, Intangible Assets, and Long-Term Investment Assets. 2 . 4.160 420 Below is the trial balance of McDuck Corporations on December 31, 2020. The counts are listed in alphabetical ander and all accounts have normal balances Acent Tule Balance: e Tide Accounts Payable Race Interest Expense Accounts Receivable 400 3.250 Interest Payable Accum. Amort. Copyright 40 3.900 Interest Receivable Accum. Amort-Patent 10 3,300 Interest Revenue 40 Accum. Depl.Gold Mine 4,000 Land 10 000 Accum. Depr - Bidap 24.500 Accum. Depr.- Equip Long-Term Lovestment in Bands 21 20 18.600 Long Term levement in Subsidiary 4200 Adjustment to Market (debit balance Los on Sale of Marketable Securities INO Allowance for Bad Debts Marketable Securities 10.00 APIC Common 28,500 Merchandise Inventory 2470 APIC-Preferred 4,200 Morte Nots Payable 30-year) 20.000 APIC-Treasury I 1,400 Notes Receivablettem 400 Bonds Payable 15 year) 80,000 Patent S600 Buildings 65.000 Preferred Stack 10.000 Cash 7A180 Ispaid Insurance 1.220 Cash Dividends Declared 4.000 Rental Reve 00 Como Stock 30.000 Retained Farming 3.730 Common Stock Dividend Distributable 200 Salancs Pavlic 2.700 Copyright 8,100 Sales S600 Cost of Goods Sold 27250 Sales Discount 1 340 Discount on Bonds Payable 13.500 Sales Returns & Allowances 4110 Dividend Revenge 350 Selling Expenses Dividends Payable 300 Short Term Notes Payable 00 Equipment 34 O SIT Payake 150 FICA Taxes Payable 690 Stock Dividends Declared NDO FIT Payable Subsidiary Income FUTA Tes Pasak 20 Supplies 1.160 Gain on Disposal of Plant Assets 210 SUTA Tases Payable 170 General Admin Espans 7530 Treasury Stock Gold Mine 14200 Umaired Gain on Valuation of MST 200 Income Tax Expense Uwear Louis Valuation of MS 340 Income Tax Payable Led Rental Revenu the Marketable Securities wenst of both guy and debe securities. The debe securities were prowad available for sale Hotel REQUIRED: Prepare the financatatements for the year for Me Du Corporation-a muhiepiscore tatemat sement of retained ning end died balance sheet 1.150 MacBook Air What is different for this project compared to Project N7. 1. New Accounts Module 12: Nendes Payuble is a long-term liability account Premium en Bonds Payable and Discount and Peale are an adjunct and contra de TO the Bonts Payable account Mert Payable is a long-term libility account Module 13: Marketable Securities is current asset Adjustment Market account weiber an adjunet (debe balance) OR centra (credit bulunee) the Marketable Securities at Lowes and Gale Sale of Marketable Securities we realized puits and lower on the income statement as a non-operating tem Unaond Lowes and Gales en Market Securities wewe on the income statement as a non-operating item Unrealised Lasses and Gatine Market Ne Securities del me on the income statement of the debe securities were purchased as trading securities OR are on the balance sheet in stockholde equity after Treasury Stock if the debit securities were purchased as wailable for sale securities Long-Term Investments in a long-term investments Long-Term wwwments in Saudiary Company under the equity methods are long-term west Subsidiary Income for share of obsidiary net income ide the equity meted) is on the income statements peting em Dividend Rennes on the income statement annoring tom Classified Balance Sheet We will now have FOUR spate assor categories Cument Ameti. Property. Plant & Tiquipment, Intangible Aucts, and Long Term Investment at MacBook Air Below is the trial balance of McDuck Corporation on December 31, 2020. The accounts are listed in alphabetical order and all accounts have normal balances. Account Title: Balance: Account Title: Balance: Accounts Payable 4,160 Interest Expense 400 Accounts Receivable 3,250 Interest Payable 40 Accum. Amort. - Copyright 3,900 Interest Receivable 10 Accum. Amort.- Patent 3,300 Interest Revenue Accum. Depl. - Gold Mine 4,000 Land 10.000 Accum. Depr.- Bldngs. 24,500 Long-Term Investment in Bonds 21.200 Accum. Depr. - Equip. 18,600 Long-Term Investment in Subsidiary 48.200 Adjustment to Market (debit balance) 1.850 Loss on Sale of Marketable Securities 180 Allowance for Bad Debts 420 Marketable Securities 10.620 APIC-Common 28,500 Merchandise Inventory 2.470 APIC-Preferred 4,200 Mortgage Note Payable (30-year) 20.000 APIC-Treasury 1.400 Notes Receivable (short-term) 400 Bonds Payable (15 year) 80.000 Patent 5,600 Buildings 65,000 Preferred Stock 10,000 Cash 7,180 Prepaid Insurance 1 220 Cash Dividends Declared I 4,000 Rental Revenue 600 Common Stock 30,000 Retained Earnings 3,730 Common Stock Dividend Distributable 200 Salaries Payable 2,700 Copyright 8,100 Sales 58,600 Cost of Goods Sold 27.250 Sales Discounts 1.8-40 Discount on Bonds Payable 13,500 Sales Returns & Allowances 4.170 Dividend Revenue 350 Selling Expenses 9.860 Dividends Payable 300 Short-Term Notes Payable 800 Equipment 34.800 SIT Payable 450 FICA Taxes Payable 690 Stock Dividends Declared 800 FIT Payable 1.350 Subsidiary Income 3.820 FUTA Taxes Payable 90 Supplies 1.160 Gain on Disposal of Plant Assets 210 SUTA Taxes Payable 270 General & Admin. Expenses 7.520 Treasury Stock 3.600 Gold Mine 14,200 Unrealized Gain on Valuation of MS (L 2.090 Income Tax Expense 1.230 Unrealized Loss on Valuation of MS 240 Income Tax Payable 340 Uncamed Rental Revenue "the Marketable Securities consist of both equity and debt securities. The debut securities were purchased available for sale securities REQUIRED: Prepare the financial statements for the year for McDuck Corporation--a multi-step income statement. a statement of retained earnings and a classified balance sheet. 200 What is different for this project compared to Project #4? 1. New Accounts: Module 12: Bonds Payable is a long-term liability account Premium on Bonds Payable and Discount on Bonds Payable are an adjunct and contra account TO the Bonds Payable account Mortgage Payable is a long-term liability account Module 13: Marketable Securities is a current asset. Adjustment to Market accounts are either an adjunct (debit balance) OR a contra credit balance) to the Marketable Securities account. Losses and Gains on Sales of Marketable Securities are realized gains and losses on the income statement as a non-operating item Unrealized Losses and Gains on Marketable Securities (equity) are on the income statement as a non-operating item Unrealized Losses and Gain on Marketable Securities (debt) are on the income statement if the debt securities were purchased as trading securities OR are on the balance sheet in stockholders' equity (after Treasury Stock) if the debit securities were purchased as available for sale securities Long-Term Investments in Bonds are long-term investments Long-Term Investments in Subsidiary Company (under the equity method) are long-term investment Subsidiary Income (our share of subsidiary net income under the equity method) is on the income statement as a non-operating item Dividend Revenue is on the income statement as a non-operating item . Classified Balance Sheet: We will now have FOUR separate asset categories: Current Assets, Property, Plant & Equipment, Intangible Assets, and Long-Term Investment Assets. 2