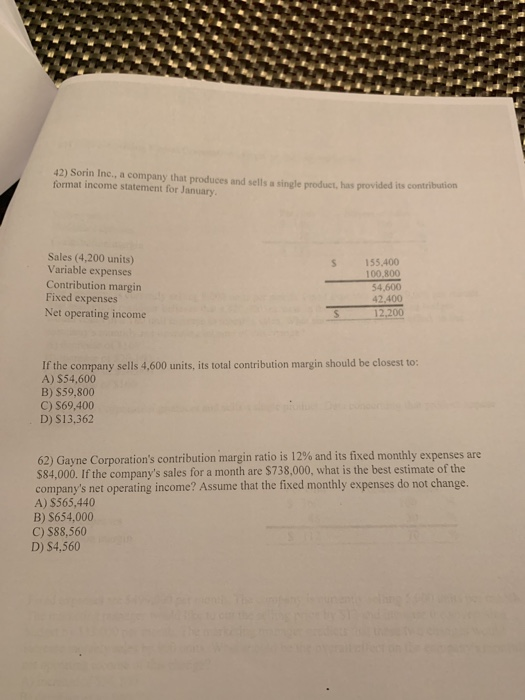

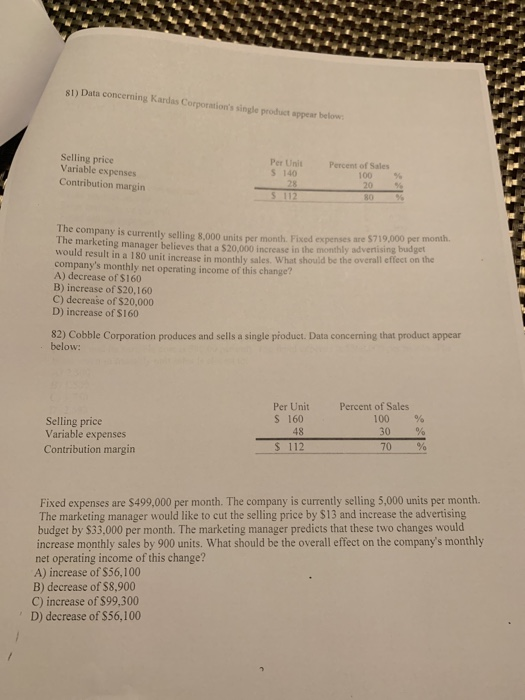

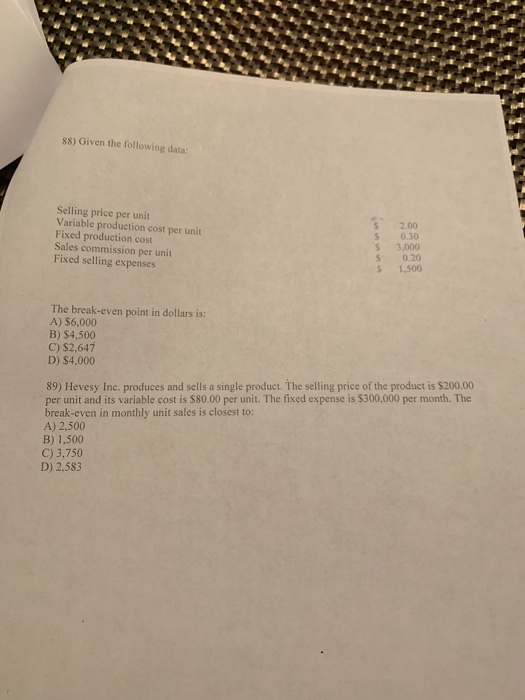

42) Sorin Inc., a company that produces and sells a single product, has provided its contribution format income statement for January Sales (4,200 units) Variable expenses Contribution margin Fixed expenses Net operating income 155,400 100,800 42.400 If the company sells 4,600 units, its total contribution margin should be closest to: A) $54,600 B) $59,800 C) S69,400 D) S13,362 62) Gayne Corporation's contribution margin ratio is 12% and its fixed monthly expenses are $84,000. If the company's sales for a month are $738,000, what is the best estimate of the company's net operating income? Assume that the fixed monthly expenses do not change. A) S565,440 B) S654,000 C) $88,560 D) S4,560 81) Data concerning Kardas Corporation's single product appear below Selling price Variable expenses Per UnitPercent of Sales S 140 100 20 80 % Contribution margin The company is currently selling 8,000 units per month. Fixed expenses are The marketing manager believes that a S would result in a 180 unit increase in monthly sales. What should be the company's monthly net operating income of this change? A) decrease of $160 B) increase of $20,160 C) decrease of $20,000 D) increase of $160 $719,000 per month. budget in the monthly advertising overall effect on the 82) Cobble Corporation produces and sells a single product. Data concerning that product appear below Percent of Sales Per Unit S 160 100 % 30% 70% Selling price Variable expenses Contribution margin S 112 Fixed expenses are $499,000 per month. The company is currently selling 5,000 units per month. The marketing manager would like to cut the selling price by $13 and increase the advertising budget by $33,000 per month. The marketing manager predicts that these two changes would increase monthly sales by 900 units. What should be the overall effect on the company's monthly net operating income of this change? A) increase of $56,100 B) decrease of $8,900 C) increase of $99,300 D) decrease of $56,100 88) Given the following data: Selling price per unit Variable production cost per unit Fixed production cost Sales commission per unit Fixed selling expenses S 2.00 S 0.30 S 3,000 S 0.20 S 1,300 The break-even point in dollars is: A) S6,000 B) $4,500 C) $2,647 D) $4,000 89) Hevesy Inc. produces and sells a single product. The selling price of the product is $200.00 per unit and its variable cost is $80.00 per unit. The fixed expense is $300,000 per month. The break-even in monthly unit sales is closest to A) 2,500 B) 1,500 C) 3,750 D) 2,583