Question

42. You are the CFO of Adelaide Antibiotics Limited and need to choose between making a public offering and arranging a private placement. In each

42. You are the CFO of Adelaide Antibiotics Limited and need to choose between making a public offering and arranging a private placement. In each case the issue involves $10 million face value of 10-year debt. You have the following data for each:

- A public issue: The interest rate on the debt would be 8.5%, and the debt would be issued at face value. The underwriting spread would be 1.5%, and other expenses would be $80,000.

- A private placement: The interest rate on the private placement would be 9%, but the total issuing expenses would be only $30,000.

a. What is the difference in the proceeds to the company net of expenses?

b. Other things being equal, which is the better deal?

c. What other factors beyond the interest rate and issue costs would you wish to consider before deciding between the two offers?

43. Bragg Corporation has a project that costs $1 million and has a base-case NPV of exactly zero (NPV=0). What is the project's APV in each of the following cases?

a. If the Bragg invests, it has to raise $500,000 by a stock issue. Issue costs are 15% of net proceeds.

b. If the Bragg invests, there are no issue costs but its debt capacity increases by $500,000. The present value of interest tax shields on this debt is $76,000.

44. Bonzo Carriers is contemplating the acquisition of Canberra Ski Sticks, Inc. The values of the two companies as separate entities are $20 million and $10 million, respectively. Bonzo Carriers estimates that by combining the two companies, it will reduce marketing and administrative costs by $500,000 per year in perpetuity. Bonzo Carriers can either pay $14 million cash for Canberra Ski Sticks or them a 50% holding in Bonzo carriers. The opportunity cost of capital is 10%.

a. What is the gain from merger?

b. What is the cost of the cash offer?

c. What is the cost of the stock alternative?

d. What is the NPV of the acquisition under the cash offer?

e. What is its NPV under the stock offer?

45. Chat Corp. is financed entirely by common stock and has a beta of 1.0. The firm is expected to generate a level, perpetual stream of earnings and dividends. The stock has a price-earnings ratio of 8 and a cost of equity of 12.5%. The company's stock is selling for $50. Now the firm decides to repurchase half of its shares and substitute an equal value of debt. The debt is risk-free, with a 5% interest rate. The company is exempt from corporate income taxes. Assuming Modigliani-Miller are correct, calculate the following items after the refinancing:

a. The cost of equity

b. The overall cost of capital (WACC)

c. The price-earnings ratio

d. The stock price

e. The stock's beta

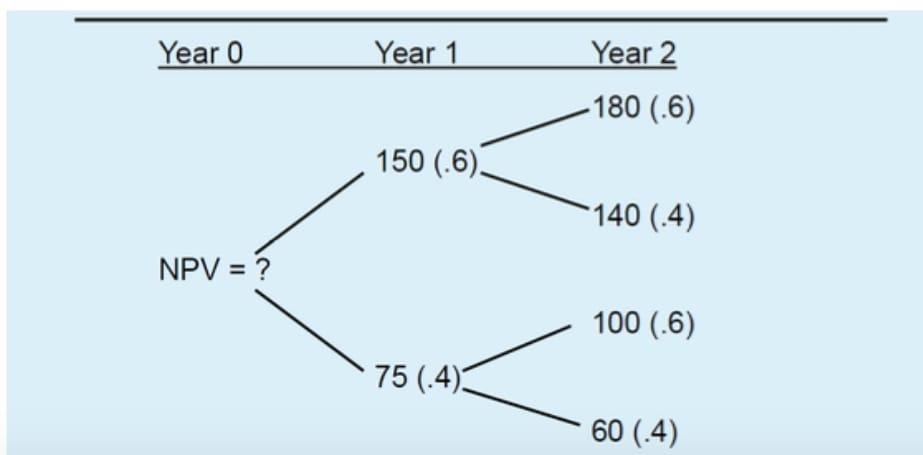

46. You are the sole owner of a company. The value of your business depends on how well the Australian economy does in the post-vaccination period. The following binomial tree represents your view of what your firm's cash flows will be during the next two years. The diagram suggests that there is a substantial chance that your company will experience below par cash flows in the next two years. Your friend, Ms. Guilder, gives you a non-retractable offer to buy your company for $175 million at any time within the next year. Use a discount rate of 10%. Assume that your firm will shut down after two years. If you need to make any additional assumptions, please state them.

a. Find the NPV of the future cash flows to estimate your firm's value now (without using Ms. Guilder's offer).

b. Draw the binomial tree, assuming that you take-up your friend's offer.

c. What is the value of the offer to you?

d. What type of option is Ms. Guilder offering you? What is the maximum amount she could charge you for this option?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started