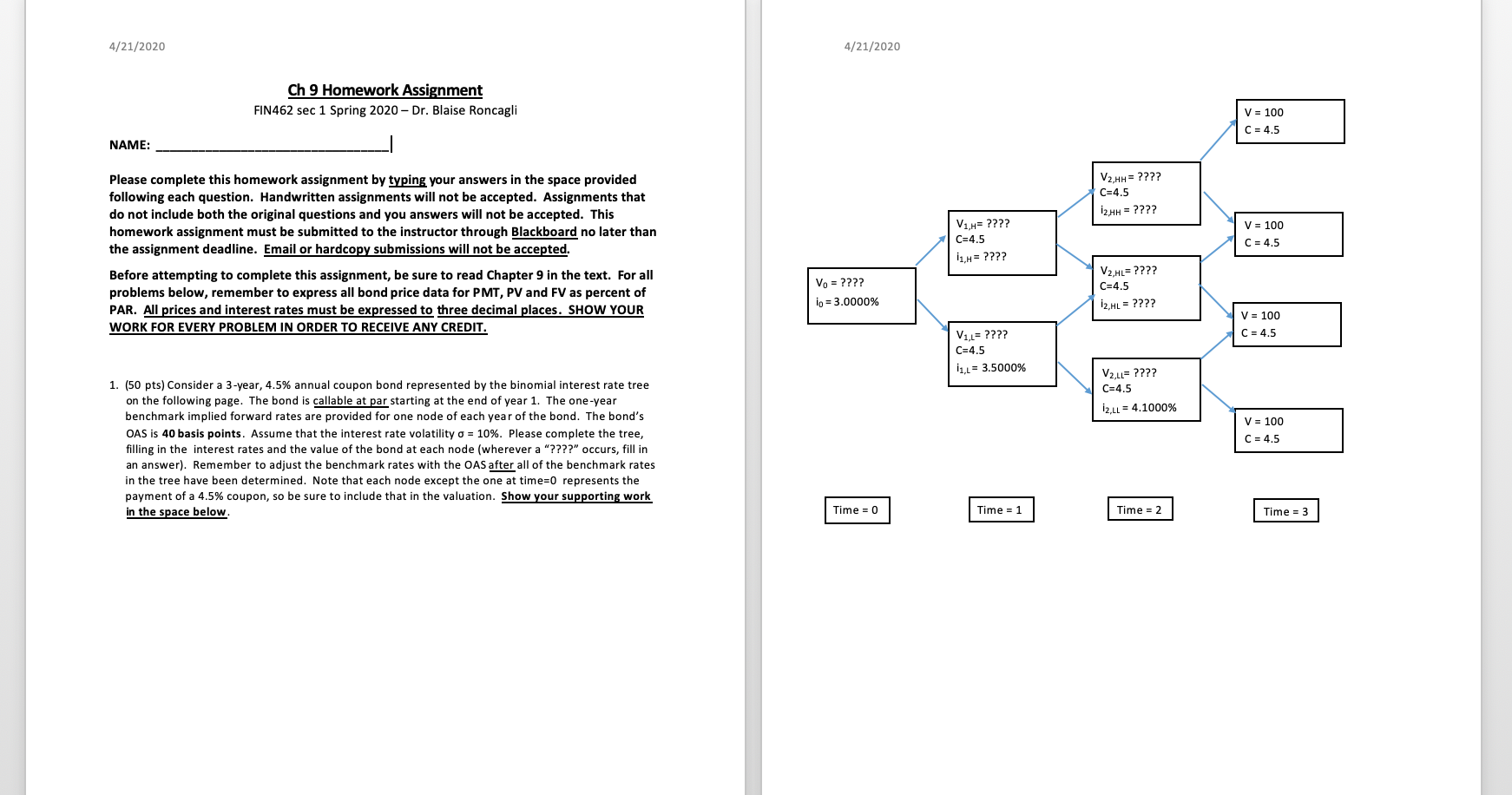

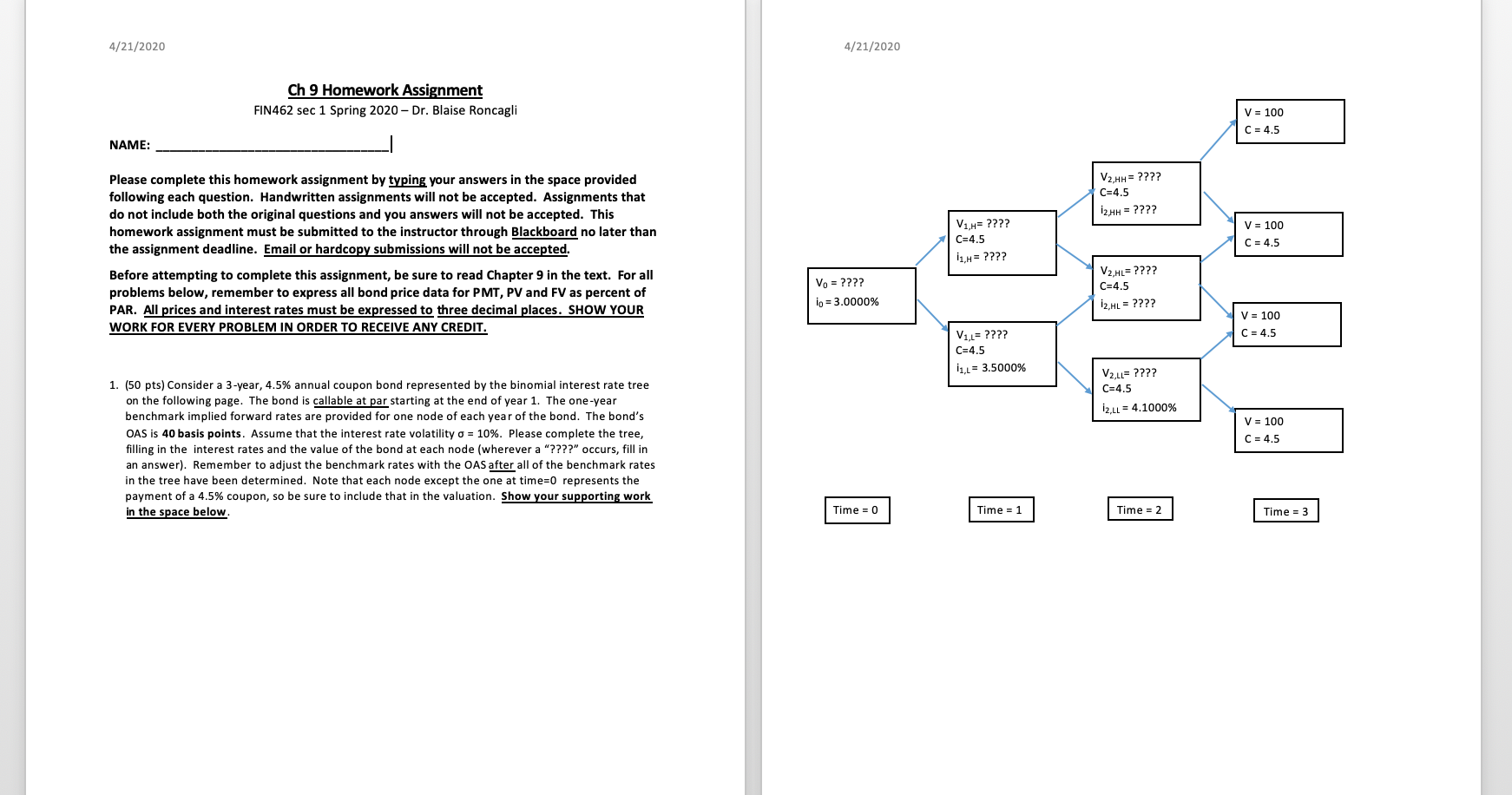

4/21/2020 4/21/2020 Ch 9 Homework Assignment FIN462 sec 1 Spring 2020 - Dr. Blaise Roncagli V = 100 C = 4.5 NAME: V2,HH = ???? C=4.5 12 HH = ???? Please complete this homework assignment by typing your answers in the space provided following each question. Handwritten assignments will not be accepted. Assignments that do not include both the original questions and you answers will not be accepted. This homework assignment must be submitted to the instructor through Blackboard no later than the assignment deadline. Email or hardcopy submissions will not be accepted. Before attempting to complete this assignment, be sure to read Chapter 9 in the text. For all problems below, remember to express all bond price data for PMT, PV and FV as percent of PAR. All prices and interest rates must be expressed to three decimal places. SHOW YOUR WORK FOR EVERY PROBLEM IN ORDER TO RECEIVE ANY CREDIT. V1,H= ???? C=4.5 11,H= ???? V = 100 C = 4.5 Vo = ???? 10 = 3.0000% V2,HL= ???? C=4.5 12,HL = ???? V = 100 C = 4.5 V1,L= ???? C=4.5 11,L = 3.5000% V2.LL= ???? C=4.5 12.LL = 4.1000% V = 100 C = 4.5 1. (50 pts) Consider a 3-year, 4.5% annual coupon bond represented by the binomial interest rate tree on the following page. The bond is callable at par starting at the end of year 1. The one-year benchmark implied forward rates are provided for one node of each year of the bond. The bond's OAS is 40 basis points. Assume that the interest rate volatility o = 10%. Please complete the tree, filling in the interest rates and the value of the bond at each node (wherever a "????" occurs, fill in an answer). Remember to adjust the benchmark rates with the OAS after all of the benchmark rates in the tree have been determined. Note that each node except the one at time=0 represents the payment of a 4.5% coupon, so be sure to include that in the valuation. Show your supporting work in the space below. Time = 0 Time = 1 Time = 2 Time = 3 4/21/2020 4/21/2020 Ch 9 Homework Assignment FIN462 sec 1 Spring 2020 - Dr. Blaise Roncagli V = 100 C = 4.5 NAME: V2,HH = ???? C=4.5 12 HH = ???? Please complete this homework assignment by typing your answers in the space provided following each question. Handwritten assignments will not be accepted. Assignments that do not include both the original questions and you answers will not be accepted. This homework assignment must be submitted to the instructor through Blackboard no later than the assignment deadline. Email or hardcopy submissions will not be accepted. Before attempting to complete this assignment, be sure to read Chapter 9 in the text. For all problems below, remember to express all bond price data for PMT, PV and FV as percent of PAR. All prices and interest rates must be expressed to three decimal places. SHOW YOUR WORK FOR EVERY PROBLEM IN ORDER TO RECEIVE ANY CREDIT. V1,H= ???? C=4.5 11,H= ???? V = 100 C = 4.5 Vo = ???? 10 = 3.0000% V2,HL= ???? C=4.5 12,HL = ???? V = 100 C = 4.5 V1,L= ???? C=4.5 11,L = 3.5000% V2.LL= ???? C=4.5 12.LL = 4.1000% V = 100 C = 4.5 1. (50 pts) Consider a 3-year, 4.5% annual coupon bond represented by the binomial interest rate tree on the following page. The bond is callable at par starting at the end of year 1. The one-year benchmark implied forward rates are provided for one node of each year of the bond. The bond's OAS is 40 basis points. Assume that the interest rate volatility o = 10%. Please complete the tree, filling in the interest rates and the value of the bond at each node (wherever a "????" occurs, fill in an answer). Remember to adjust the benchmark rates with the OAS after all of the benchmark rates in the tree have been determined. Note that each node except the one at time=0 represents the payment of a 4.5% coupon, so be sure to include that in the valuation. Show your supporting work in the space below. Time = 0 Time = 1 Time = 2 Time = 3