Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4-23 RATIO ANALYSIS Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, so the market value of

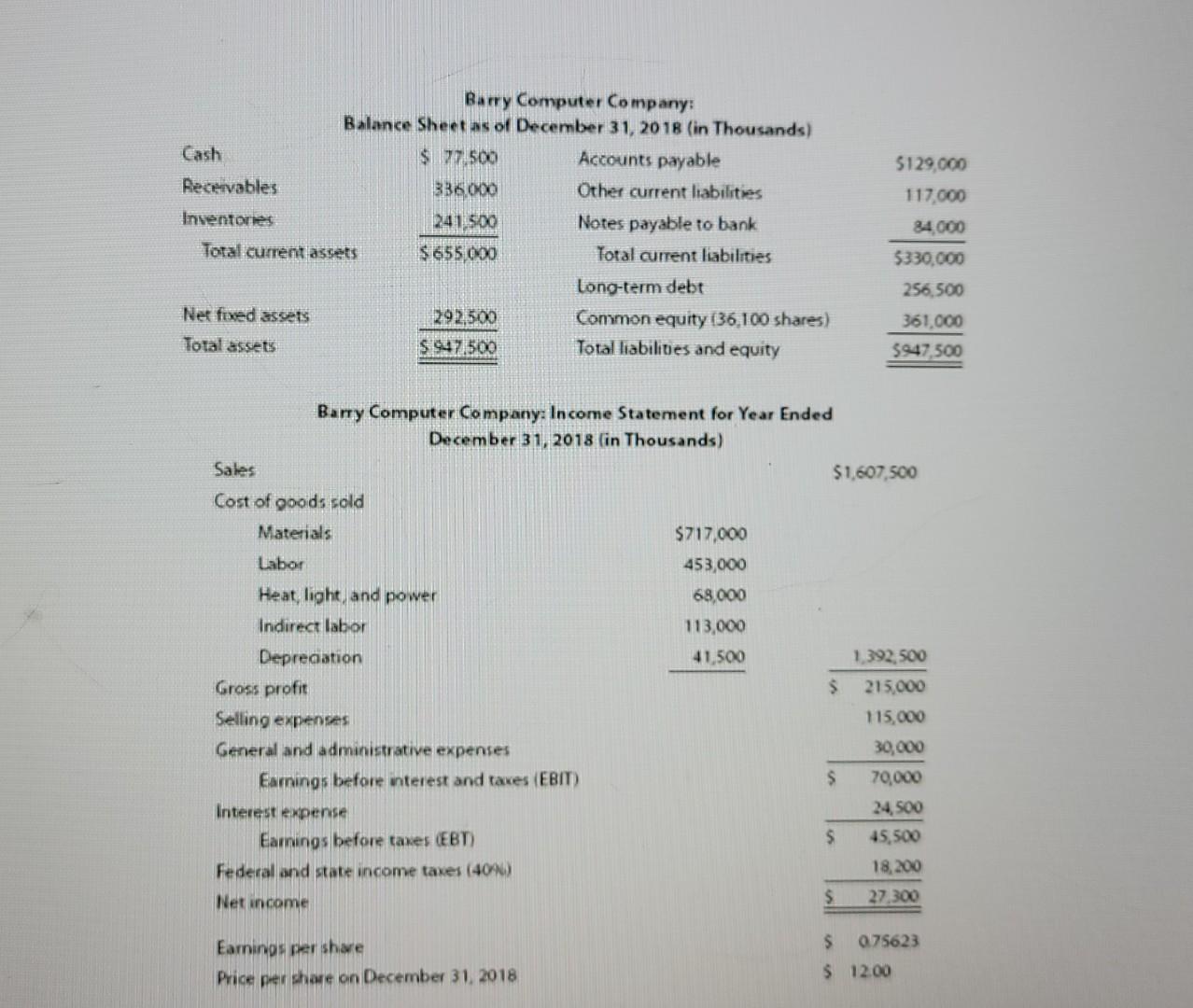

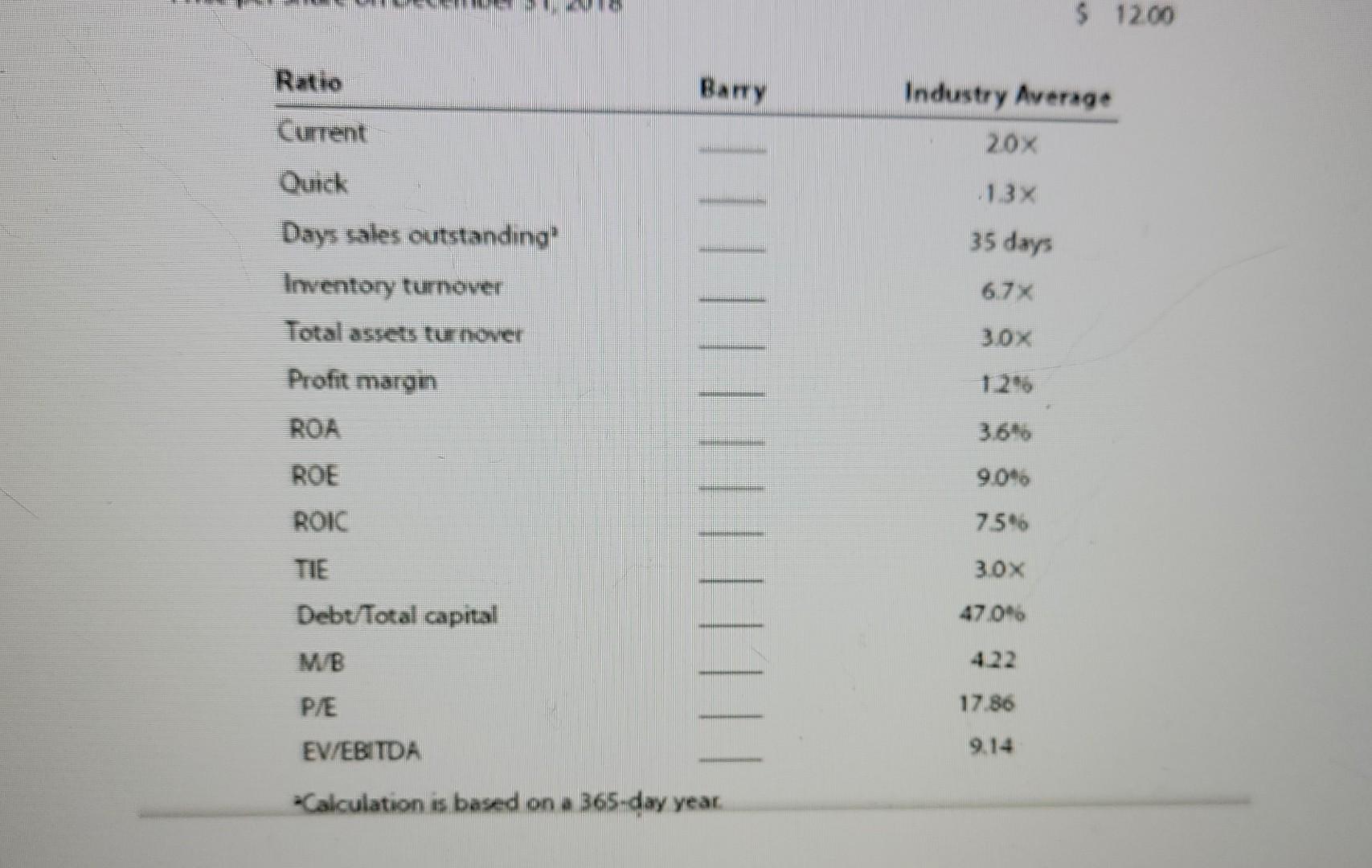

4-23 RATIO ANALYSIS Data for Barry Computer Co. and its industry averages follow. The firm's debt is priced at par, so the market value of its debt equals its book value. Since dollars are in thousands, the number of shares is shown in thousands too. a. Calculate the indicated ratios for Barry. Barry Computer Company: Balance Sheet as of December 31, 2018 (in Thousands) Barry Computer Company: Income Statement for Year Ended December 31, 2018 (in Thousands) Sales Cost of goods sold Materials Labor Heat, light, and power Indirect labor Deprecation Gross profit Selling expenses General and administrative expenses Eamings before interest and taves (EBIT) $1,607,500 Interest experse Eamings before taves (EBT) Federal and state income taves (40N)) Net income * Calculation is based on a 365-day year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started