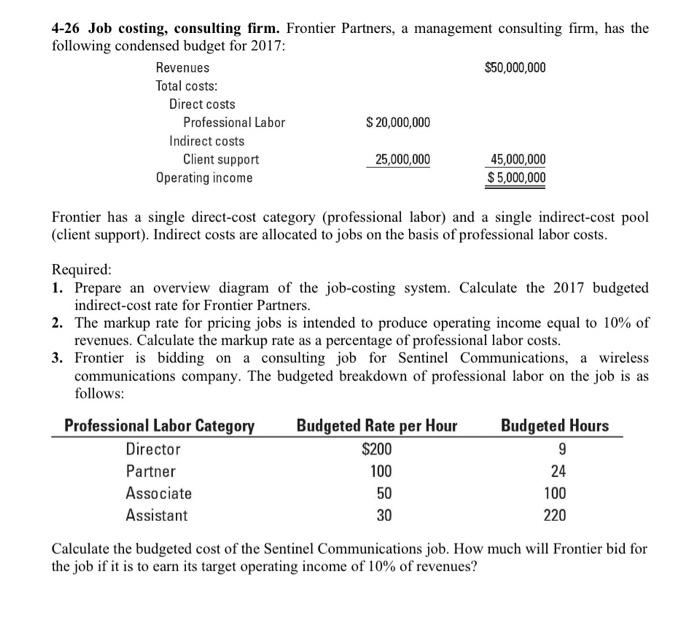

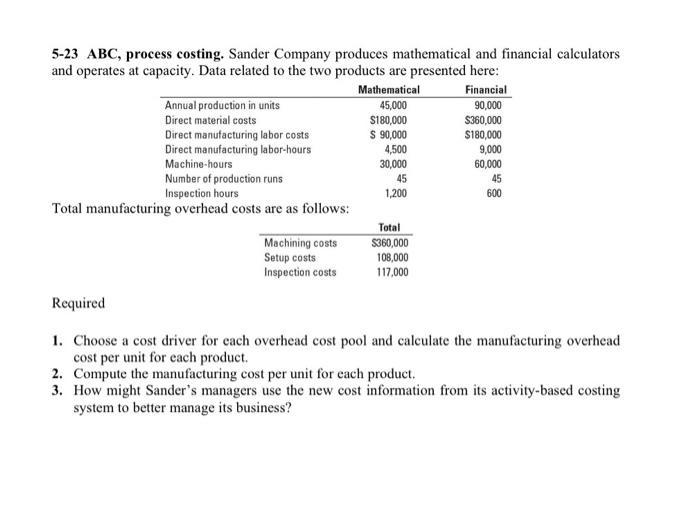

4-26 Job costing, consulting firm. Frontier Partners, a management consulting firm, has the following condensed budget for 2017: Revenues $50,000,000 Total costs: Direct costs Professional Labor $ 20,000,000 Indirect costs Client support 25,000,000 45,000,000 Operating income $5,000,000 Frontier has a single direct-cost category (professional labor) and a single indirect-cost pool (client support). Indirect costs are allocated to jobs on the basis of professional labor costs. Required: 1. Prepare an overview diagram of the job-costing system. Calculate the 2017 budgeted indirect-cost rate for Frontier Partners. 2. The markup rate for pricing jobs is intended to produce operating income equal to 10% of revenues. Calculate the markup rate as a percentage of professional labor costs. 3. Frontier is bidding on a consulting job for Sentinel Communications, a wireless communications company. The budgeted breakdown of professional labor on the job is as follows: Professional Labor Category Budgeted Rate per Hour Budgeted Hours Director $200 9 Partner Associate 50 100 Assistant 30 220 Calculate the budgeted cost of the Sentinel Communications job. How much will Frontier bid for the job if it is to earn its target operating income of 10% of revenues? 100 24 5-23 ABC, process costing. Sander Company produces mathematical and financial calculators and operates at capacity. Data related to the two products are presented here: Mathematical Financial Annual production in units 45,000 90,000 Direct material costs S180,000 $360,000 Direct manufacturing labor costs $ 90,000 $180,000 Direct manufacturing labor-hours 4,500 9,000 Machine hours 30,000 60,000 Number of production runs 45 45 Inspection hours 1,200 600 Total manufacturing overhead costs are as follows: Total Machining costs S360,000 Setup costs 108,000 Inspection costs 117,000 Required 1. Choose a cost driver for each overhead cost pool and calculate the manufacturing overhead cost per unit for each product 2. Compute the manufacturing cost per unit for each product. 3. How might Sander's managers use the new cost information from its activity-based costing system to better manage its business? 4-26 Job costing, consulting firm. Frontier Partners, a management consulting firm, has the following condensed budget for 2017: Revenues $50,000,000 Total costs: Direct costs Professional Labor $ 20,000,000 Indirect costs Client support 25,000,000 45,000,000 Operating income $5,000,000 Frontier has a single direct-cost category (professional labor) and a single indirect-cost pool (client support). Indirect costs are allocated to jobs on the basis of professional labor costs. Required: 1. Prepare an overview diagram of the job-costing system. Calculate the 2017 budgeted indirect-cost rate for Frontier Partners. 2. The markup rate for pricing jobs is intended to produce operating income equal to 10% of revenues. Calculate the markup rate as a percentage of professional labor costs. 3. Frontier is bidding on a consulting job for Sentinel Communications, a wireless communications company. The budgeted breakdown of professional labor on the job is as follows: Professional Labor Category Budgeted Rate per Hour Budgeted Hours Director $200 9 Partner Associate 50 100 Assistant 30 220 Calculate the budgeted cost of the Sentinel Communications job. How much will Frontier bid for the job if it is to earn its target operating income of 10% of revenues? 100 24 5-23 ABC, process costing. Sander Company produces mathematical and financial calculators and operates at capacity. Data related to the two products are presented here: Mathematical Financial Annual production in units 45,000 90,000 Direct material costs S180,000 $360,000 Direct manufacturing labor costs $ 90,000 $180,000 Direct manufacturing labor-hours 4,500 9,000 Machine hours 30,000 60,000 Number of production runs 45 45 Inspection hours 1,200 600 Total manufacturing overhead costs are as follows: Total Machining costs S360,000 Setup costs 108,000 Inspection costs 117,000 Required 1. Choose a cost driver for each overhead cost pool and calculate the manufacturing overhead cost per unit for each product 2. Compute the manufacturing cost per unit for each product. 3. How might Sander's managers use the new cost information from its activity-based costing system to better manage its business