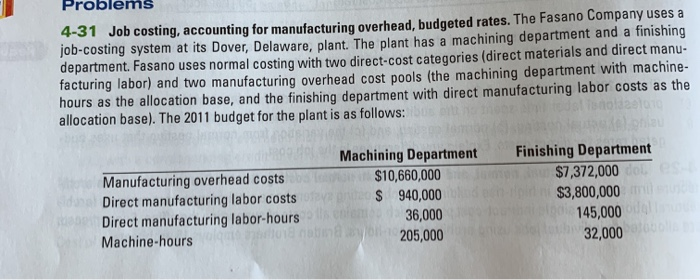

4-29 Job costing; actual, normal, and variation from normal costing. Braden Brothers, Inc., is an archi- tecture firm specializing in high-rise buildings. Its job-costing system has a single direct-cost category (archi- tectural labor) and a single indirect-cost pool, which contains all costs of supporting the office. Support costs are allocated to individual jobs using architect labor-hours. Braden Brothers employs 15 architects. Problem 4-31 Job costing, accounting for manufacturing overhead, budgeted rates. The Fasano Company uses a job-costing system at its Dover, Delaware, plant. The plant has a machining department and a finishing department. Fasano uses normal costing with two direct-cost categories (direct materials and direct manu- facturing labor) and two manufacturing overhead cost pools (the machining department with machine- hours as the allocation base, and the finishing department with direct manufacturing labor costs as the etoic hlau allocation base). The 2011 budget for the plant is as follows: Finishing Department $7,372,000doles $3,800,000 145,000 32,000 Machining Department $10,660,000 $ 940,000 36,000 18 nainay 205,000 Manufacturing overhead costs Direct manufacturing labor costs Direct manufacturing labor-hours olle Machine-hours 4-29 Job costing; actual, normal, and variation from normal costing. Braden Brothers, Inc., is an archi- tecture firm specializing in high-rise buildings. Its job-costing system has a single direct-cost category (archi- tectural labor) and a single indirect-cost pool, which contains all costs of supporting the office. Support costs are allocated to individual jobs using architect labor-hours. Braden Brothers employs 15 architects. Problem 4-31 Job costing, accounting for manufacturing overhead, budgeted rates. The Fasano Company uses a job-costing system at its Dover, Delaware, plant. The plant has a machining department and a finishing department. Fasano uses normal costing with two direct-cost categories (direct materials and direct manu- facturing labor) and two manufacturing overhead cost pools (the machining department with machine- hours as the allocation base, and the finishing department with direct manufacturing labor costs as the etoic hlau allocation base). The 2011 budget for the plant is as follows: Finishing Department $7,372,000doles $3,800,000 145,000 32,000 Machining Department $10,660,000 $ 940,000 36,000 18 nainay 205,000 Manufacturing overhead costs Direct manufacturing labor costs Direct manufacturing labor-hours olle Machine-hours