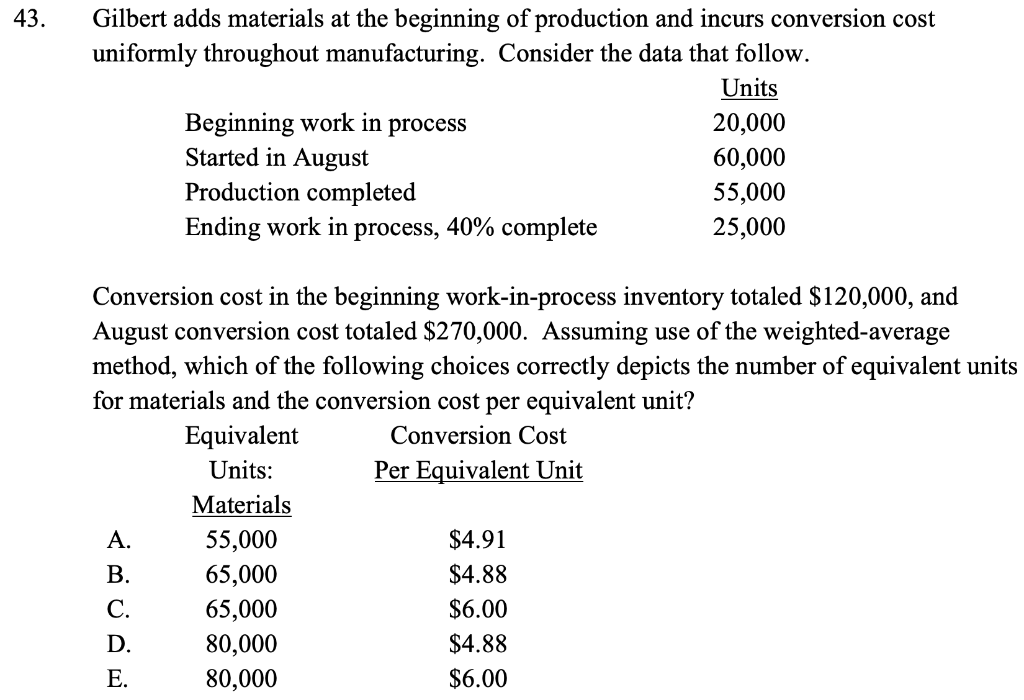

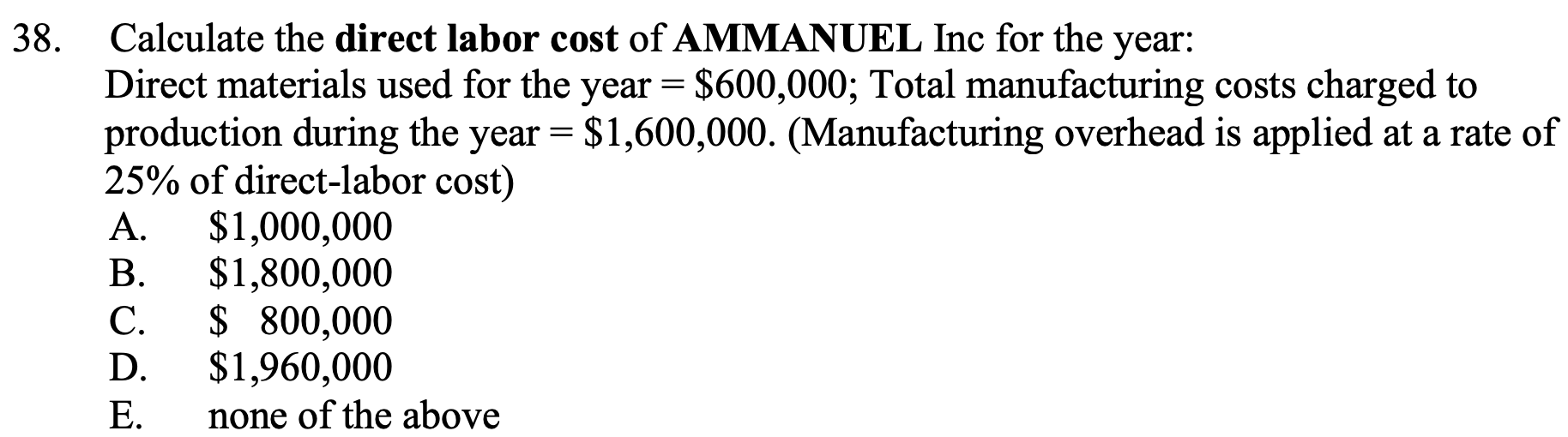

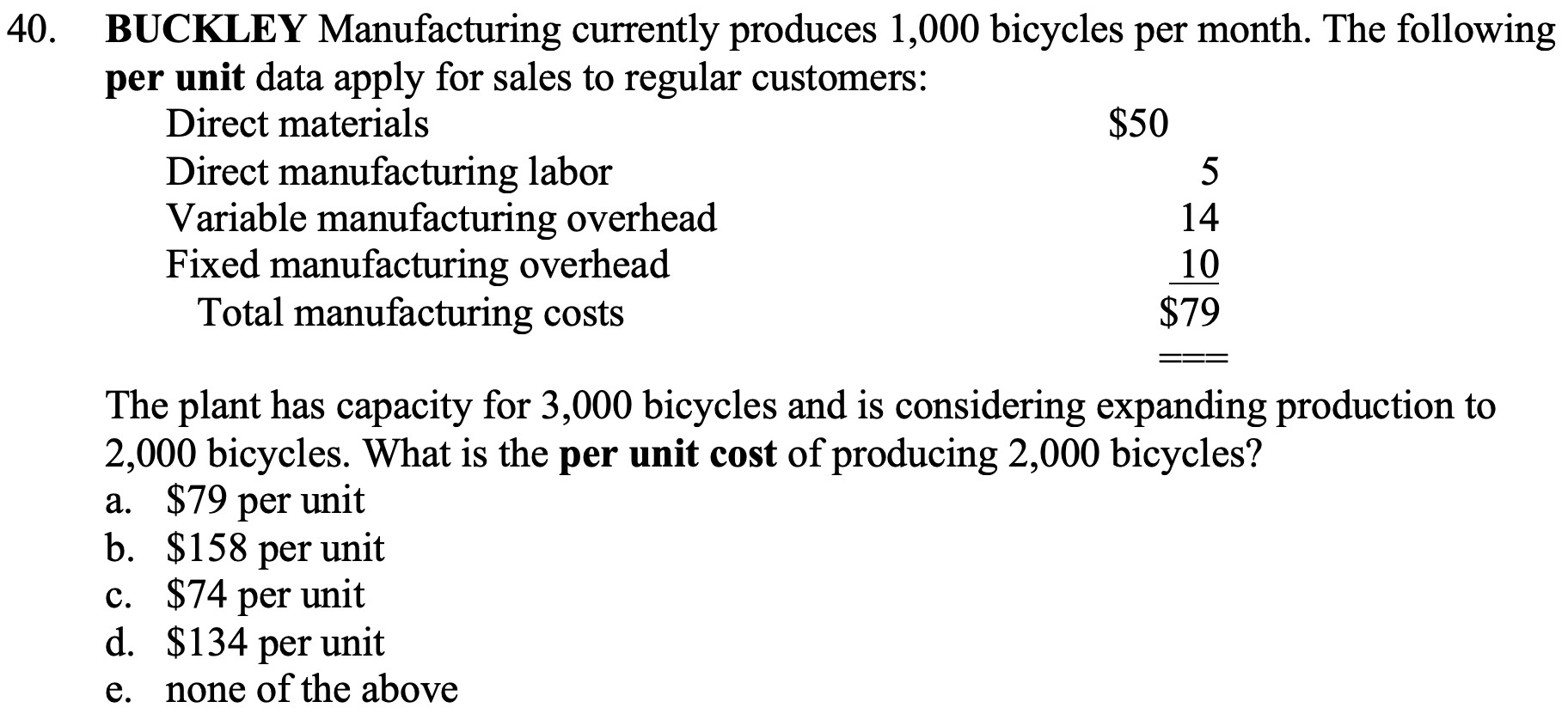

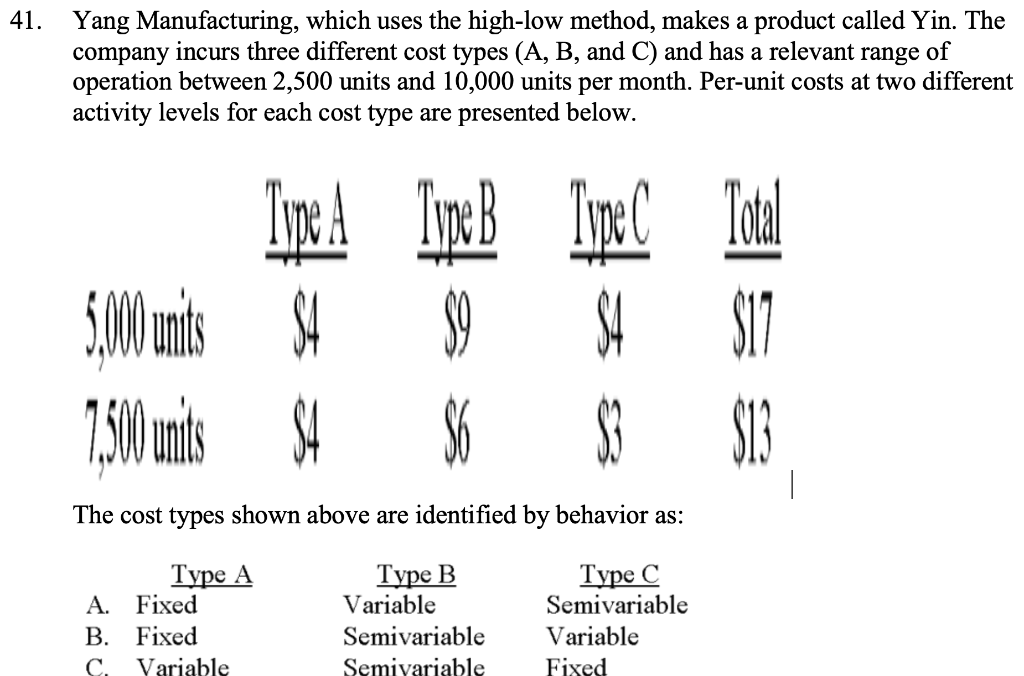

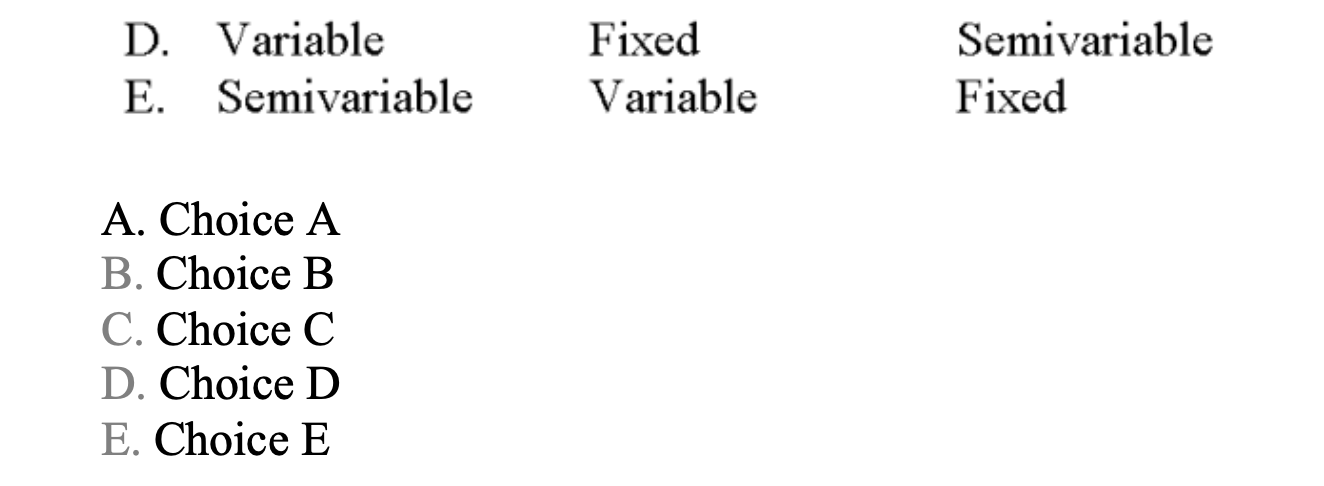

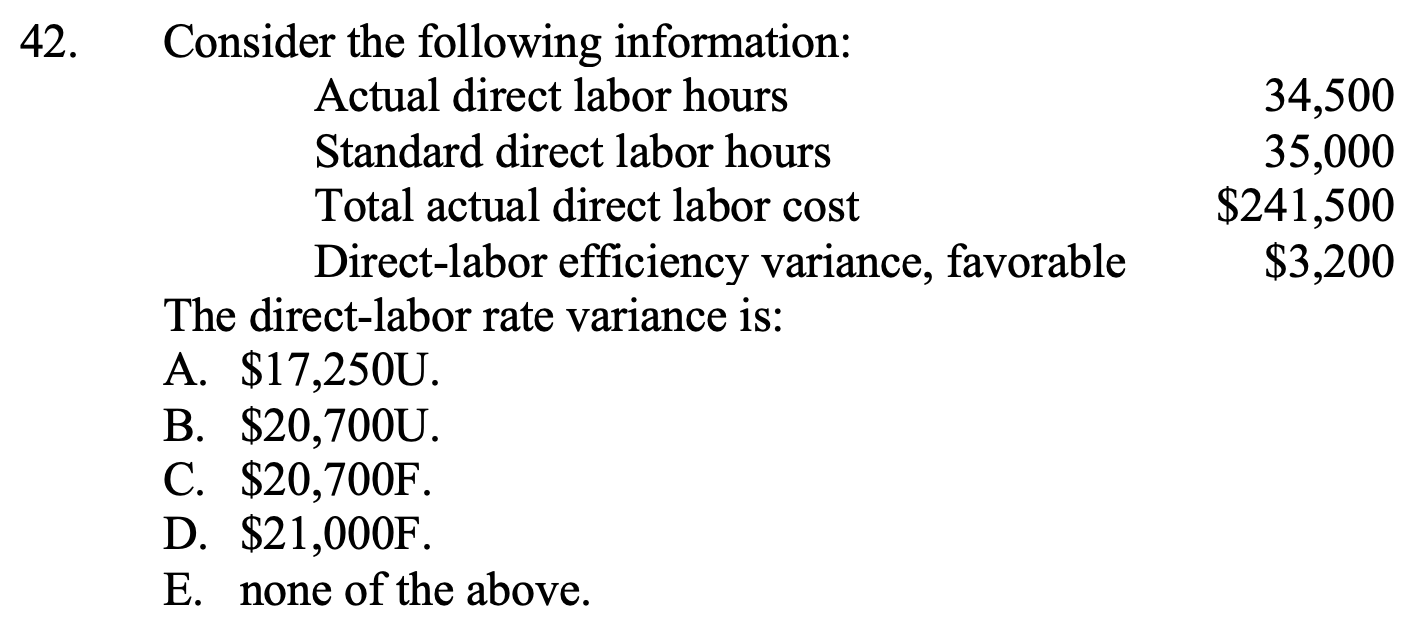

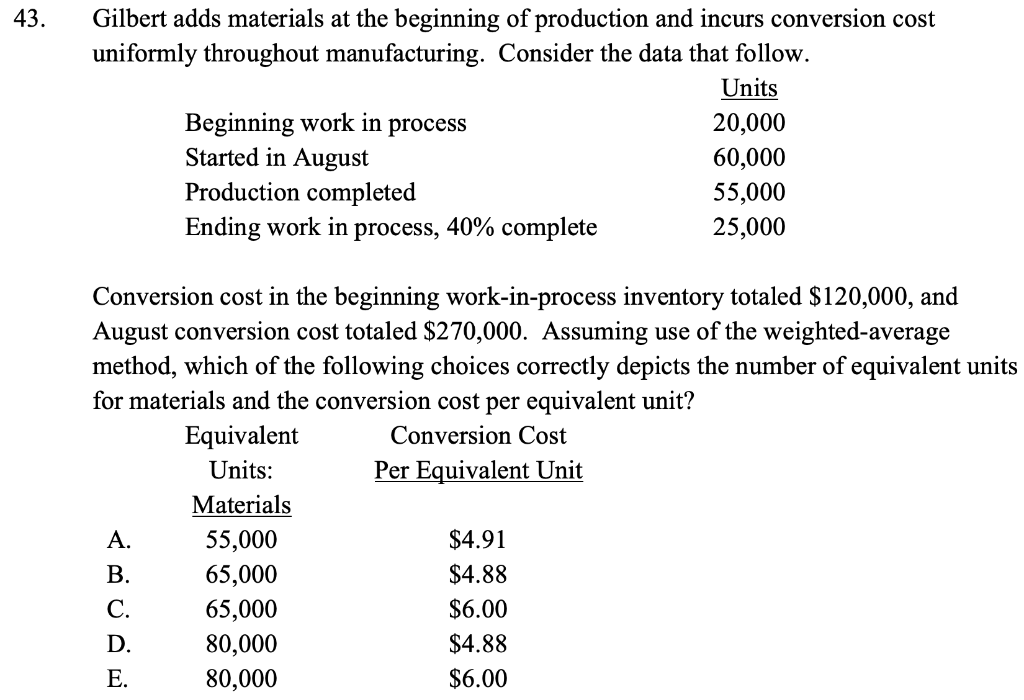

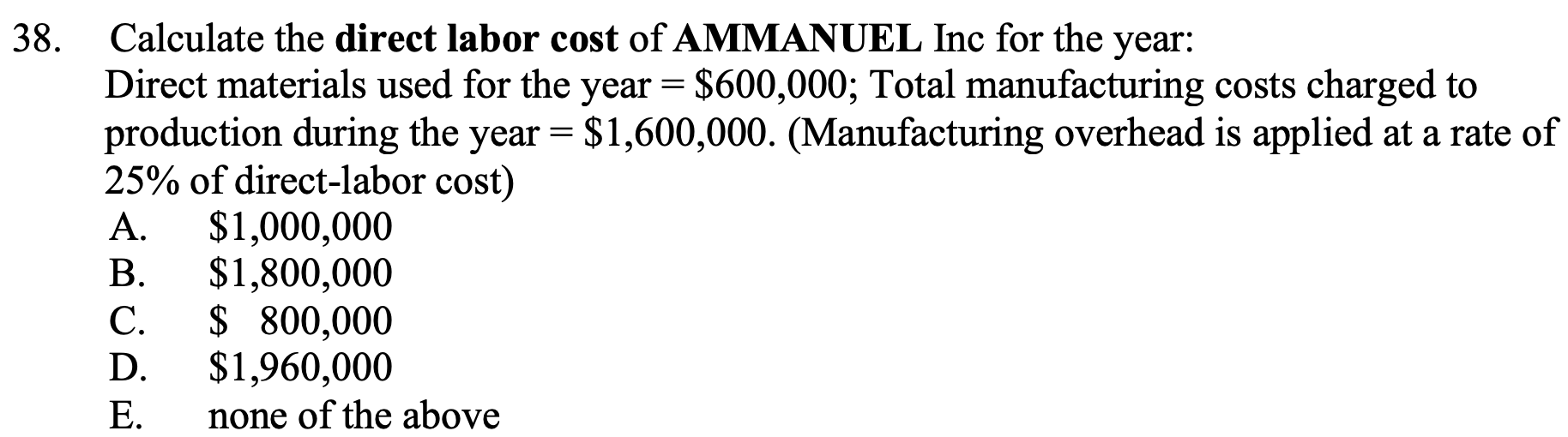

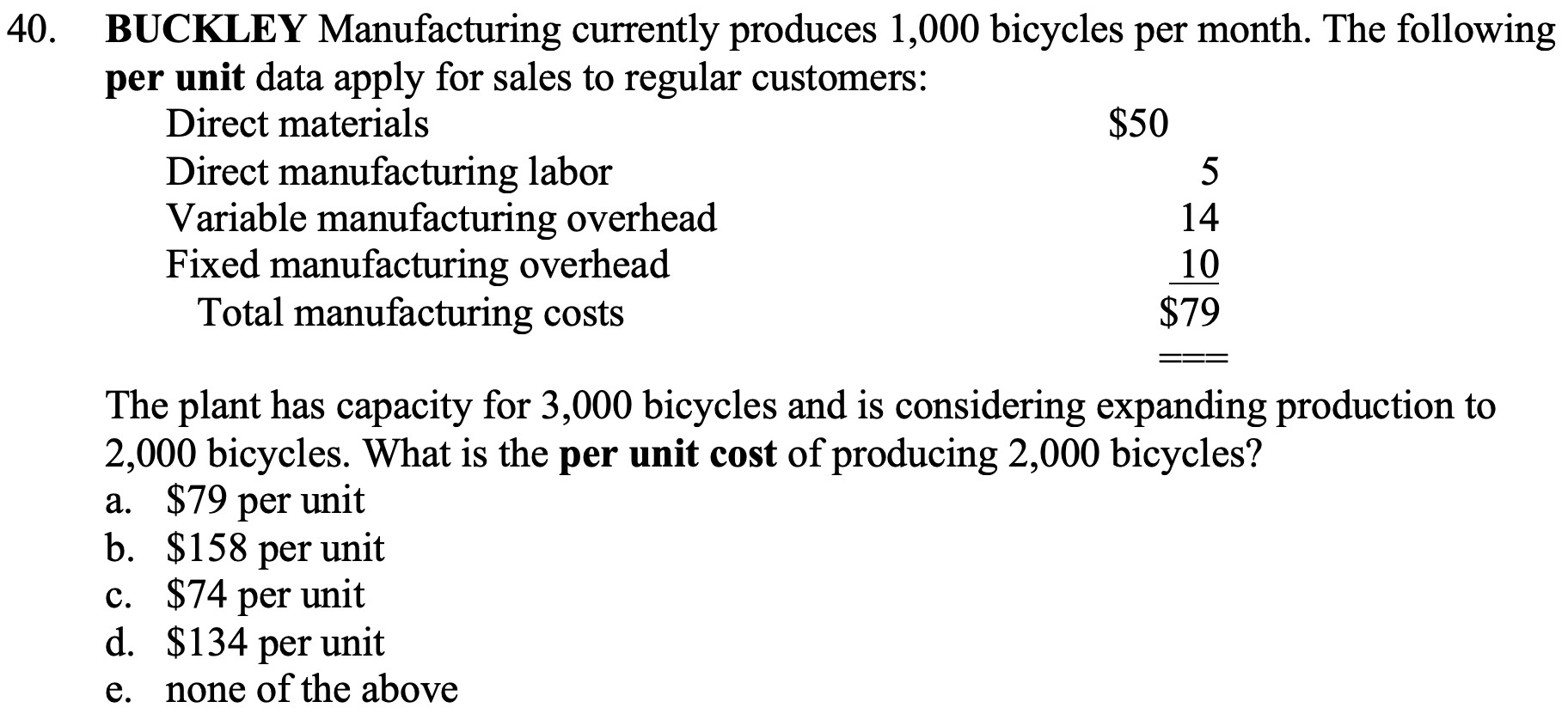

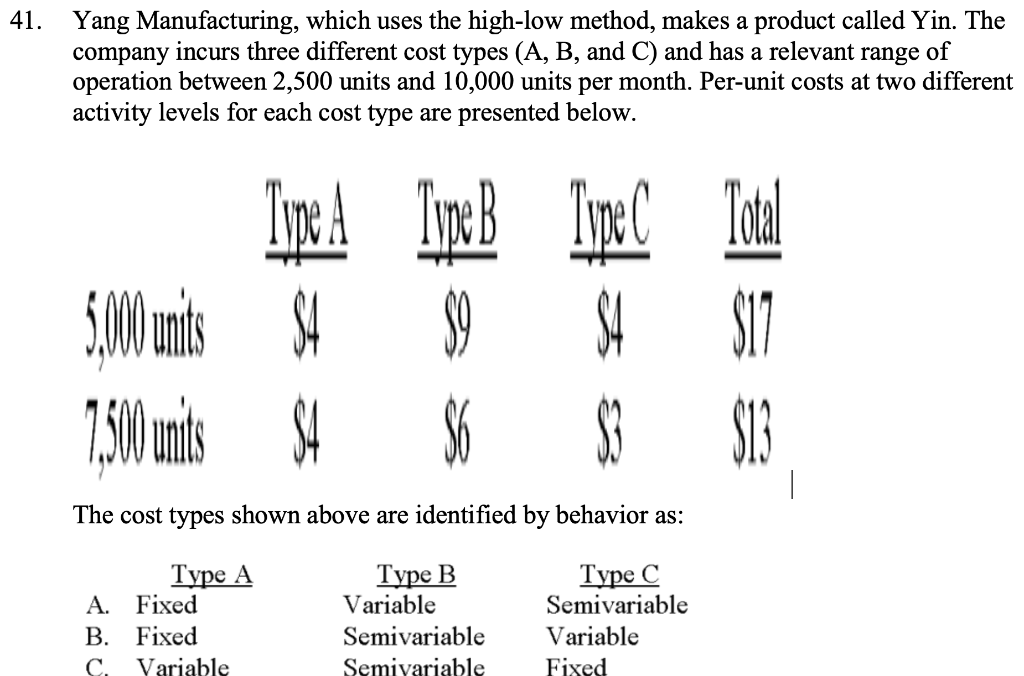

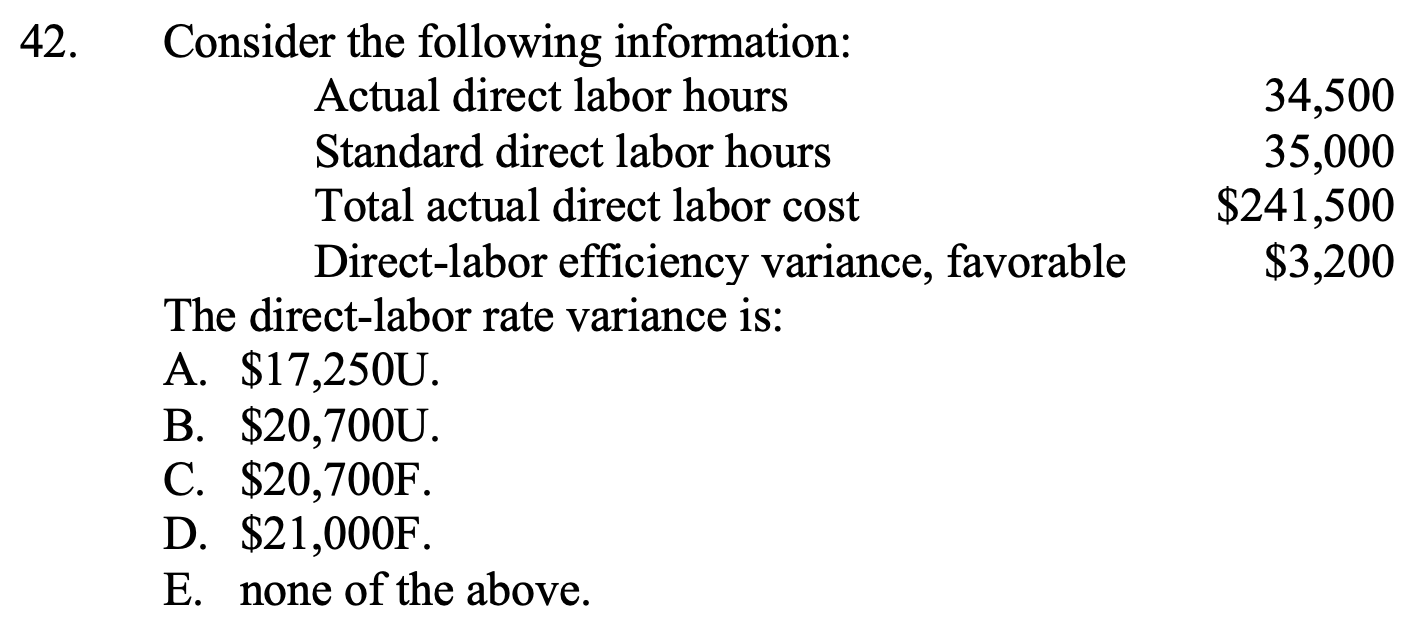

43. Gilbert adds materials at the beginning of production and incurs conversion cost uniformly throughout manufacturing. Consider the data that follow. Units Beginning work in process 20,000 Started in August 60,000 Production completed 55,000 Ending work in process, 40% complete 25,000 Conversion cost in the beginning work-in-process inventory totaled $120,000, and August conversion cost totaled $270,000. Assuming use of the weighted average method, which of the following choices correctly depicts the number of equivalent units for materials and the conversion cost per equivalent unit? Equivalent Conversion Cost Units: Per Equivalent Unit Materials 55,000 $4.91 65,000 $4.88 65,000 $6.00 80,000 $4.88 80,000 $6.00 cu en 38. Calculate the direct labor cost of AMMANUEL Inc for the year: Direct materials used for the year = $600,000; Total manufacturing costs charged to production during the year = $1,600,000. (Manufacturing overhead is applied at a rate of 25% of direct-labor cost) A. $1,000,000 $1,800,000 $ 800,000 $1,960,000 E. none of the above 40 RIO BUCKLEY Manufacturing currently produces 1,000 bicycles per month. The following per unit data apply for sales to regular customers: Direct materials $50 Direct manufacturing labor 5 Variable manufacturing overhead 14 Fixed manufacturing overhead Total manufacturing costs $79 10 The plant has capacity for 3,000 bicycles and is considering expanding production to 2,000 bicycles. What is the per unit cost of producing 2,000 bicycles? a. $79 per unit b. $158 per unit c. $74 per unit d. $134 per unit e. none of the above 41. Yang Manufacturing, which uses the high-low method, makes a product called Yin. The company incurs three different cost types (A, B, and C) and has a relevant range of operation between 2,500 units and 10,000 units per month. Per-unit costs at two different activity levels for each cost type are presented below. Type C 35,00 units 350 units Type A $ $ Type B $ $ Total $17 $13 $ The cost types shown above are identified by behavior as: Type A A. Fixed B. Fixed c. Variable Type B Variable Semivariable Semivariable Type C Semivariable Variable Fixed P. Variable D. Variable E. Semivariable Fixed Variable Fixed Semivariable Fixed Semivariable A. Choice A B. Choice B C. Choice C D. Choice D E. Choice E 42. 34,500 35,000 $241,500 $3,200 Consider the following information: Actual direct labor hours Standard direct labor hours Total actual direct labor cost Direct-labor efficiency variance, favorable The direct-labor rate variance is: A. $17,250U. B. $20,700U. C. $20,700F. D. $21,000F. E. none of the above