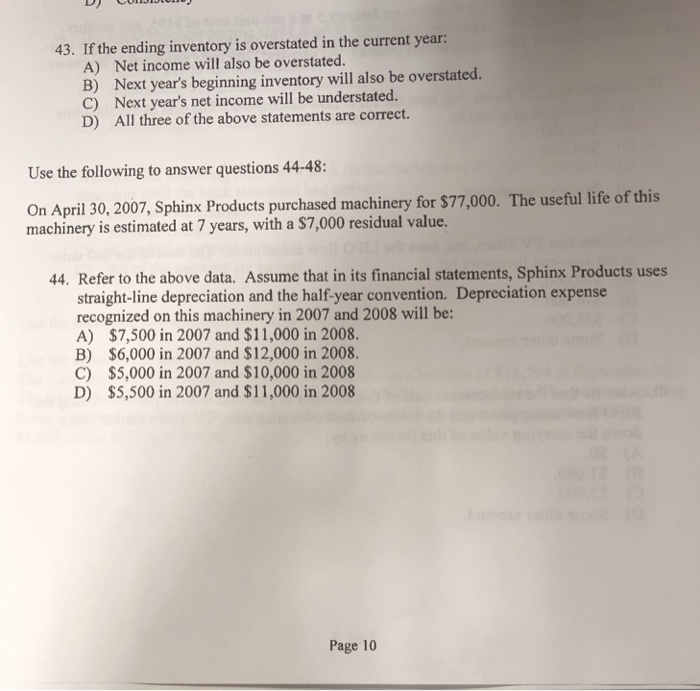

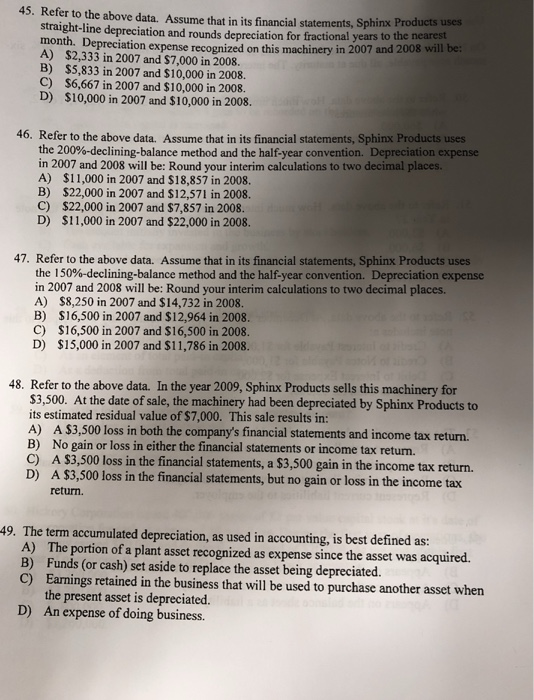

43. If the ending inventory is overstated in the current year: A) B) C) D) Net income will also be overstated. Next year's beginning inventory will also be overstated. Next year's net income will be understated. All three of the above statements are correct. Use the following to answer questions 44-48 On April 30, 2007, Sphinx Products purchased machinery for $77,000. The useful life of this machinery is estimated at 7 years, with a $7,000 residual value. 44. Refer to the above data. Assume that in its financial statements, Sphinx Products uses straight-line depreciation and the half-year convention. Depreciation expense recognized on this machinery in 2007 and 2008 will be: A) $7,500 in 2007 and $11,000 in 2008. B) $6,000 in 2007 and $12,000 in 2008. C) $5,000 in 2007 and $10,000 in 2008 D) S5,500 in 2007 and $11,000 in 2008 Page 10 45. Refer to the above data. Assume that in its financial statements, Sphinx Products uses straight-line depreciation and rounds depreciation for fractional years to the month. Depreciation expense recognized on this machinery in 2007 A) $2,333 in 2007 and $7,000 in 2008. B) $5,833 in 2007 and $10,000 in 2008. C) $6,667 in 2007 and $10,000 in 2008. D) $10,000 in 2007 and $10,000 in 2008. nearest and 2008 will be: 46. Refer to the above data. Assume that in its financial statements, Sphinx Products uses the 200% declining-balance method and the half-year convention. Depreciation expense in 2007 and 2008 will be: Round your interim calculations to two decimal places. A) $11,000 in 2007 and $18,857 in 2008 B) $22,000 in 2007 and $12,571 in 2008. C) $22,000 in 2007 and $7,857 in 2008. D) $11,000 in 2007 and $22,000 in 2008. 47. Refer to the above data. Assume that in its financial statements, Sphinx Products uses the l 50%-declining-balance method and the half-year convention. Depreciation expense in 2007 and 2008 will be: Round your interim calculations to two decimal places A) $8,250 in 2007 and $14,732 in 2008. B) $ 16,500 in 2007 and $12,964 in 2008. C) $16,500 in 2007 and $16,500 in 2008. D) $15,000 in 2007 and $11,786 in 2008. 48. Refer to the above data. In the year 2009, Sphinx Products sells this machinery for $3,500. At the date of sale, the machinery had been depreciated by Sphinx Products to its estimated residual value of $7,000. This sale results in: A) A $3,500 loss in both the company's financial statements and income tax return. B) No gain or loss in either the financial statements or income tax retun. C) A S3,500 loss in the financial statements, a $3,500 gain in the income tax return. A $3,500 loss in the financial statements, but no gain or loss in the income tax return. D) 49. The term accumulated depreciation, as used in accounting, is best defined as: A) B) C) The portion of a plant asset recognized as expense since the asset was acquired. Funds (or cash) set aside to replace the asset being depreciated. Earnings retained in the business that will be used to purchase another asset when the present asset is depreciated. An expense of doing business. D)