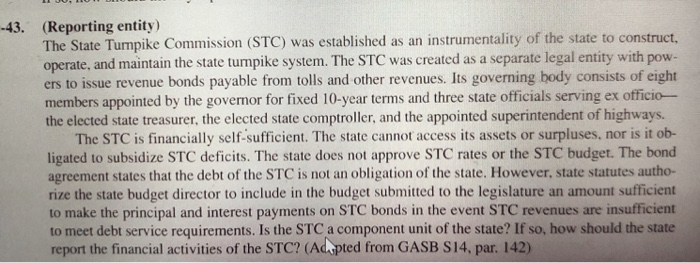

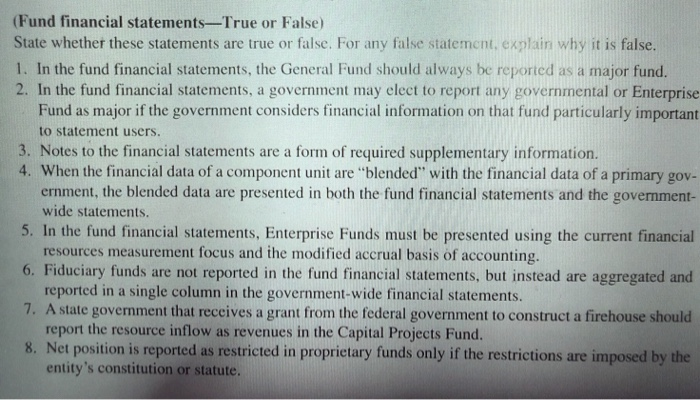

-43. (Reporting entity) The State Turnpike Commission (STC) was established as an instrumentality of the state to construct, operate, and maintain the state tumpike system. The STC was created as a separate legal entity with pow- ers to issue revenue bonds payable from tolls and other revenues. Its governing body consists of eight members appointed by the governor for fixed 10-year terms and three state officials serving ex officio the elected state treasurer, the elected state comptroller, and the appointed superintendent of highways. The STC is financially self-sufficient. The state cannot access its assets or surpluses, nor is it ob- ligated to subsidize STC deficits. The state does not approve STC rates or the STC budget. The bond agreement states that the debt of the STC is not an obligation of the state. However, state statutes autho- rize the state budget director to include in the budget submitted to the legislature an amount sufficient to make the principal and interest payments on STC bonds in the event STC revenues are insufficient to meet debt service requirements. Is the STC a component unit of the state? If so, how should the state report the financial activities of the STC? (Adapted from GASB S14, par. 142) (Fund financial statements-True or False) State whether these statements are true or false. For any false statement, explain why it is false. 1. In the fund financial statements, the General Fund should always be reported as a major fund. 2. In the fund financial statements, a government may elect to report any governmental or Enterprise Fund as major if the government considers financial information on that fund particularly important to statement users. 3. Notes to the financial statements are a form of required supplementary information. 4. When the financial data of a component unit are "blended" with the financial data of a primary gov. ernment, the blended data are presented in both the fund financial statements and the government- wide statements. 5. In the fund financial statements, Enterprise Funds must be presented using the current financial resources measurement focus and the modified accrual basis of accounting. 6. Fiduciary funds are not reported in the fund financial statements, but instead are aggregated and reported in a single column in the government-wide financial statements. 7. A state government that receives a grant from the federal government to construct a firehouse should report the resource inflow as revenues in the Capital Projects Fund. 8. Net position is reported as restricted in proprietary funds only if the restrictions are imposed by the entity's constitution or statute. -43. (Reporting entity) The State Turnpike Commission (STC) was established as an instrumentality of the state to construct, operate, and maintain the state tumpike system. The STC was created as a separate legal entity with pow- ers to issue revenue bonds payable from tolls and other revenues. Its governing body consists of eight members appointed by the governor for fixed 10-year terms and three state officials serving ex officio the elected state treasurer, the elected state comptroller, and the appointed superintendent of highways. The STC is financially self-sufficient. The state cannot access its assets or surpluses, nor is it ob- ligated to subsidize STC deficits. The state does not approve STC rates or the STC budget. The bond agreement states that the debt of the STC is not an obligation of the state. However, state statutes autho- rize the state budget director to include in the budget submitted to the legislature an amount sufficient to make the principal and interest payments on STC bonds in the event STC revenues are insufficient to meet debt service requirements. Is the STC a component unit of the state? If so, how should the state report the financial activities of the STC? (Adapted from GASB S14, par. 142) (Fund financial statements-True or False) State whether these statements are true or false. For any false statement, explain why it is false. 1. In the fund financial statements, the General Fund should always be reported as a major fund. 2. In the fund financial statements, a government may elect to report any governmental or Enterprise Fund as major if the government considers financial information on that fund particularly important to statement users. 3. Notes to the financial statements are a form of required supplementary information. 4. When the financial data of a component unit are "blended" with the financial data of a primary gov. ernment, the blended data are presented in both the fund financial statements and the government- wide statements. 5. In the fund financial statements, Enterprise Funds must be presented using the current financial resources measurement focus and the modified accrual basis of accounting. 6. Fiduciary funds are not reported in the fund financial statements, but instead are aggregated and reported in a single column in the government-wide financial statements. 7. A state government that receives a grant from the federal government to construct a firehouse should report the resource inflow as revenues in the Capital Projects Fund. 8. Net position is reported as restricted in proprietary funds only if the restrictions are imposed by the entity's constitution or statute