Answered step by step

Verified Expert Solution

Question

1 Approved Answer

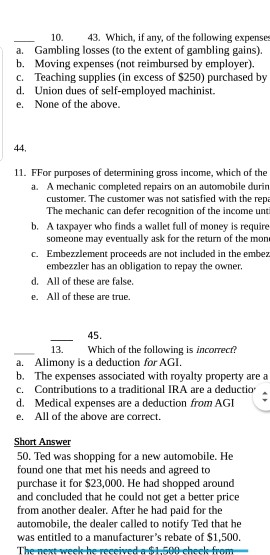

43. Which, if any, of the following expenses a. b. C. d. e. 10. Gambling losses (to the extent of gambling gains). Moving expenses (not

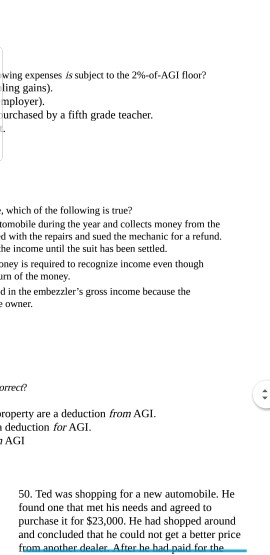

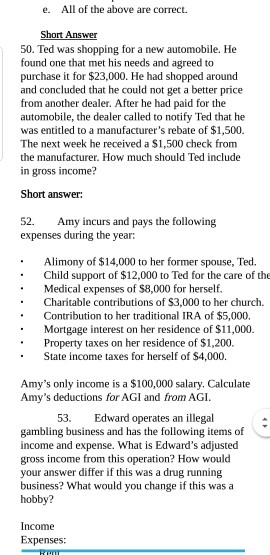

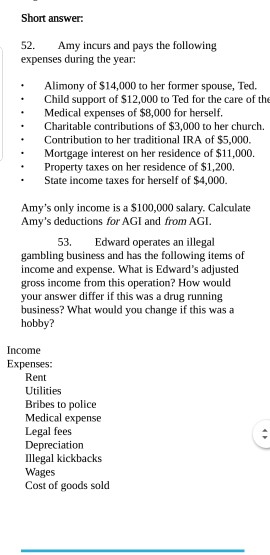

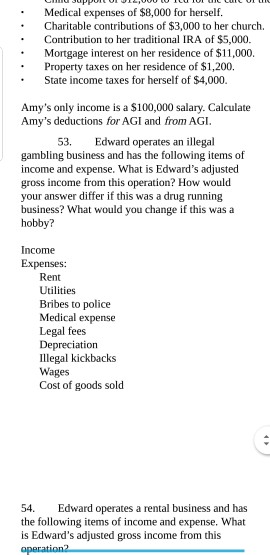

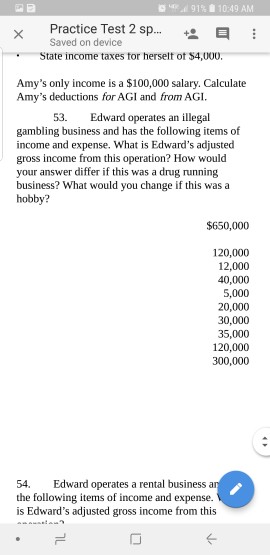

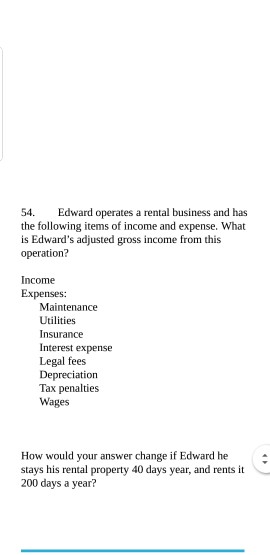

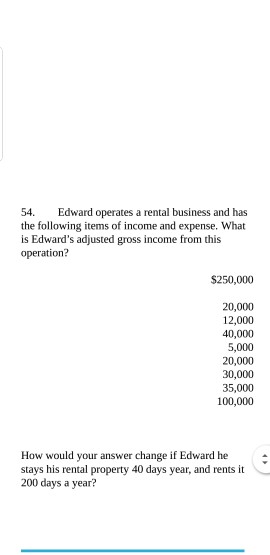

43. Which, if any, of the following expenses a. b. C. d. e. 10. Gambling losses (to the extent of gambling gains). Moving expenses (not reimbursed by employer). Teaching supplies (in excess of S250) purchased by Union dues of self-employed machinist. None of the above 44, 11. FFor purposes of determining gross income, which of the a. A mechanic completed repairs on an automobile durin customer. The customer was not satisfied with the repa The mechanic can defer recognition of the income unt b. A taxpayer who finds a wallet full of money is require someone may eventually ask for the return of the mon C. Embezzlement proceeds are not included in the embez embezzler has an obligation to repay the owner All of these are false. All of these are true. d. e. 13. Which of the following is incorrecf? a. Alimony is a deduction for AGI b. The expenses associated with royalty property area c. Contributions to a traditional IRA are a deductio d. Medical expenses are a deduction from AGI e. All of the above are correct. Short Answer 50. Ted was shopping for a new automobile. He found one that met his needs and agreed to purchase it for $23,000. He had shopped around and concluded that he could not get a better price from another dealer. After he had paid for the automobile, the dealer called to notify Ted that he was entitled to a manufacturer's rebate of $1,500 43. Which, if any, of the following expenses a. b. C. d. e. 10. Gambling losses (to the extent of gambling gains). Moving expenses (not reimbursed by employer). Teaching supplies (in excess of S250) purchased by Union dues of self-employed machinist. None of the above 44, 11. FFor purposes of determining gross income, which of the a. A mechanic completed repairs on an automobile durin customer. The customer was not satisfied with the repa The mechanic can defer recognition of the income unt b. A taxpayer who finds a wallet full of money is require someone may eventually ask for the return of the mon C. Embezzlement proceeds are not included in the embez embezzler has an obligation to repay the owner All of these are false. All of these are true. d. e. 13. Which of the following is incorrecf? a. Alimony is a deduction for AGI b. The expenses associated with royalty property area c. Contributions to a traditional IRA are a deductio d. Medical expenses are a deduction from AGI e. All of the above are correct. Short Answer 50. Ted was shopping for a new automobile. He found one that met his needs and agreed to purchase it for $23,000. He had shopped around and concluded that he could not get a better price from another dealer. After he had paid for the automobile, the dealer called to notify Ted that he was entitled to a manufacturer's rebate of $1,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started