43. which of the following statements best describes the risk exposure of the comstocks current portfolio

A. their current portfolio as structured subjects them to a significant amount of market risk

B. they are protected against the threat of increased inflation given their substantial cash position

C. their total portfolio risk may be reduced through greater diversification into appropriate equity investments

D. they are subject to an excessive amount of systematic risk that may be diversified away

44. With respect to the Comstocks stated risk tolerance and preferences, which of the following statements is CORRECT?

A. the apparent lack of cash may jeopardize the saftey of the portfolios principal.

B. they are too heavily weighted in fixed-income investments to achieve long term growth

C. reguardless of their risk preference and investments time horizon, an investment in antiques and fine art will prove highly liquid

D. becuase of their risk preference and investment time horizon, richard should invest his IRA balance in 30-year treasury bond

45. to diversify the Comstocks current portfolio, which of the following would tou recommend as an additional investment

A. leveraged real estate

B. municipal bond fund

C. international stock mutual fund

D. taxable zero-coupon bond fund

46. With regard to Richards Gold to retire in 10 years, which of these investments is most suitable?

A. growth stock mutual fund, because this one has historically achieved a greater annual return with managed risk

B. The S&P 500 index fund, because it will permit active uncestment management

C. Treasudy bills, because they match his investment tiem horizon and will not incur purchasing power risk

D. leveraged real estate, because the potential for maximum after-tax return is substantial with little threat to investment principal

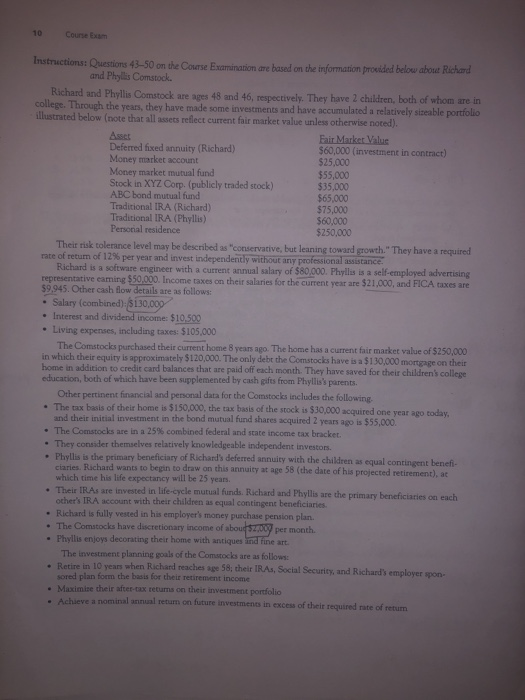

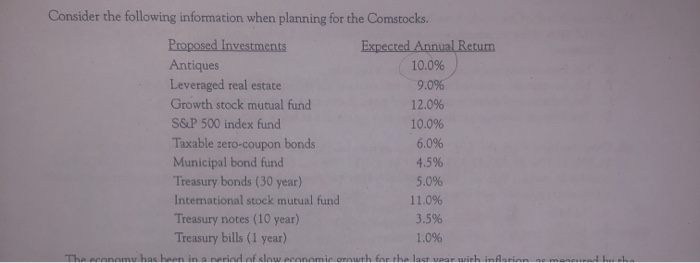

10 Course Exam Instructions: Questions 43-50 on t nation are based on the information prowided below about Richard and Phyillis Comstock Richard and Phyllis Comstock are ages 48 and 46, respectively, They have 2 children. both of whom are in college. Through the years, they have made some investments and have accumulated a relatively sizeable portfolio illustrated below (note that all assetsreflect current fair market value unless otherwise noted) Assct Deferred fixed annuity (Richard) Money market account Money market mutual fund Stock in XYZ Corp. (publicly traded stock) ABC bond mutual fund Traditional IRA (Richard) Traditional IRA (Phyllis) Personial residence $60,000 (investment in contract) $25,000 $55,000 535,000 $65,000 $75,000 $60,000 $250,000 Their risk tolerance level may be described as "conservative, but leaning toward growth." They have a required ut any professional assistance Richard is a software engineer with a current annual salary of $80,000. Phyllas is a self-employed advertising Salary (combined) $130,009 Living expenses, including taxes: $105,000 representative eaming $50,000. Income taxes on their salaries for the current year are $21,000, and FICA taxes are $9945. Other cash flow details are as follows: Interest and dividend income: $10,509 The Comstocks purchased their current home 8 yean ago. The home has a current fair market value of $2 in which their equity is approximately $120,000. The only debt the Comstocks have is a $130,000 home in addition to credit card balances that are paid off each month. They have saved for their children's college education, both of which have been supplemented by cash gifes from Phyllis's parents Other pertinent financial and personal data for the Comstocks includes the following and their initial investment in the bond mutual fund shares acquired 2 years ago is $55,000 They consider themselves relatively knowledgeable independent investons . The tax basis of their home is $150,000, the tax basis of the stock is $30,000 acquired one year ago today * The Constocks are in a 25% combined federal and state income tax bracket. . Phyllis is primary is the primary beneficiary of Richard's deferred annuity with the children as equal contingent benefi- Richard wants to begin to draw on this annuity at age 58 (the date of his projected retirement), ac which time his life expectancy will be 25 years. . Their IRAs are invested in life-cycle mutual funds. Richard and Phyllis are the primary beneficiaties on each other's IRA account with their children as equal contingent beneficiaries Richard is fully vested in his employer's money purchase pension plan. The Comstocks have discretionary income of Phyllis enjoys decorating their home with antiques The investment planning goals of the Comstocks are as follows Retire i sored plan form the basis for their retirement income 0y per month n 10 years when Richard reaches age 58, their IRAs, Social Security, and Richard's employer spon- . Maximise their after-tax returns on their investment portfolic a nominal annual return on future investments in excess of theit required rate of retun Consider the following information when planning for the Comstocks. Proposed Investments Antiques Leveraged real estate Growth stock mutual fund S&P 500 index fund Taxable zero-coupon bonds Municipal bond fund Treasury bonds (30 year) International stock mutual fund Treasury notes (10 year) Treasury bills (1 year) Expected Annua 10.0% 90% 12.0% 10.0% 6.0% 4.5% 5.0% 11.0% 3.5% 1.0% 10 Course Exam Instructions: Questions 43-50 on t nation are based on the information prowided below about Richard and Phyillis Comstock Richard and Phyllis Comstock are ages 48 and 46, respectively, They have 2 children. both of whom are in college. Through the years, they have made some investments and have accumulated a relatively sizeable portfolio illustrated below (note that all assetsreflect current fair market value unless otherwise noted) Assct Deferred fixed annuity (Richard) Money market account Money market mutual fund Stock in XYZ Corp. (publicly traded stock) ABC bond mutual fund Traditional IRA (Richard) Traditional IRA (Phyllis) Personial residence $60,000 (investment in contract) $25,000 $55,000 535,000 $65,000 $75,000 $60,000 $250,000 Their risk tolerance level may be described as "conservative, but leaning toward growth." They have a required ut any professional assistance Richard is a software engineer with a current annual salary of $80,000. Phyllas is a self-employed advertising Salary (combined) $130,009 Living expenses, including taxes: $105,000 representative eaming $50,000. Income taxes on their salaries for the current year are $21,000, and FICA taxes are $9945. Other cash flow details are as follows: Interest and dividend income: $10,509 The Comstocks purchased their current home 8 yean ago. The home has a current fair market value of $2 in which their equity is approximately $120,000. The only debt the Comstocks have is a $130,000 home in addition to credit card balances that are paid off each month. They have saved for their children's college education, both of which have been supplemented by cash gifes from Phyllis's parents Other pertinent financial and personal data for the Comstocks includes the following and their initial investment in the bond mutual fund shares acquired 2 years ago is $55,000 They consider themselves relatively knowledgeable independent investons . The tax basis of their home is $150,000, the tax basis of the stock is $30,000 acquired one year ago today * The Constocks are in a 25% combined federal and state income tax bracket. . Phyllis is primary is the primary beneficiary of Richard's deferred annuity with the children as equal contingent benefi- Richard wants to begin to draw on this annuity at age 58 (the date of his projected retirement), ac which time his life expectancy will be 25 years. . Their IRAs are invested in life-cycle mutual funds. Richard and Phyllis are the primary beneficiaties on each other's IRA account with their children as equal contingent beneficiaries Richard is fully vested in his employer's money purchase pension plan. The Comstocks have discretionary income of Phyllis enjoys decorating their home with antiques The investment planning goals of the Comstocks are as follows Retire i sored plan form the basis for their retirement income 0y per month n 10 years when Richard reaches age 58, their IRAs, Social Security, and Richard's employer spon- . Maximise their after-tax returns on their investment portfolic a nominal annual return on future investments in excess of theit required rate of retun Consider the following information when planning for the Comstocks. Proposed Investments Antiques Leveraged real estate Growth stock mutual fund S&P 500 index fund Taxable zero-coupon bonds Municipal bond fund Treasury bonds (30 year) International stock mutual fund Treasury notes (10 year) Treasury bills (1 year) Expected Annua 10.0% 90% 12.0% 10.0% 6.0% 4.5% 5.0% 11.0% 3.5% 1.0%