Answered step by step

Verified Expert Solution

Question

1 Approved Answer

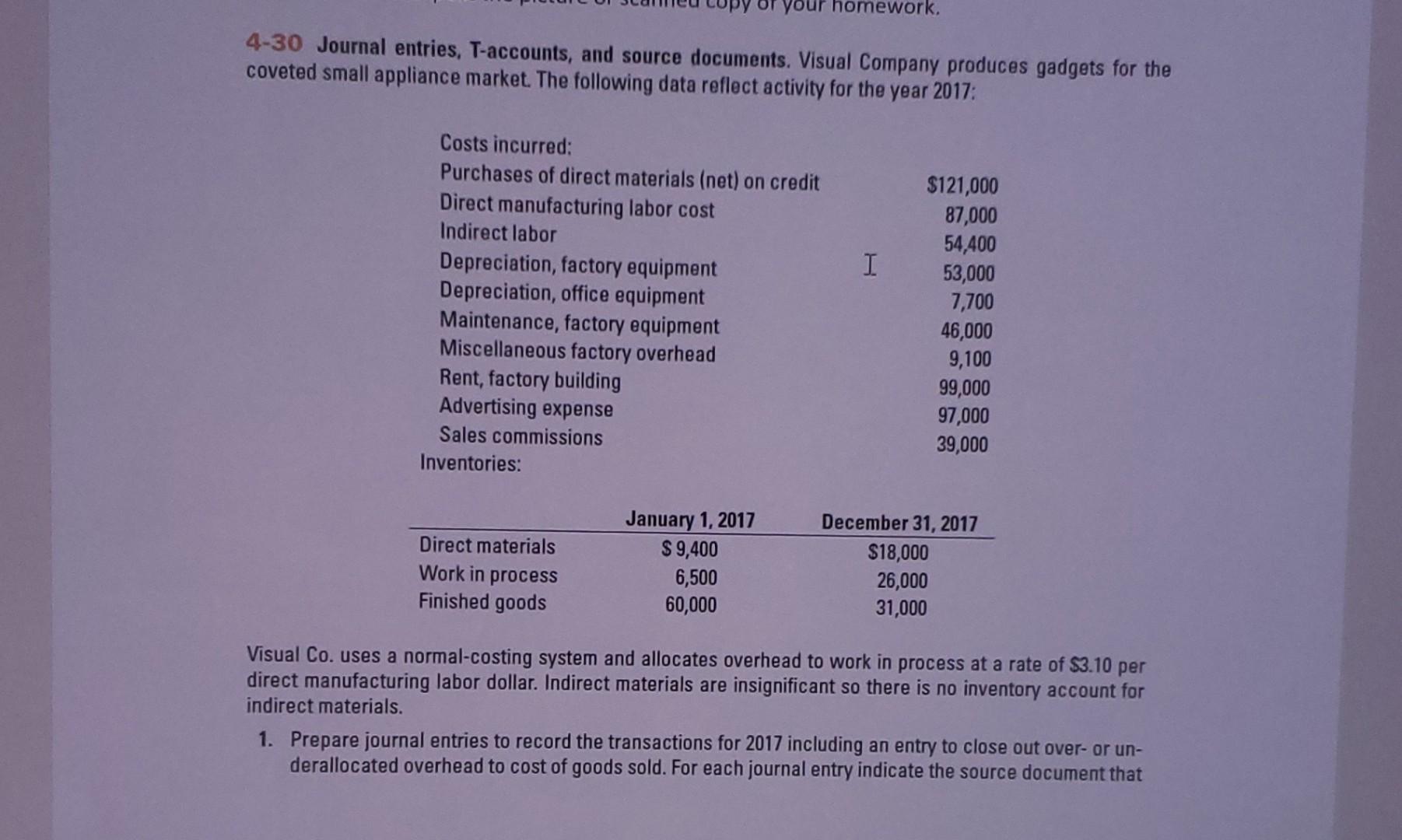

4-30 Journal entries, T-accounts, and source documents. Visual Company produces gadgets for the coveted small appliance market. The following data reflect activity for the year

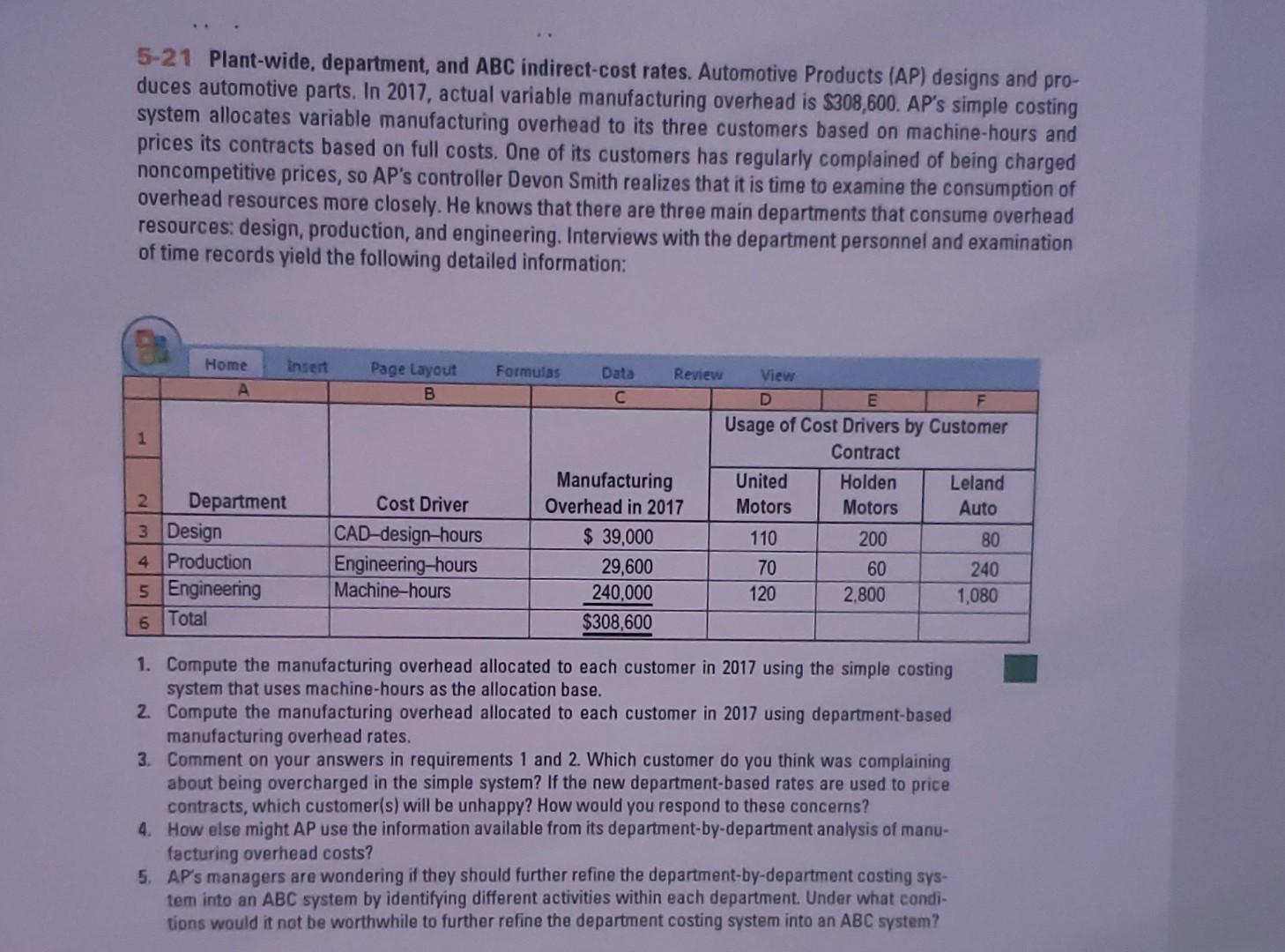

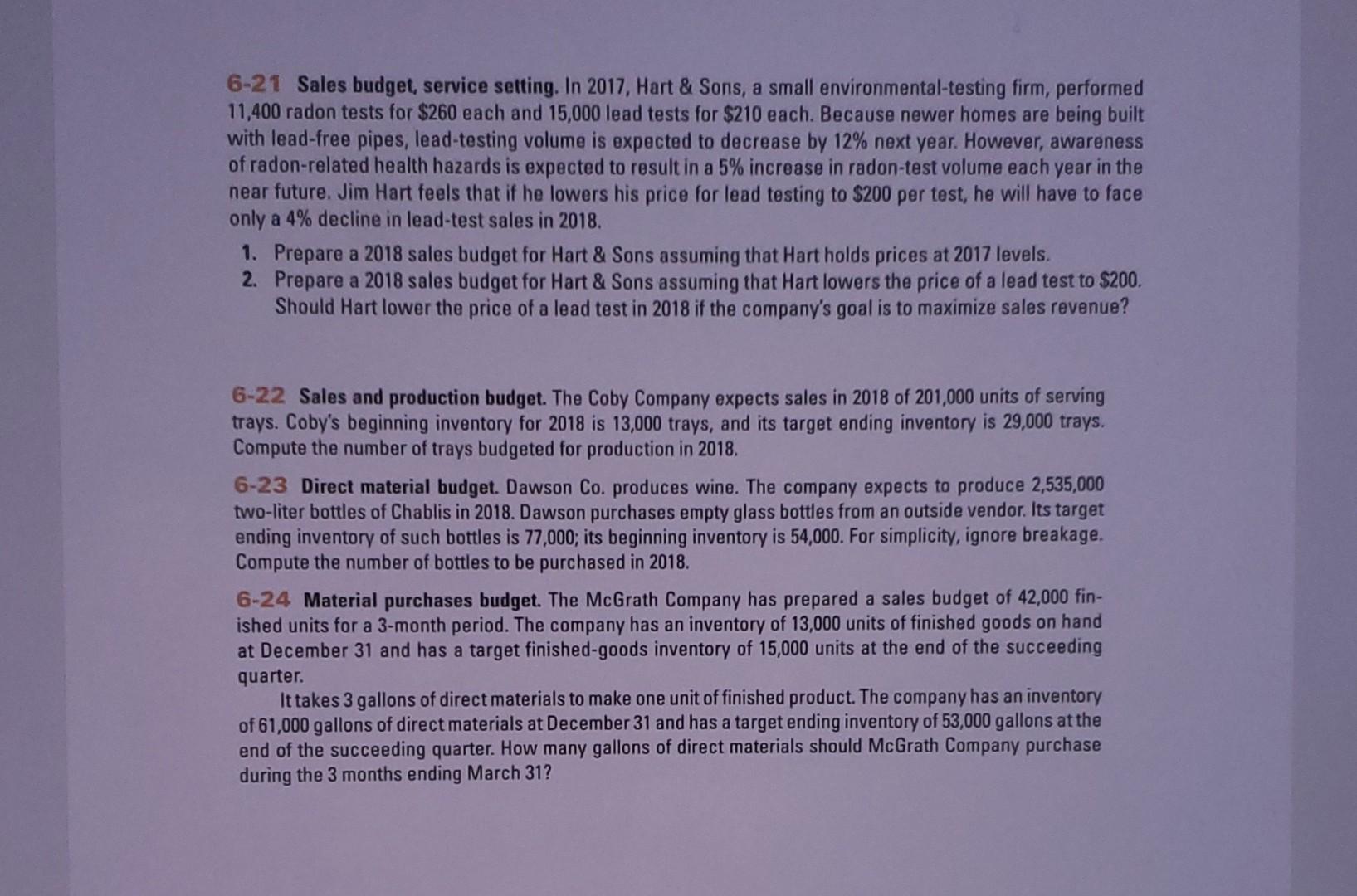

4-30 Journal entries, T-accounts, and source documents. Visual Company produces gadgets for the coveted small appliance market. The following data reflect activity for the year 2017: Visual Co. uses a normal-costing system and allocates overhead to work in process at a rate of $3.10 per direct manufacturing labor dollar. Indirect materials are insignificant so there is no inventory account for indirect materials. 1. Prepare journal entries to record the transactions for 2017 including an entry to close out over- or underallocated overhead to cost of goods sold. For each journal entry indicate the source document that 5-21 Plant-wide, department, and ABC indirect-cost rates. Automotive Products (AP) designs and produces automotive parts. In 2017, actual variable manufacturing overhead is $308,600. AP's simple costing system allocates variable manufacturing overhead to its three customers based on machine-hours and prices its contracts based on full costs. One of its customers has regularly complained of being charged noncompetitive prices, so AP's controller Devon Smith realizes that it is time to examine the consumption of overhead resources more closely. He knows that there are three main departments that consume overhead resources: design, production, and engineering. Interviews with the department personnel and examination of time records yield the following detailed information: 1. Compute the manufacturing overhead allocated to each customer in 2017 using the simple costing system that uses machine-hours as the allocation base. 2. Compute the manufacturing overhead allocated to each customer in 2017 using department-based manufacturing overhead rates. 3. Comment on your answers in requirements 1 and 2. Which customer do you think was complaining about being overcharged in the simple system? If the new department-based rates are used to price contracts, which customer(s) will be unhappy? How would you respond to these concerns? 4. How else might AP use the information available from its department-by-department analysis of manufacturing overhead costs? 5. AP's managers are wondering if they should further refine the department-by-department costing system into an ABC system by identifying different activities within each department. Under what conditions would it not be worthwhile to further refine the department costing system into an ABC system? 6-21 Sales budget, service setting. In 2017, Hart \& Sons, a small environmental-testing firm, performed 11,400 radon tests for $260 each and 15,000 lead tests for $210 each. Because newer homes are being built with lead-free pipes, lead-testing volume is expected to decrease by 12% next year. However, awareness of radon-related health hazards is expected to result in a 5% increase in radon-test volume each year in the near future. Jim Hart feels that if he lowers his price for lead testing to $200 per test, he will have to face only a 4% decline in lead-test sales in 2018. 1. Prepare a 2018 sales budget for Hart \& Sons assuming that Hart holds prices at 2017 levels. 2. Prepare a 2018 sales budget for Hart \& Sons assuming that Hart lowers the price of a lead test to $200. Should Hart lower the price of a lead test in 2018 if the company's goal is to maximize sales revenue? 6-22 Sales and production budget. The Coby Company expects sales in 2018 of 201,000 units of serving trays. Coby's beginning inventory for 2018 is 13,000 trays, and its target ending inventory is 29,000 trays. Compute the number of trays budgeted for production in 2018. 6-23 Direct material budget. Dawson Co. produces wine. The company expects to produce 2,535,000 two-liter bottles of Chablis in 2018. Dawson purchases empty glass bottles from an outside vendor. Its target ending inventory of such bottles is 77,000 ; its beginning inventory is 54,000 . For simplicity, ignore breakage. Compute the number of bottles to be purchased in 2018. 6-24 Material purchases budget. The McGrath Company has prepared a sales budget of 42,000 finished units for a 3-month period. The company has an inventory of 13,000 units of finished goods on hand at December 31 and has a target finished-goods inventory of 15,000 units at the end of the succeeding quarter. It takes 3 gallons of direct materials to make one unit of finished product. The company has an inventory of 61,000 gallons of direct materials at December 31 and has a target ending inventory of 53,000 gallons at the end of the succeeding quarter. How many gallons of direct materials should McGrath Company purchase during the 3 months ending March 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started