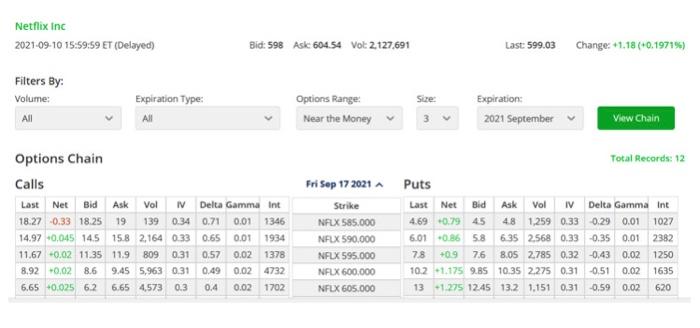

4)(30 points total) Suppose you are bearish on NFLX and therefore shorted 100 shares. You are bearish in the long term but want to hedge your short position for a week since you are worried about incoming news. The hedges that you are considering are to buy one 600 call option or to write (sell) one 600 put option. $600 is of course the strike price. Use the option table below to answer the following questions. Netflix Inc 2021-09-10 15:59:59 Delayed 3:59 Ascenes Vot:212741 Filters By: Volume pation Type Options Range AB Wow Charm Fri Sep 172001 Options Chain Calls Last Net Bid Ask Vol Delta Game 18.27 -0.33 18:25 19 130 0.34 0.71 001346 14.97-0045 145 150 2164 0.6 0.01 1904 11.67 -0.0211.35 119 309 310.57 00 1378 8.92 -2 26 45 5963 031 0.43 DO 4732 6.650 45 3040m 1700 NFLXS000 NFEX 95.000 NAXE NEL 60.000 Puts Last Net Ask Delta Gamma int 2015 on 029 1027 Cotos 2013 0:00 776 5 27 60 Geo 1250 13235 2275 31651 08 1835 13-125 126 12 1903 02 00 In the space below, draw the profit function of both hedges on the same diagram: buying the 600 call and writing the 600 put. Be sure to label the breakeven points. If you drew the diagram correctly. The profit functions should cross at two points - call them indiffi and indiff2. Calculate what the spot at expiration has to be at each indiff point (there are two of them) 20 points for correct and completely labeled graph a)(10 points) Now consider point indiffl, the indifference point on the left with the lower spot at expiration than indiff2. Explain why these two losses are the same - that is, explain why the call hedge loses what it does and why the put hedge loses what it does. Be very specific! 1 Netflix Inc 2021-09-10 15:59:59 ET (Delayed) Bid: 598 Ask 604.54 Vol 2 127,691 Last: 599.03 Change: +1.18 (+0.19719) Filters By: Volume: All Size: Expiration Type: All Options Range: Near the Money Expiration: 2021 September View Chain Total Records: 12 Options Chain Calls Last Net Bid Ask Vol IV 18.27 -0.33 18.25 19 139 0.34 14.97 +0,045 145 15.8 2,164 0.33 11.67 -0.02 11.35 11.9 809 0.31 8.92 +0,02 9.45 5.963 0.31 6.65 0.025 6.2 6,65 4,573 0.3 Delta Gamma Int 0.71 0.01 1346 0.65 0.01 1934 0.57 0.02 1378 0.49 0.02 4732 0.4 0.02 1702 Fri Sep 17 2021 Strike NFLX 585.000 NFLX 590.000 NFLX 595.000 NFLX 600.000 NFLX 605.000 Puts Last Net Bid Ask Vol IV Delta Gamma int 4.69 0.79 45 4.8 1,259 0.33 0.29 0.01 1027 6.01 0.86 5.8 635 2.568 0.33 0.35 0.01 2382 +09 8.05 2785 0.32 0.43 0.02 1250 102 1.175 9.85 10.35 2.275 0.31 0.51 0.02 1635 13 +1.275 12.45 13.2 1.151 0.31 0.59 0.02 620 78 7.6 86 4)(30 points total) Suppose you are bearish on NFLX and therefore shorted 100 shares. You are bearish in the long term but want to hedge your short position for a week since you are worried about incoming news. The hedges that you are considering are to buy one 600 call option or to write (sell) one 600 put option. $600 is of course the strike price. Use the option table below to answer the following questions. Netflix Inc 2021-09-10 15:59:59 Delayed 3:59 Ascenes Vot:212741 Filters By: Volume pation Type Options Range AB Wow Charm Fri Sep 172001 Options Chain Calls Last Net Bid Ask Vol Delta Game 18.27 -0.33 18:25 19 130 0.34 0.71 001346 14.97-0045 145 150 2164 0.6 0.01 1904 11.67 -0.0211.35 119 309 310.57 00 1378 8.92 -2 26 45 5963 031 0.43 DO 4732 6.650 45 3040m 1700 NFLXS000 NFEX 95.000 NAXE NEL 60.000 Puts Last Net Ask Delta Gamma int 2015 on 029 1027 Cotos 2013 0:00 776 5 27 60 Geo 1250 13235 2275 31651 08 1835 13-125 126 12 1903 02 00 In the space below, draw the profit function of both hedges on the same diagram: buying the 600 call and writing the 600 put. Be sure to label the breakeven points. If you drew the diagram correctly. The profit functions should cross at two points - call them indiffi and indiff2. Calculate what the spot at expiration has to be at each indiff point (there are two of them) 20 points for correct and completely labeled graph a)(10 points) Now consider point indiffl, the indifference point on the left with the lower spot at expiration than indiff2. Explain why these two losses are the same - that is, explain why the call hedge loses what it does and why the put hedge loses what it does. Be very specific! 1 Netflix Inc 2021-09-10 15:59:59 ET (Delayed) Bid: 598 Ask 604.54 Vol 2 127,691 Last: 599.03 Change: +1.18 (+0.19719) Filters By: Volume: All Size: Expiration Type: All Options Range: Near the Money Expiration: 2021 September View Chain Total Records: 12 Options Chain Calls Last Net Bid Ask Vol IV 18.27 -0.33 18.25 19 139 0.34 14.97 +0,045 145 15.8 2,164 0.33 11.67 -0.02 11.35 11.9 809 0.31 8.92 +0,02 9.45 5.963 0.31 6.65 0.025 6.2 6,65 4,573 0.3 Delta Gamma Int 0.71 0.01 1346 0.65 0.01 1934 0.57 0.02 1378 0.49 0.02 4732 0.4 0.02 1702 Fri Sep 17 2021 Strike NFLX 585.000 NFLX 590.000 NFLX 595.000 NFLX 600.000 NFLX 605.000 Puts Last Net Bid Ask Vol IV Delta Gamma int 4.69 0.79 45 4.8 1,259 0.33 0.29 0.01 1027 6.01 0.86 5.8 635 2.568 0.33 0.35 0.01 2382 +09 8.05 2785 0.32 0.43 0.02 1250 102 1.175 9.85 10.35 2.275 0.31 0.51 0.02 1635 13 +1.275 12.45 13.2 1.151 0.31 0.59 0.02 620 78 7.6 86