Question

44. Assume that Modigliani and Miller Proposition I holds such that capital structure is irrelevant. If the value of a levered firm (VL) is

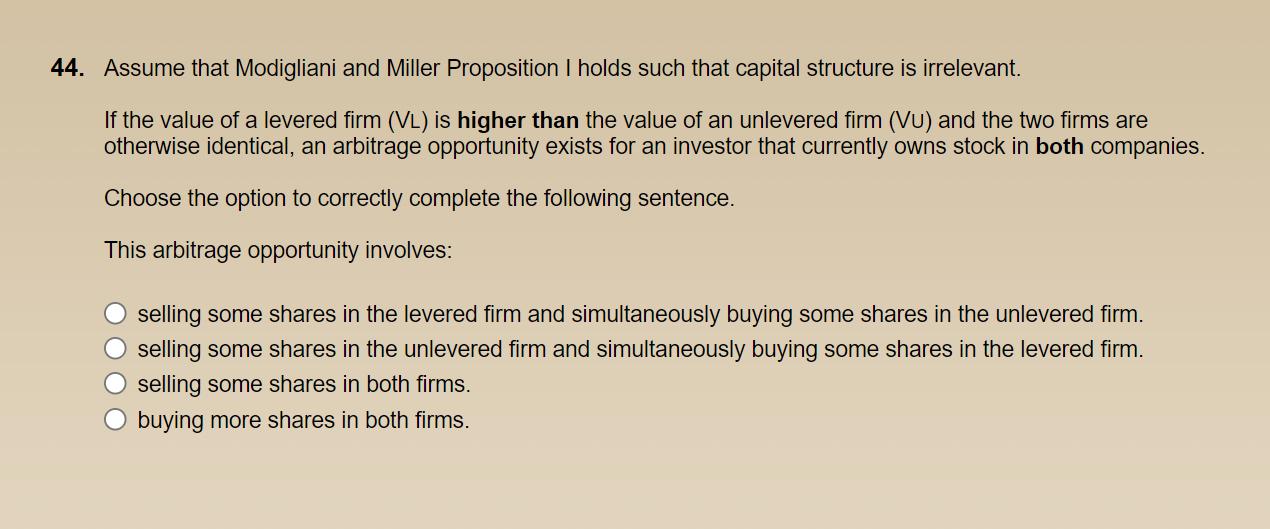

44. Assume that Modigliani and Miller Proposition I holds such that capital structure is irrelevant. If the value of a levered firm (VL) is higher than the value of an unlevered firm (VU) and the two firms are otherwise identical, an arbitrage opportunity exists for an investor that currently owns stock in both companies. Choose the option to correctly complete the following sentence. This arbitrage opportunity involves: selling some shares in the levered firm and simultaneously buying some shares in the unlevered firm. selling some shares in the unlevered firm and simultaneously buying some shares in the levered firm. selling some shares in both firms. buying more shares in both firms.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started