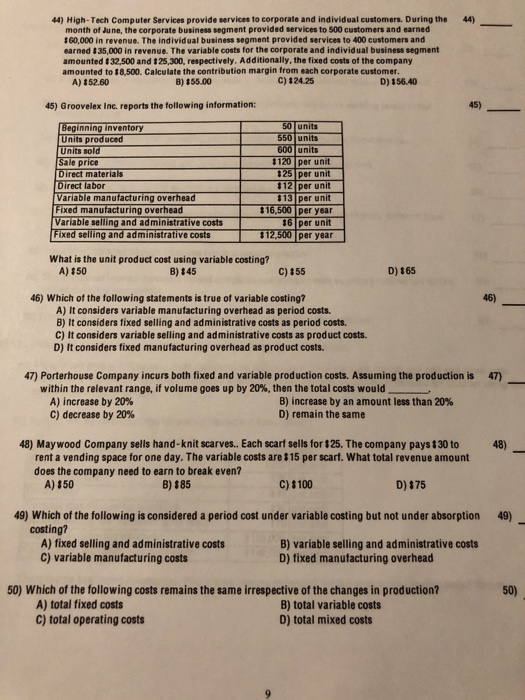

44) High-Tech Computer Services provide services to corporate and individual customers. During the 44) month of June, the corporate business segment provided services to 500 customers and earned $60,000 in revenue. The individual business segment provided services to 400 customers and earned $35,000 in revenue. The variable costs for the corporate and individual business segment amounted 132,500 and t25,300, respectively. Additionally, the fixed costs of the company amounted to $8,500. Calculate the contribution margin from each corporate customer. C) 124.25 8) 155.00 D) 156.40 A) $52.60 45) Groovelex Inc. reports the following information: Beginning inventory Units produced Units sold units 120 per unit 25 per unit price Direct materials Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative costs Fixed selling and administrative costs $13 per unit 116,500 per year 36per unit 2.500peryear What is the unit product cost using variable costing? B) 45 D) $65 A) 150 C) $55 46) 46) Which of the following statements is true of variable costing? A) It considers variable manufacturing overhead as period costs. B) It considers fixed selling and administrative costs as period costs. C) It considers variable selling and administrative costs as product costs. D) It considers fixed manufacturing overhead as product costs. 47) Porterhouse Company incurs both fixed and variable production costs. Assuming the production is 47) within the relevant range, if volume goes up by 20%, then the total costs would B) increase by an amount less than 20% D) remain the same A) increase by 20% C) decrease by 20% 48) Maywood Company sells hand-knit scarves. Each scart sells for $25. The company pays $30 to 48) rent a vending space for one day. The variable costs are $15 per scart. What total revenue amount does the company need to earn to break even? A) $50 B) $85 C) $100 D) $75 49) Which of the following is considered a period cost under variable costing but not under absorption 49) costing? A) fixed selling and administrative costs C) variable manufacturing costs B) variable selling and administrative costs D) fixed manufacturing overhead 50) Which of the following costs remains the same irrespective of the changes in production? 50) A) total fixed costs C) total operating costs B) total variable costs D) total mixed costs