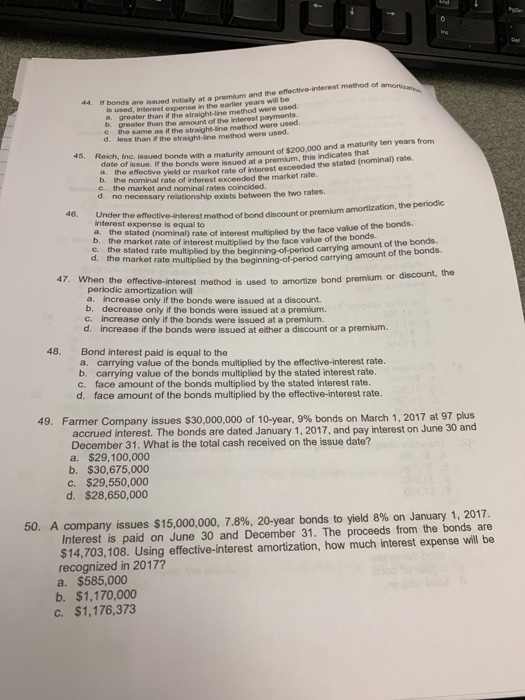

44. If Dbonds are ssued initialy at a premium and the effective-interest method of is used, interest expense in the earlier years a. greater than if the straight-line method were used. of the inter the same as if the straight-line method were used. e d. loss than ifthe straight-ine method were usod 5. Rash, lne. lssued bonds with a maturity amount of $200,000 and a maturity ten years from date of issue. If the bonds were issued at a premium, this indicates that b,the ective yield or market rate of interest exceoded the stated (nominal) rate c. the market and nominal rates coincided. rate of interest exceeded the market rate necessary relationship exists between the two rates. 46. Under the effective-interest method of bond discount or premium interest expense is equal to amortization, the periodic b, nominal) rate of interest multiplied by the face value of the bonds. the market rate of interest multiplied by the face value of the bonds the stated rate multiplied by the beginning-of-penod C, carrying amount of the bonds. ae muiiplled by the beginning-of-period carrying amount of the bonds. 47. When the effective-interest method is used to amortize bond premium or discount, the periodic amortization will a. increase only if the bonds were issued at a discount. b. decrease only if the bonds were issued at a premium. C. increase only if the bonds were issued at a premium. d. increase if the bonds were issued at either a discount or a premium 48. Bond interest paid is equal to the a. carrying value of the bonds multiplied by the effective-interest rate. carrying value of the bonds multiplied by the stated interest rate. face amount of the bonds multiplied by the stated interest rate. face amount of the bonds multiplied by the effective-interest rate. b. c. d. 49, Farmer Company issues $30,000,000 of 10-year, 9% bonds on March 1, 2017 at 97 plus accrued interest. The bonds are dated January 1, 2017, and pay interest on June 30 and December 31. What is the total cash received on the issue date? a. $29,100,000 b. $30,675,000 c. $29,550,000 d. $28,650,000 50, A company issues $15,000,000, 7.8%, 20-year bonds to yield 8% on January 1, 2017. Interest is paid on June 30 and December 31. The proceeds from the bonds are $14,703,108. Using effective-interest amortization, how much interest expense will be recognized in 2017? a. $585,000 b. $1,170,000 c. $1,176,373