Answered step by step

Verified Expert Solution

Question

1 Approved Answer

$44,000 $3,680 PT Barnum Company uses the periodic inventory system and has the following data from its December accounting records: Sales Sales Returns &

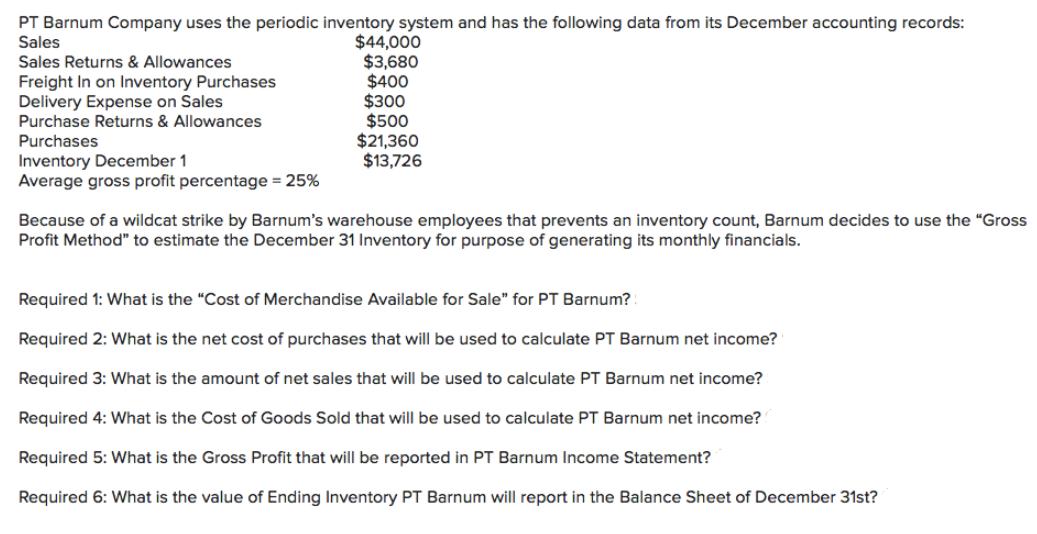

$44,000 $3,680 PT Barnum Company uses the periodic inventory system and has the following data from its December accounting records: Sales Sales Returns & Allowances Freight In on Inventory Purchases Delivery Expense on Sales Purchase Returns & Allowances Purchases $400 $300 $500 $21,360 Inventory December 1 $13,726 Average gross profit percentage = 25% Because of a wildcat strike by Barnum's warehouse employees that prevents an inventory count, Barnum decides to use the "Gross Profit Method" to estimate the December 31 Inventory for purpose of generating its monthly financials. Required 1: What is the "Cost of Merchandise Available for Sale" for PT Barnum? Required 2: What is the net cost of purchases that will be used to calculate PT Barnum net income? Required 3: What is the amount of net sales that will be used to calculate PT Barnum net income? Required 4: What is the Cost of Goods Sold that will be used to calculate PT Barnum net income? Required 5: What is the Gross Profit that will be reported in PT Barnum Income Statement? Required 6: What is the value of Ending Inventory PT Barnum will report in the Balance Sheet of December 31st?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required 1 Cost of Merchandise Available for Sale Cost of Merchandise Available for Sale Inventory D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started