Question

C Company sells home testing kits for Covid19: Antigen Rapid Test (ART), RT-PCR, Auto-Immune Response (AIR). For its first year of operations 2020 show the

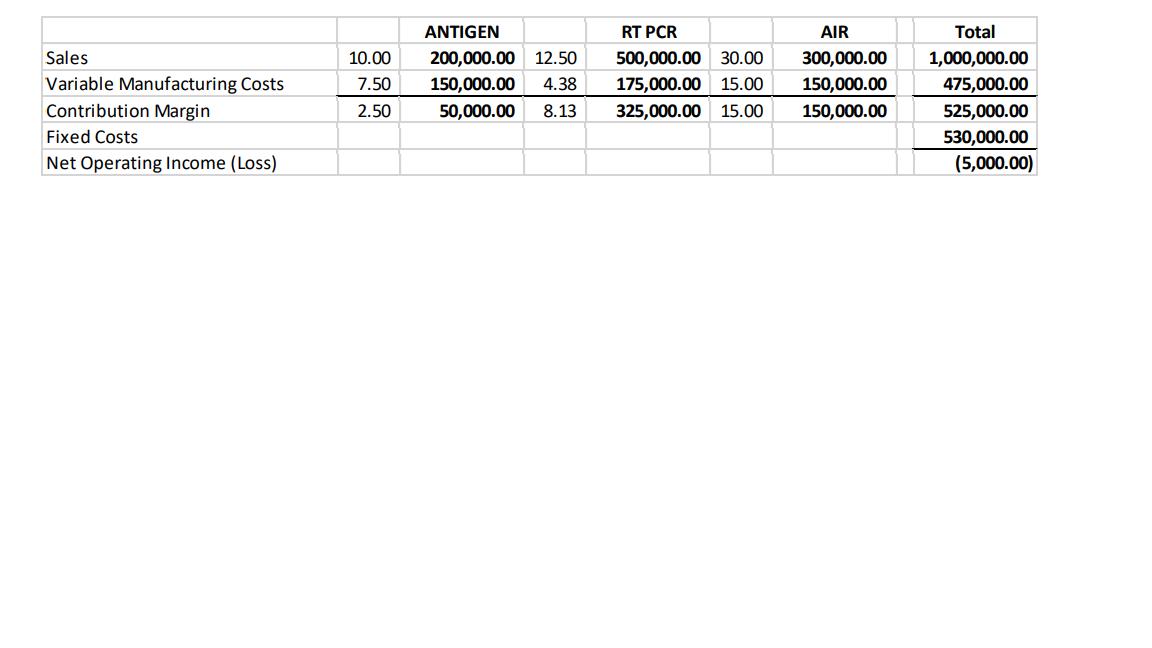

C Company sells home testing kits for Covid19: Antigen Rapid Test (ART), RT-PCR, Auto-Immune Response (AIR). For its first year of operations 2020 show the following income statement summarized performance. Required:

Required:

15. Management has asked you to compute its break-even point. *two decimal places.

16. At the break-even point, how many units of Antigen must be sold? Round off to the nearest unit.

17. At the break-even point, how many units of RTPCR must be sold? Round off to the nearest unit.

18. At the break-even point, how many units of AIR must be sold? Round off to the nearest unit.

19. For the year 2021, actual total sales of the products are as follows: Antigen $500,000; RT PCR $312,500; and AIR $360,000. How much is the Net Operating Income (Loss) for 2021 assuming no change in the company’s cost and pricing?

20. What is the new weighted contribution margin ratio for 2021? *two decimal places

Sales Variable Manufacturing Costs Contribution Margin Fixed Costs Net Operating Income (Loss) 10.00 7.50 2.50 ANTIGEN 200,000.00 12.50 150,000.00 4.38 50,000.00 8.13 RT PCR AIR 300,000.00 500,000.00 30.00 175,000.00 15.00 150,000.00 325,000.00 15.00 150,000.00 Total 1,000,000.00 475,000.00 525,000.00 530,000.00 (5,000.00)

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Question Working Notes WN1 Calculation of Contribution Margin and Sales Mix ANTIGEN RT PCR AIR Total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started