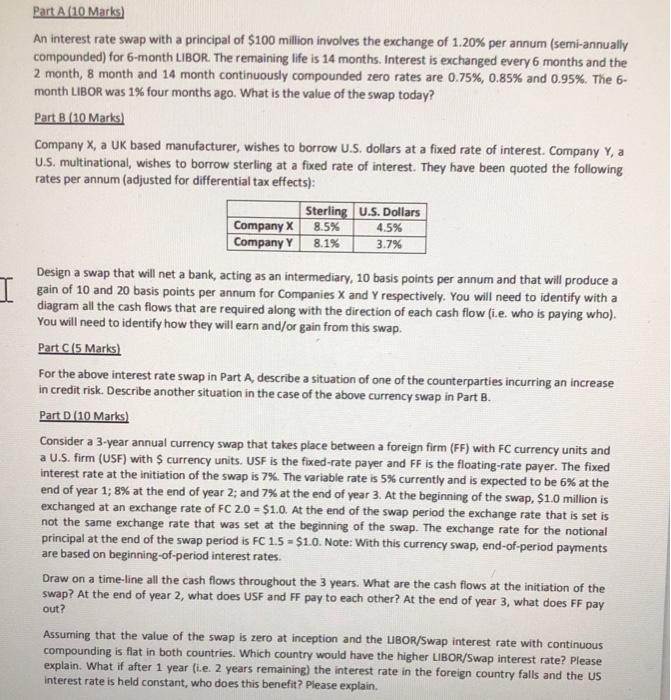

4.5% 3.7% Part A (10 Marks) An interest rate swap with a principal of $100 million involves the exchange of 1.20% per annum (semi-annually compounded) for 6-month LIBOR. The remaining life is 14 months. Interest is exchanged every 6 months and the 2 month, 8 month and 14 month continuously compounded zero rates are 0.75%, 0.85% and 0.95%. The 6- month LIBOR was 1% four months ago. What is the value of the swap today? Part B (10 Marks) Company X, a UK based manufacturer, wishes to borrow U.S. dollars at a fixed rate of interest. Company Y, a U.S. multinational, wishes to borrow sterling at a fixed rate of interest. They have been quoted the following rates per annum (adjusted for differential tax effects): Sterling U.S. Dollars Company X 8.5% Company Y 8.1% Design a swap that will net a bank, acting as an intermediary, 10 basis points per annum and that will produce a I sain of 10 and 20 basis points per annum for Companies X and Y respectively. You will need to identify with a diagram all the cash flows that are required along with the direction of each cash flow (i.e. who is paying who). You will need to identify how they will earn and/or gain from this swap. Part C(5 Marks) For the above interest rate swap in Part A, describe a situation of one of the counterparties incurring an increase in credit risk. Describe another situation in the case of the above currency swap in Part B. Part D (10 Marks) Consider a 3-year annual currency swap that takes place between a foreign firm (FF) with FC currency units and a U.S. firm (USF) with $ currency units. USF is the fixed-rate payer and FF is the floating-rate payer. The fixed interest rate at the initiation of the swap is 7%. The variable rate is 5% currently and is expected to be 6% at the end of year 1; 8% at the end of year 2; and 7% at the end of year 3. At the beginning of the swap. $1.0 million is exchanged at an exchange rate of FC 20 = $1.0. At the end of the swap period the exchange rate that is set is not the same exchange rate that was set at the beginning of the swap. The exchange rate for the notional principal at the end of the swap period is FC 1.5 = $1.0. Note: With this currency swap, end-of-period payments are based on beginning-of-period interest rates. Draw on a time-line all the cash flows throughout the 3 years. What are the cash flows at the initiation of the swap? At the end of year 2, what does USF and FF pay to each other? At the end of year 3, what does FF pay out? Assuming that the value of the swap is zero at inception and the LIBOR/Swap interest rate with continuous compounding is flat in both countries. Which country would have the higher LIBOR/Swap interest rate? Please explain. What if after 1 year (i.e. 2 years remaining) the interest rate in the foreign country falls and the US Interest rate is held constant, who does this benefit? Please explain