Question

4-53 Pharmaceutical Company Financial Statements Merck & Co., Incorporated, is a global health-care company that offers prescription medicines, vaccines, biologic therapies, animal health, and consumer

4-53 Pharmaceutical Company Financial Statements

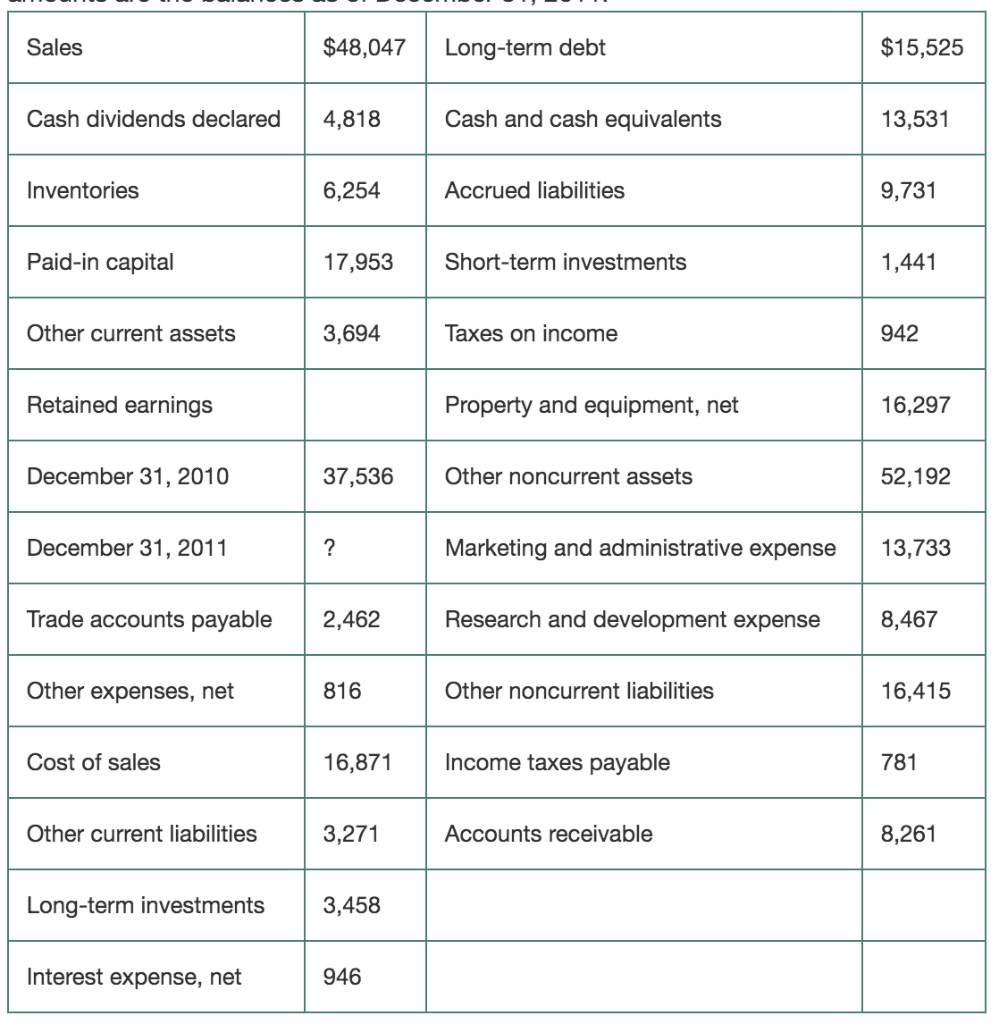

Merck & Co., Incorporated, is a global health-care company that offers prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. The annual report for the year ended December 31, 2011, included the data (slightly modified) shown next ($ in millions). Unless otherwise specified, the balance sheet amounts are the balances as of December 31, 2011.

-

Prepare a combined multiple-step statement of income.

-

Prepare a classified balance sheet. Include the correct number for retained earnings.

-

The average common stockholders equity for the year was $56,874 million. What was the percentage of net income to average common stockholders equity?

-

The average total assets for the year were $105,454.5 million. What was the percentage of net income to average total assets?

-

Compute (a) gross profit percentage, and (b) percentage of net income to sales.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started