Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4:57 PM Thu Feb 4 < Home Insert BI U abe ACC125-Unit+4+Assignment Draw Formulas VPN 51% Data Review View A ABC 123 18 fx

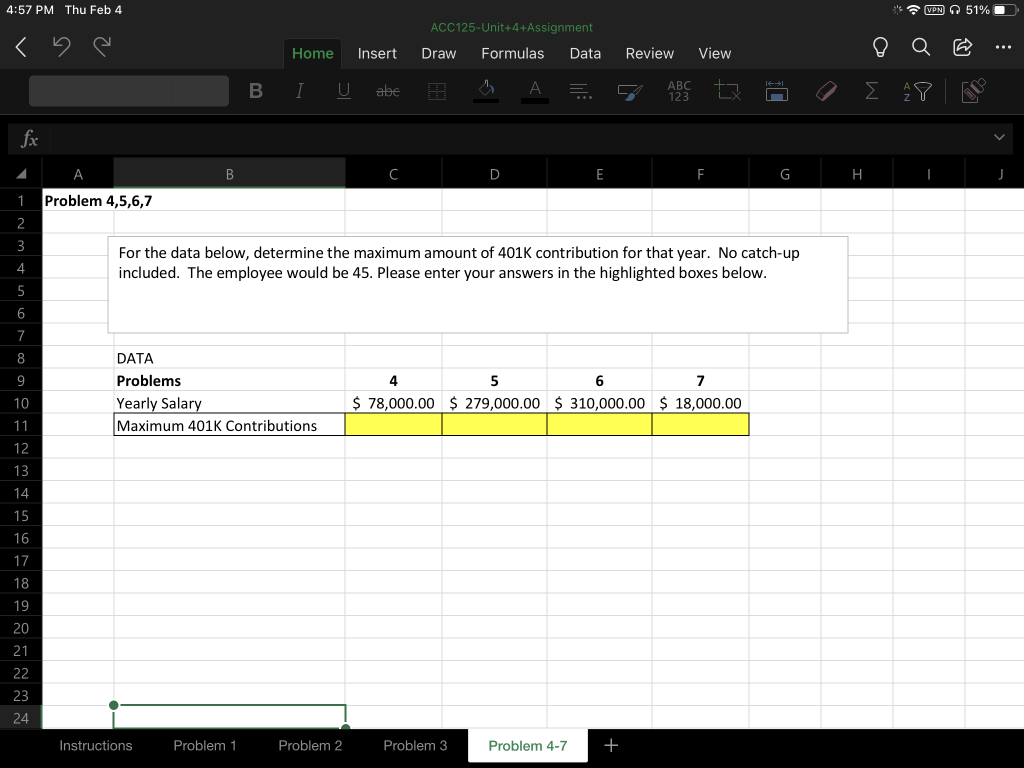

4:57 PM Thu Feb 4 < Home Insert BI U abe ACC125-Unit+4+Assignment Draw Formulas VPN 51% Data Review View A ABC 123 18 fx A B C E 1 Problem 4,5,6,7 2 3 4 For the data below, determine the maximum amount of 401K contribution for that year. No catch-up included. The employee would be 45. Please enter your answers in the highlighted boxes below. 5 6 7 8 DATA 9 Problems 4 5 6 7 10 Yearly Salary $ 78,000.00 $ 279,000.00 $310,000.00 $ 18,000.00 11 Maximum 401k Contributions 18 19 20 12345676222222 Instructions Problem 1 Problem 2 Problem 3 Problem 4-7 + H

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started