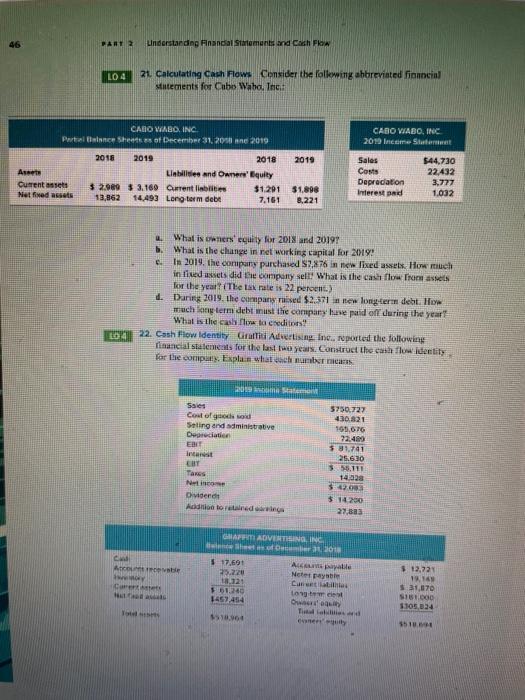

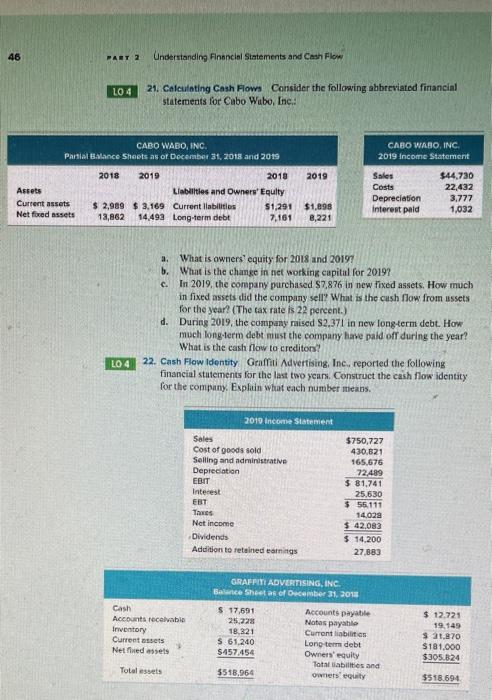

46 PART 3 Linderstanding Financial Statements and Cash Flow L04 21. Calculating Cash Flow Consider the following abbreviated financial utements for Cabo Wabo, Inc CABO VIABO, INC 2012 Inci Set CABO VABO INC Partial lainnee Shtes of December 31, 2018 2019 2016 2019 2018 Aste Linbidea and Owners' Equity Current assets $ 2.989 $ 3.169 Current liabilities $1.291 Net fixed asset 13,862 14493 Long term debe 7.161 2019 Sales Costs Deprecation Interested $44,730 22.432 3.777 1.032 31.898 8,221 What is owners equity for 2013 and 20191 b What is the change in net working capital for 2019! In 2019, the company purchased $7.876 in new lixed assets. How much in fixed assets did be company selt! What is the cash flow from asses for the year. The tax rate is 22 percent) . During 2019. the cur pan used $2.371 itew long-term debt. How much long term debt must the company huse paid off during the year! What is the cash flow to creditors! 22. Cash Flow Identity Grafiti Advertising Inc. oported the following Tinancial statements for the last two years. Construct the cash flow identity for the company. Explain what och numberman 20 Ssies Contol good Seling and administrative Cupretiation| ET Intant CHY Tanes Nico Dividere Addition to redes 5750.727 430.821 100.676 22.489 $83.741 25.630 3 5.1 1432 $2003 14200 27.833 w ACOV wy GAM ADVERTISING, INC. 2018 $17.691 Anale 25.226 Noter pa 1.121 Cunut 6140 Longest 1459 454 Our $12,223 1914 $ 31,070 SO 1105,034 10.04 151 46 PART 2 Understanding Financial Statements and Cash Flow LO4 21. Calculating Cash Flows Consider the following abbreviated financial statements for Cabo Wubo, Inc.: CABO WABO, INC. PASA Balance Sheets as of December 31, 2018 and 2019 CABO WABO, INC 2019 Income Statement 2019 Assets Current assets Net foxed assets 2018 2019 2018 Liabilities and Owners' Equity $ 2,989 $ 3.169 Current abilities $1,291 13,862 14.493 Long-term debt 7,161 Sales Costs Depreciation Interest pald $44,730 22,432 3.777 1,032 $1,898 8,221 a. What is owners' equity for 2018 and 20197 b. What is the change in net working capital for 20197 C. In 2019, the company purchased $7,876 in new fixed assets. How much in fixed assets did the company sell? What is the cash flow from assets for the year? (The tax rate is 22 percent.) d. During 2019, the company raised $2.371 in new long-term debt. How much long-term dobt must the company have paid off during the year? What is the cash flow to creditors? 22. Cash Flow Identity Graffiti Advertising, Inc. reported the following financial statements for the last two years. Construct the cash flow identity for the company. Explain what each number means. LO 4 2019 Income Statement Sales Cost of goods sold Selling and administrative Depreciation EBIT Interest EBT Taxes Net income Dividends Addition to retained earnings $750,727 430.821 165.676 72,489 $ 81,741 25.630 $ 55.111 14.023 $ 42,083 $ 14,200 27,883 Cash Accounts receivable Inventory Current assets Netrued assets GRAFFITI ADVERTISING, INC. Balance Sheets of December 31, 2013 S 17,591 Accounts payable 25.228 Notas payable 18,321 Current liabilities S 61.240 Long term debt 5457 454 Owners' equity Total liabilities and 5518,964 owners' equity $ 12.721 19.149 $ 21,870 $181,000 $305.824 Totales 5518.694