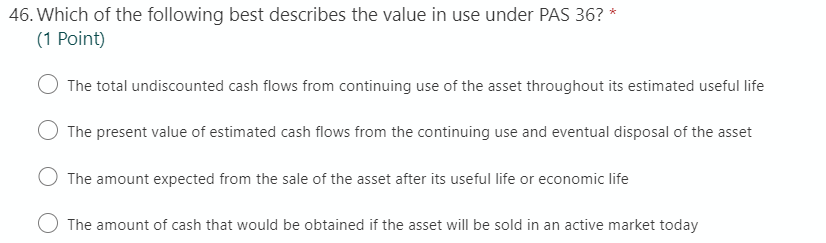

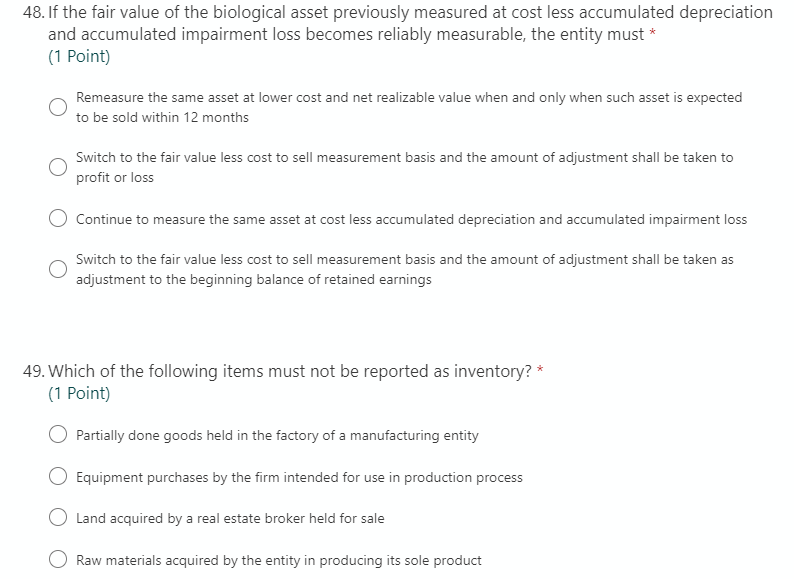

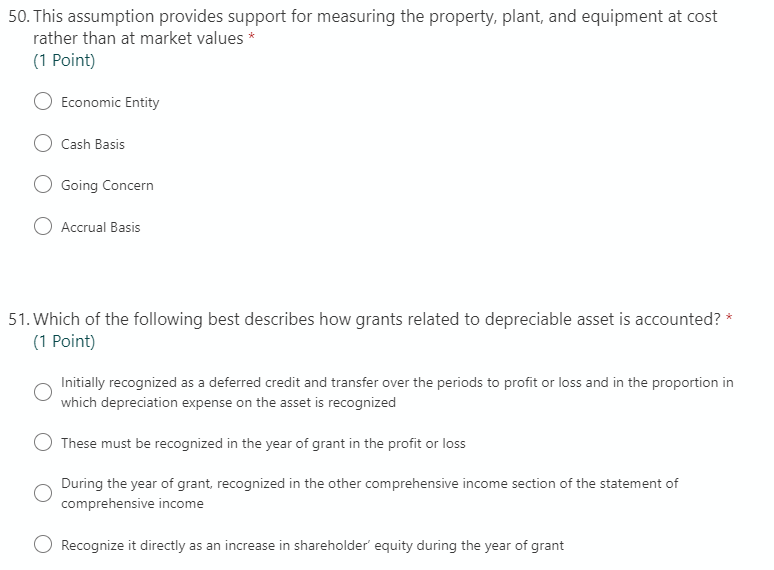

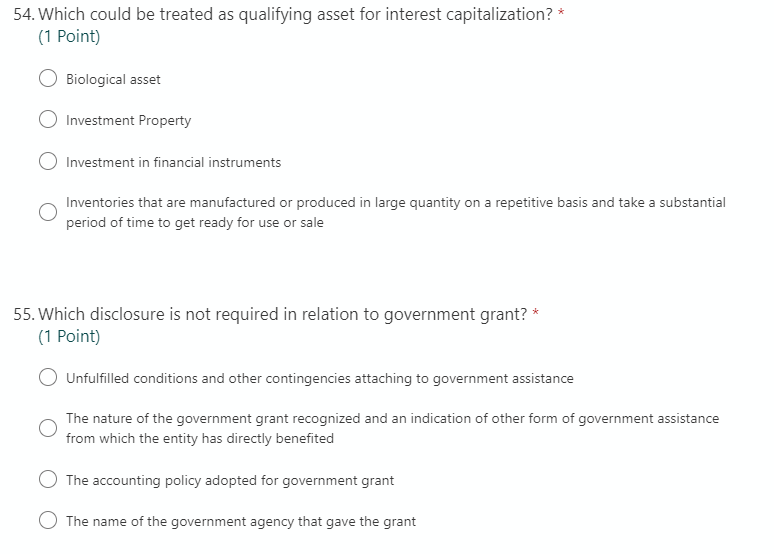

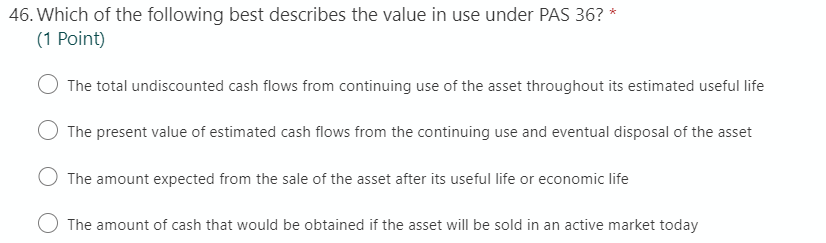

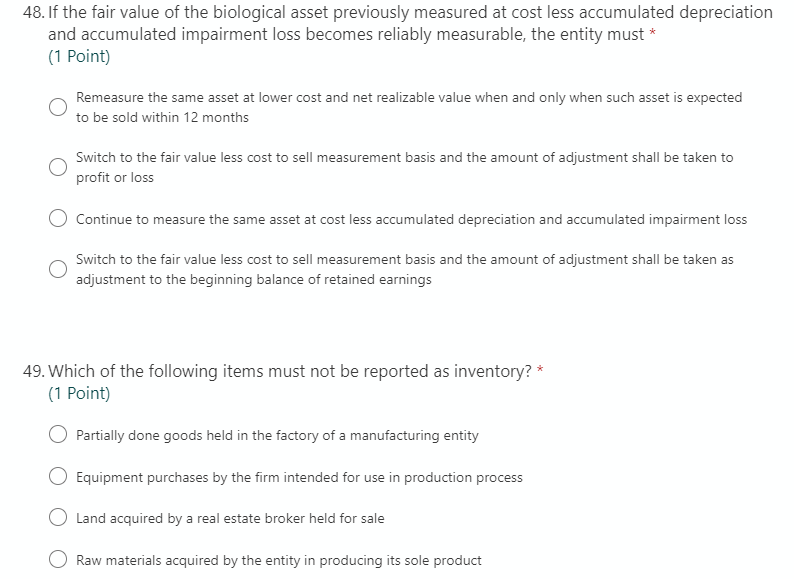

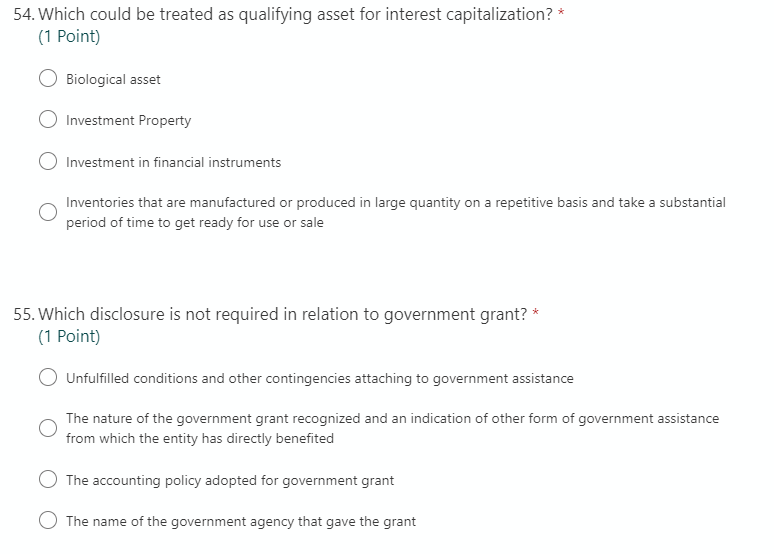

46. Which of the following best describes the value in use under PAS 36?* (1 Point) The total undiscounted cash flows from continuing use of the asset throughout its estimated useful life The present value of estimated cash flows from the continuing use and eventual disposal of the asset The amount expected from the sale of the asset after its useful life or economic life The amount of cash that would be obtained if the asset will be sold in an active market today 48. If the fair value of the biological asset previously measured at cost less accumulated depreciation and accumulated impairment loss becomes reliably measurable, the entity must * (1 Point) Remeasure the same asset at lower cost and net realizable value when and only when such asset is expected to be sold within 12 months Switch to the fair value less cost to sell measurement basis and the amount of adjustment shall be taken to profit or loss Continue to measure the same asset at cost less accumulated depreciation and accumulated impairment loss Switch to the fair value less cost to sell measurement basis and the amount of adjustment shall be taken as adjustment to the beginning balance of retained earnings 49. Which of the following items must not be reported as inventory?* (1 Point) Partially done goods held in the factory of a manufacturing entity Equipment purchases by the firm intended for use in production process Land acquired by a real estate broker held for sale Raw materials acquired by the entity in producing its sole product 50. This assumption provides support for measuring the property, plant, and equipment at cost rather than at market values * (1 Point) Economic Entity Cash Basis Going Concern O Accrual Basis 51. Which of the following best describes how grants related to depreciable asset is accounted? * (1 Point) Initially recognized as a deferred credit and transfer over the periods to profit or loss and in the proportion in which depreciation expense on the asset is recognized These must be recognized in the year of grant in the profit or loss During the year of grant, recognized in the other comprehensive income section of the statement of comprehensive income Recognize it directly as an increase in shareholder' equity during the year of grant 54. Which could be treated as qualifying asset for interest capitalization? * (1 Point) Biological asset Investment Property Investment in financial instruments Inventories that are manufactured or produced in large quantity on a repetitive basis and take a substantial period of time to get ready for use or sale 55. Which disclosure is not required in relation to government grant?* (1 Point) Unfulfilled conditions and other contingencies attaching to government assistance The nature of the government grant recognized and an indication of other form of government assistance from which the entity has directly benefited The accounting policy adopted for government grant The name of the government agency that gave the grant