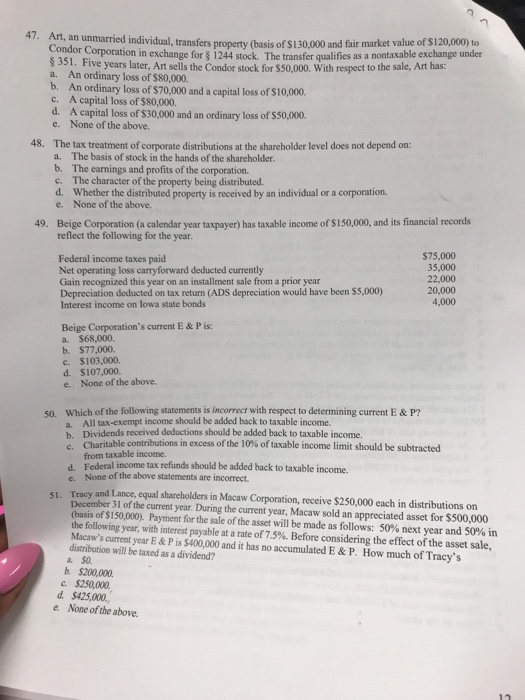

47. Art, an unmarried ind ividual, transfers property (basis of $130,000 and fair market value of $120,000) to orporation in exchange for $ 1244 stock. The transfer qualifies as a nontaxable exchange under 351. Five years later, Art sells the Condor stock for $50,000. With respect to the sale, Art has: a. An ordinary loss of $80,000. b. An ordinary loss of $70,000 and a capital loss of $10,000 c. A capital loss of $80,000. d. A capital loss of $30,000 and an ordinary loss of $50,000. e. None of the above. 48. The tax treatment of corporate distributions at the shareholder level does not depend on: a. The basis of stock in the hands of the shareholder. b. The earnings and profits of the corporation. c The character of the property being distributed. d. Whether the distributed property is received by an individual or a corporation. e. None of the above. 49. Beige Coporation (a calendar year taxpayer) has taxable income of $150,000, and its financial records reflect the following for the year. $75,000 35,000 Federal income taxes paid Net operating loss carryforward deducted currently Gain recognized this year on an installment sale from a prior year Depreciation deducted on tax return (ADS depreciation would have been $5,000) Interest income on lowa state bonds $5,000) 20,000 4,000 Beige Corporation's current E & P is a. $68,000. b. $77,000. c. $103,000. d. $107,000. e. None of the above. 50. Which of the following statements is incorrecr with respect to determining current E&P All tax-exempt income should be added back to taxable income. a. b. Dividends received deductions should be added back to taxable income. Charitable contributions in excess ofthe 10% oftaxable income limit should be subtracted c from taxable income. d. Federal income tax refunds should be added back to taxable income. None of the above statements are incorrect. 51. Tracy and Lance, equal shareholders in Macaw Corporation, receive $250,000 each in distributions on December 31 of the current year. During the current year, Macaw sold an appreciated asset for $500,000 (basis of $150,000). Payment for the sale of the asset will be made as follows: 50% next year and 50% in the following year, with interest payable at a rate of 7.5%. Before considering the effect of the asset sale, Macaw's current year E & P is $400,000 and it has no accumulated E & P. How much of Tracy's distribution will be taxed as a dividend? b. $200,000 C.$2.50,000. d. $425,000. e. None of the above