Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4.7 The management of Ajax Industries has concluded that no more than $100,000 of new investment funds can be made available during the coming year.

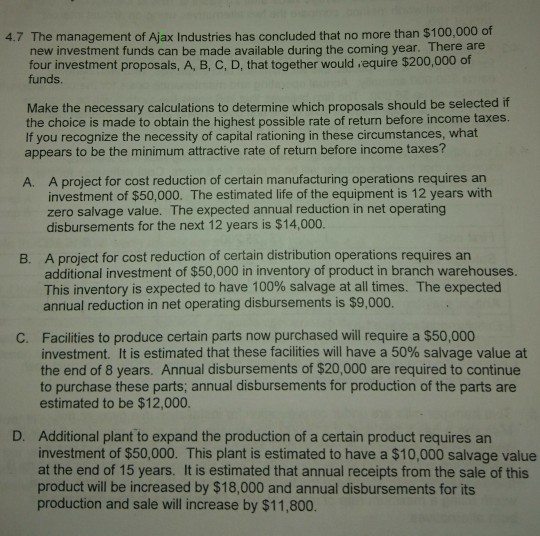

4.7 The management of Ajax Industries has concluded that no more than $100,000 of new investment funds can be made available during the coming year. There are four investment proposals, A, B, C, D, that together would equire $200,000 of funds. Make the necessary calculations to determine which proposals should be selected if the choice is made to obtain the highest possible rate of return before income taxes. If you recognize the necessity of capital rationing in these circumstances, what appears to be the minimum attractive rate of return before income taxes? A project for cost reduction of certain manufacturing operations requires an investment of $50,000. The estimated life of the equipment is 12 years with zero salvage value. The expected annual reduction in net operating disbursements for the next 12 years is $14,000 A. A project for cost reduction of certain distribution operations requires an additional investment of $50,000 in inventory of product in branch warehouses. This inventory is expected to have 100% salvage at all times. The expected annual reduction in net operating disbursements is $9,000 B. Facilities to produce certain parts now purchased will require a $50,000 investment. It is estimated that these facilities will have a 50% salvage value at the end of 8 years. Annual disbursements of $20,000 are required to continue to purchase these parts, annual disbursements for production of the parts are estimated to be $12,000 C. D. Additional plant to expand the production of a certain product requires an investment of $50,000. This plant is estimated to have a $10,000 salvage value at the end of 15 years. It is estimated that annual receipts from the sale of this product will be increased by $18,000 and annual disbursements for its production and sale will increase by $11,800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started