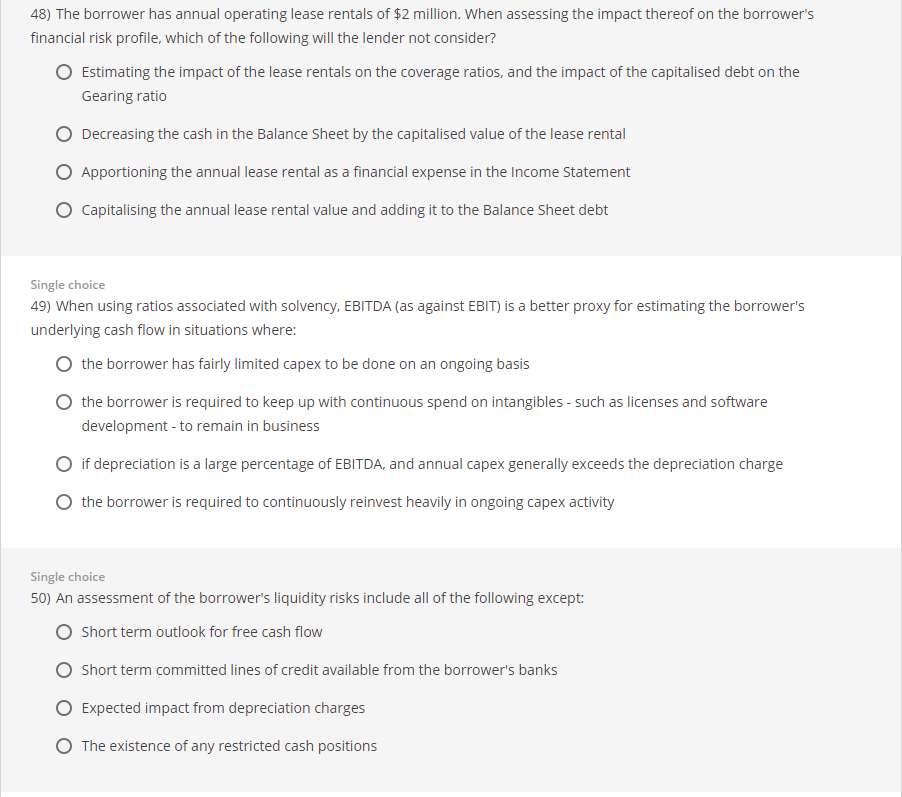

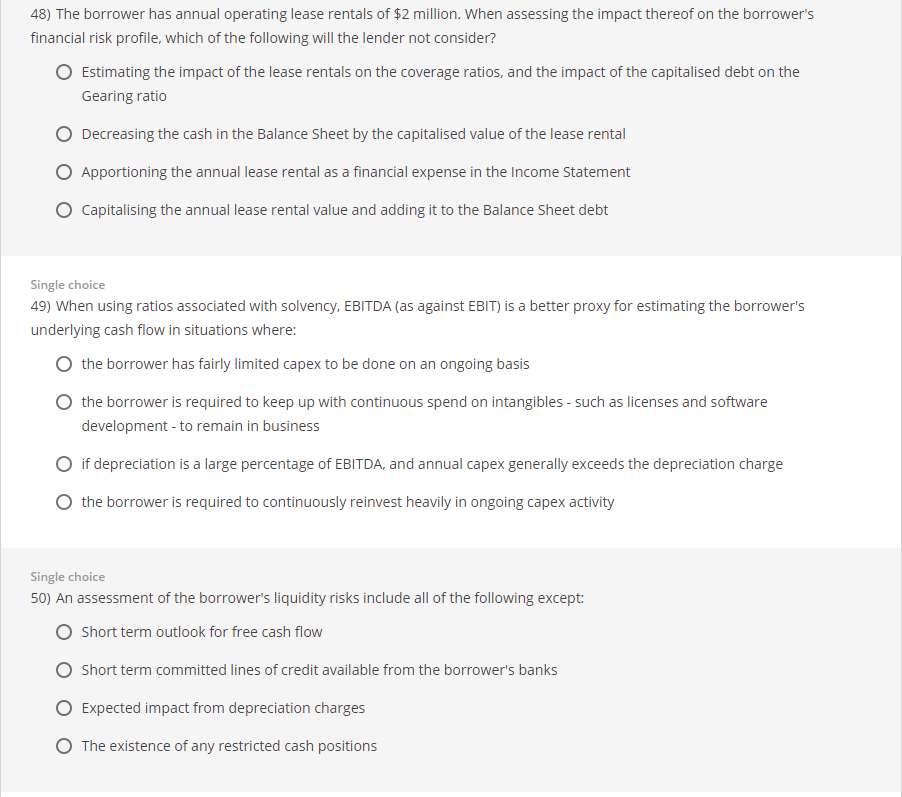

48) The borrower has annual operating lease rentals of $2 million. When assessing the impact thereof on the borrower's financial risk profile, which of the following will the lender not consider? Estimating the impact of the lease rentals on the coverage ratios, and the impact of the capitalised debt on the Gearing ratio Decreasing the cash in the Balance Sheet by the capitalised value of the lease rental Apportioning the annual lease rental as a financial expense in the Income Statement Capitalising the annual lease rental value and adding it to the Balance Sheet debt Single choice 49) When using ratios associated with solvency, EBITDA (as against EBIT) is a better proxy for estimating the borrower's underlying cash flow in situations where: O the borrower has fairly limited capex to be done on an ongoing basis the borrower is required to keep up with continuous spend on intangibles - such as licenses and software development - to remain in business if depreciation is a large percentage of EBITDA, and annual capex generally exceeds the depreciation charge the borrower is required to continuously reinvest heavily in ongoing capex activity Single choice 50) An assessment of the borrower's liquidity risks include all of the following except: Short term outlook for free cash flow Short term committed lines of credit available from the borrower's banks Expected impact from depreciation charges The existence of any restricted cash positions 48) The borrower has annual operating lease rentals of $2 million. When assessing the impact thereof on the borrower's financial risk profile, which of the following will the lender not consider? Estimating the impact of the lease rentals on the coverage ratios, and the impact of the capitalised debt on the Gearing ratio Decreasing the cash in the Balance Sheet by the capitalised value of the lease rental Apportioning the annual lease rental as a financial expense in the Income Statement Capitalising the annual lease rental value and adding it to the Balance Sheet debt Single choice 49) When using ratios associated with solvency, EBITDA (as against EBIT) is a better proxy for estimating the borrower's underlying cash flow in situations where: O the borrower has fairly limited capex to be done on an ongoing basis the borrower is required to keep up with continuous spend on intangibles - such as licenses and software development - to remain in business if depreciation is a large percentage of EBITDA, and annual capex generally exceeds the depreciation charge the borrower is required to continuously reinvest heavily in ongoing capex activity Single choice 50) An assessment of the borrower's liquidity risks include all of the following except: Short term outlook for free cash flow Short term committed lines of credit available from the borrower's banks Expected impact from depreciation charges The existence of any restricted cash positions