Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4-9 Using the information in question 3, and linear interpolation, the project's discounted payback period is most nearly 3.62 years. 2.33 years 2.05 years. 3.41

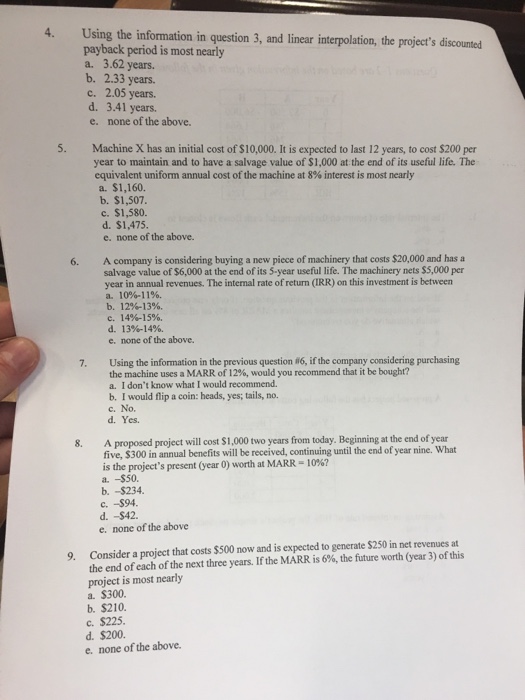

4-9  Using the information in question 3, and linear interpolation, the project's discounted payback period is most nearly 3.62 years. 2.33 years 2.05 years. 3.41 years. none of the above. Machine X has an initial cost of $10,000. It is expected to last 12 years, to cost $200 per year to maintain and to have a salvage value of $1,000 at the end of its useful life. The equivalent uniform annual cost of the machine at 8% interest is most nearly $1, 160. $1, 507. $1, 580 $1, 475. none of the above. A company is considering buying a new piece of machinery that costs $20,000 and has a salvage value of $6,000 at the end of its 5-year useful life. The machinery nets $5,000 per year in annual revenues. The internal rate of return (IRR) on this investment is between 10%-11% 12%-13%. 14%-15% 13%-14%. none of the above. Using the information in the previous question #6, if the company considering purchasing the machine uses a MARR of 12%, would you recommend that it be bought? I don't know what I would recommend. I would flip a coin: heads, yes; tails, no. No. Yes. A proposed project will cost $1,000 two years from today. Beginning at the end of year five, $300 in annual benefits will be received, continuing until the end of year nine. What is the project's present (year 0) worth at MARR = 10%? -$50. -$234. -$94. -$42. none of the above Consider a project that costs $500 now and is expected to generate $250 in net revenues at the end of each of the next three years. If the MARR is 6%, the future worth (year 3) of this project is most nearly $300. $210. $225. $200. none of the above. Using the information in question 3, and linear interpolation, the project's discounted payback period is most nearly 3.62 years. 2.33 years 2.05 years. 3.41 years. none of the above. Machine X has an initial cost of $10,000. It is expected to last 12 years, to cost $200 per year to maintain and to have a salvage value of $1,000 at the end of its useful life. The equivalent uniform annual cost of the machine at 8% interest is most nearly $1, 160. $1, 507. $1, 580 $1, 475. none of the above. A company is considering buying a new piece of machinery that costs $20,000 and has a salvage value of $6,000 at the end of its 5-year useful life. The machinery nets $5,000 per year in annual revenues. The internal rate of return (IRR) on this investment is between 10%-11% 12%-13%. 14%-15% 13%-14%. none of the above. Using the information in the previous question #6, if the company considering purchasing the machine uses a MARR of 12%, would you recommend that it be bought? I don't know what I would recommend. I would flip a coin: heads, yes; tails, no. No. Yes. A proposed project will cost $1,000 two years from today. Beginning at the end of year five, $300 in annual benefits will be received, continuing until the end of year nine. What is the project's present (year 0) worth at MARR = 10%? -$50. -$234. -$94. -$42. none of the above Consider a project that costs $500 now and is expected to generate $250 in net revenues at the end of each of the next three years. If the MARR is 6%, the future worth (year 3) of this project is most nearly $300. $210. $225. $200. none of the above

Using the information in question 3, and linear interpolation, the project's discounted payback period is most nearly 3.62 years. 2.33 years 2.05 years. 3.41 years. none of the above. Machine X has an initial cost of $10,000. It is expected to last 12 years, to cost $200 per year to maintain and to have a salvage value of $1,000 at the end of its useful life. The equivalent uniform annual cost of the machine at 8% interest is most nearly $1, 160. $1, 507. $1, 580 $1, 475. none of the above. A company is considering buying a new piece of machinery that costs $20,000 and has a salvage value of $6,000 at the end of its 5-year useful life. The machinery nets $5,000 per year in annual revenues. The internal rate of return (IRR) on this investment is between 10%-11% 12%-13%. 14%-15% 13%-14%. none of the above. Using the information in the previous question #6, if the company considering purchasing the machine uses a MARR of 12%, would you recommend that it be bought? I don't know what I would recommend. I would flip a coin: heads, yes; tails, no. No. Yes. A proposed project will cost $1,000 two years from today. Beginning at the end of year five, $300 in annual benefits will be received, continuing until the end of year nine. What is the project's present (year 0) worth at MARR = 10%? -$50. -$234. -$94. -$42. none of the above Consider a project that costs $500 now and is expected to generate $250 in net revenues at the end of each of the next three years. If the MARR is 6%, the future worth (year 3) of this project is most nearly $300. $210. $225. $200. none of the above. Using the information in question 3, and linear interpolation, the project's discounted payback period is most nearly 3.62 years. 2.33 years 2.05 years. 3.41 years. none of the above. Machine X has an initial cost of $10,000. It is expected to last 12 years, to cost $200 per year to maintain and to have a salvage value of $1,000 at the end of its useful life. The equivalent uniform annual cost of the machine at 8% interest is most nearly $1, 160. $1, 507. $1, 580 $1, 475. none of the above. A company is considering buying a new piece of machinery that costs $20,000 and has a salvage value of $6,000 at the end of its 5-year useful life. The machinery nets $5,000 per year in annual revenues. The internal rate of return (IRR) on this investment is between 10%-11% 12%-13%. 14%-15% 13%-14%. none of the above. Using the information in the previous question #6, if the company considering purchasing the machine uses a MARR of 12%, would you recommend that it be bought? I don't know what I would recommend. I would flip a coin: heads, yes; tails, no. No. Yes. A proposed project will cost $1,000 two years from today. Beginning at the end of year five, $300 in annual benefits will be received, continuing until the end of year nine. What is the project's present (year 0) worth at MARR = 10%? -$50. -$234. -$94. -$42. none of the above Consider a project that costs $500 now and is expected to generate $250 in net revenues at the end of each of the next three years. If the MARR is 6%, the future worth (year 3) of this project is most nearly $300. $210. $225. $200. none of the above

4-9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started