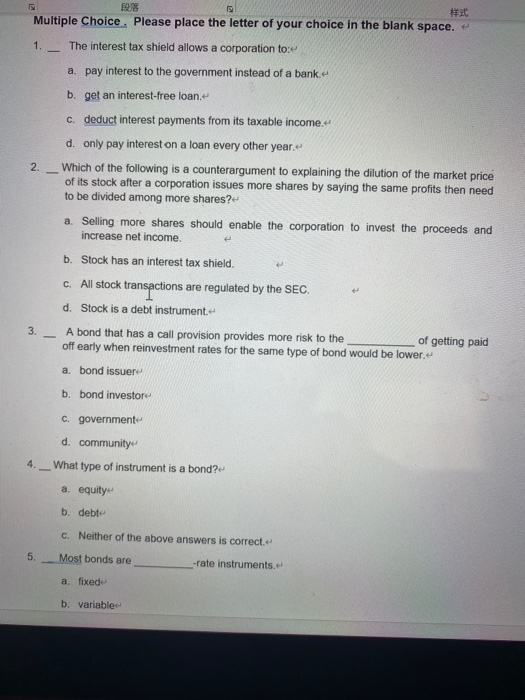

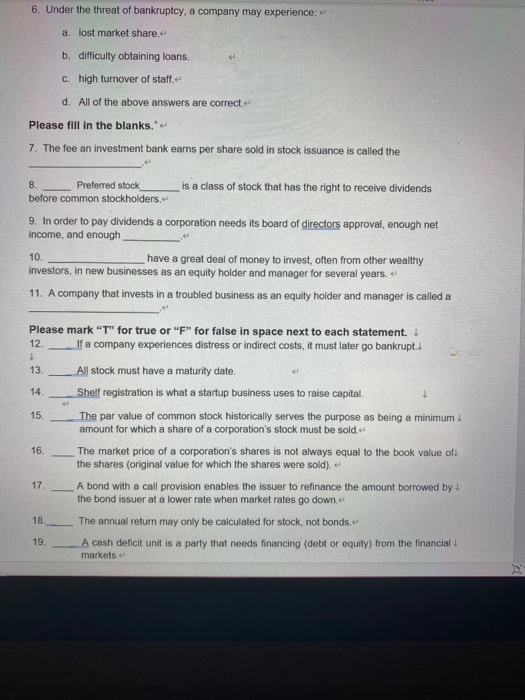

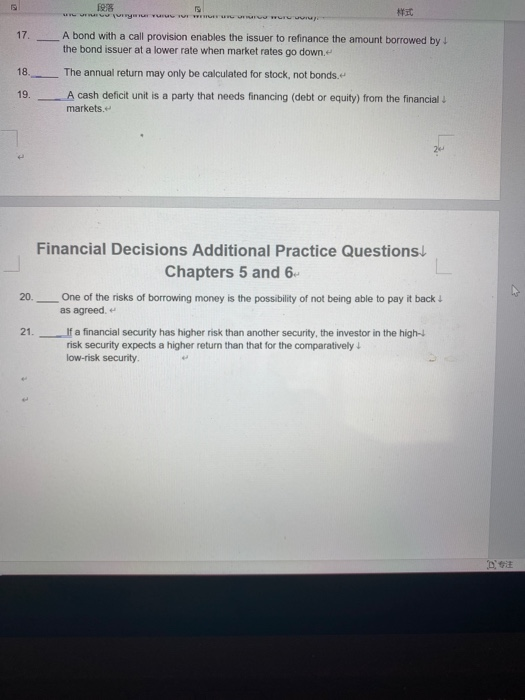

4922 #xt Multiple Choice. Please place the letter of your choice in the blank space. 1. The interest tax shield allows a corporation to e a. pay interest to the government instead of a bank.e b. get an interest-free loan. C. deduct interest payments from its taxable income. d. only pay interest on a loan every other year. Which of the following is a counterargument to explaining the dilution of the market price of its stock after a corporation issues more shares by saying the same profits then need to be divided among more shares? a. Selling more shares should enable the corporation to invest the proceeds and increase net income. b. Stock has an interest tax shield. C. All stock transactions are regulated by the SEC. d. Stock is a debt instrumente A bond that has a call provision provides more risk to the of getting paid off early when reinvestment rates for the same type of bond would be lower a. bond issuere b. bond investor C. government d. community What type of instrument is a bond? a. equity b. debt c. Neither of the above answers is correct 5. Most bonds are -rate instruments. a. fixede b. variable 6. Under the threat of bankruptcy, a company may experience: a. lost market share. b. difficulty obtaining loans. C. high turnover of staff. d. All of the above answers are correcte Please fill in the blanks. 7. The fee an investment bank earns per share sold in stock issuance is called the Preferred stock before common stockholders. is a class of stock that has the right to receive dividends 9. In order to pay dividends a corporation needs its board of directors approval, enough net income, and enough - have a great deal of money to invest, often from other wealthy investors, in new businesses as an equity holder and manager for several years. 11. A company that invests in a troubled business as an equity holder and manager is called a Please mark "T" for true or "F" for false in space next to each statement. 12. If a company experiences distress or indirect costs, it must later go bankrupt. All stock must have a maturity date. Shelf registration is what a startup business uses to raise capital The par value of common stock historically serves the purpose as being a minimum amount for which a share of a corporation's stock must be sold. The market price of a corporation's shares is not always equal to the book value of the shares (original value for which the shares were sold). A bond with a call provision enables the issuer to refinance the amount borrowed by the bond issuer at a lower rate when market rates go down The annual return may only be calculated for stock, not bonds. 19 A cash deficit unit is a party that needs financing (debt or equity) from the financial markets. fo = A bond with a call provision enables the issuer to refinance the amount borrowed by the bond issuer at a lower rate when market rates go down The annual return may only be calculated for stock, not bonds. A cash deficit unit is a party that needs financing (debt or equity) from the financial markets. t Financial Decisions Additional Practice Questions Chapters 5 and 6 20. _ One of the risks of borrowing money is the possibility of not being able to pay it back! as agreed. 21. If a financial security has higher risk than another security, the investor in the high- risk security expects a higher return than that for the comparatively! low-risk security D