Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4a. Assume that the rate of inflation is 6%, use the Net Present Value (NPV), approach to calculate the NPV for both projects. Which project

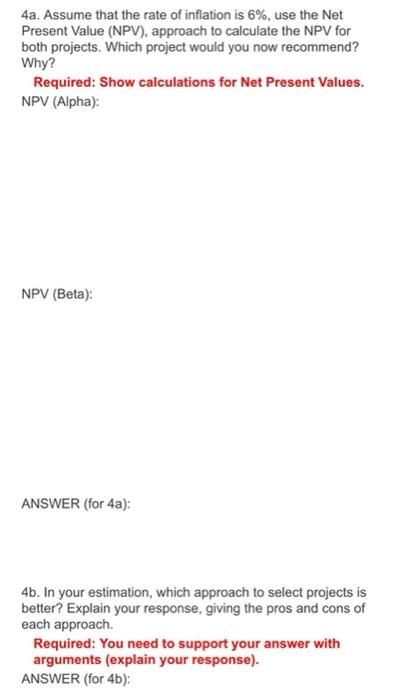

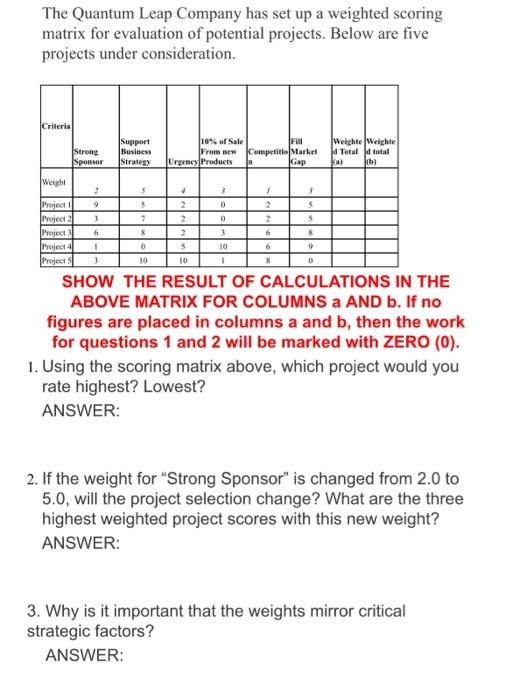

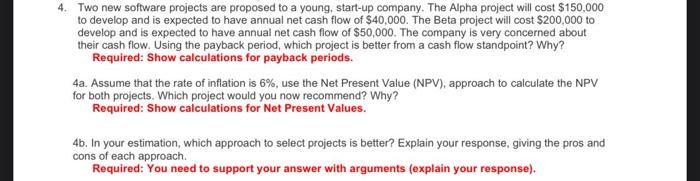

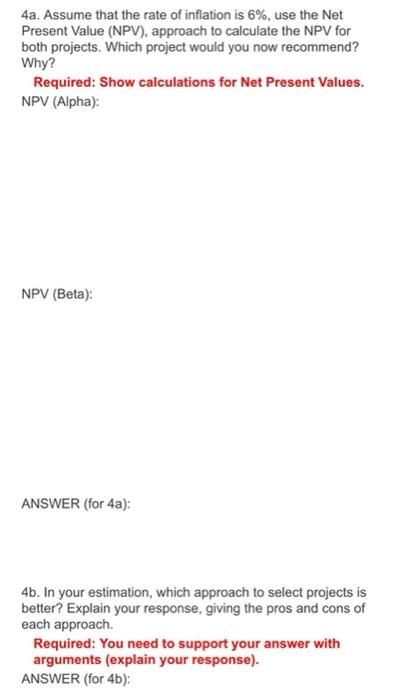

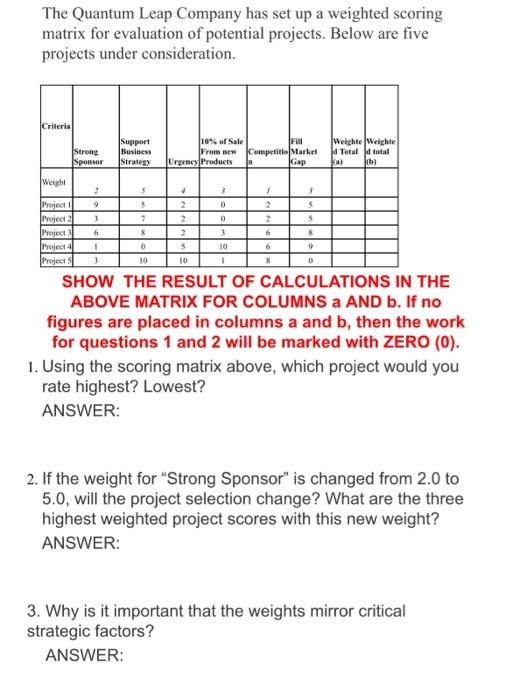

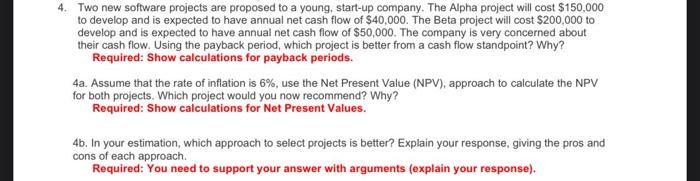

4a. Assume that the rate of inflation is 6%, use the Net Present Value (NPV), approach to calculate the NPV for both projects. Which project would you now recommend? Why? Required: Show calculations for Net Present Values. NPV (Alpha): NPV (Beta): ANSWER (for 4a); 4b. In your estimation, which approach to select projects is better? Explain your response, giving the pros and cons of each approach. Required: You need to support your answer with arguments (explain your response). ANSWER (for 4b): The Quantum Leap Company has set up a weighted scoring matrix for evaluation of potential projects. Below are five projects under consideration. Criteria Strong Sponsor Support ( Business Strategy 10% of Sale Full From new CompetitioMarket Urgency Products Gap Weight Weight Total ld total a) th) Weight 5 4 3 2 o 1 2 $ 0 5 s 1 7 2 0 2 Project Project 2 Project 3 Project 4 Projects 6 3 6 8 0 R 9 1 s 10 6 10 10 1 & SHOW THE RESULT OF CALCULATIONS IN THE ABOVE MATRIX FOR COLUMNS a AND b. If no figures are placed in columns a and b, then the work for questions 1 and 2 will be marked with ZERO (O). 1. Using the scoring matrix above, which project would you rate highest? Lowest? ANSWER: 2. If the weight for "Strong Sponsor" is changed from 2.0 to 5.0, will the project selection change? What are the three highest weighted project scores with this new weight? ANSWER: 3. Why is it important that the weights mirror critical strategic factors? ANSWER: 4. Two new software projects are proposed to a young, start-up company. The Alpha project will cost $150,000 to develop and is expected to have annual net cash flow of $40,000. The Beta project will cost $200,000 to develop and is expected to have annual net cash flow of $50,000. The company is very concerned about their cash flow. Using the payback period, which project is better from a cash flow standpoint? Why? Required: Show calculations for payback periods. 4a. Assume that the rate of inflation is 6%, use the Net Present Value (NPV), approach to calculate the NPV for both projects. Which project would you now recommend? Why? Required: Show calculations for Net Present Values. 4b. In your estimation, which approach to select projects is better? Explain your response, giving the pros and cons of each approach. Required: You need to support your answer with arguments (explain your response)

4a. Assume that the rate of inflation is 6%, use the Net Present Value (NPV), approach to calculate the NPV for both projects. Which project would you now recommend? Why? Required: Show calculations for Net Present Values. NPV (Alpha): NPV (Beta): ANSWER (for 4a); 4b. In your estimation, which approach to select projects is better? Explain your response, giving the pros and cons of each approach. Required: You need to support your answer with arguments (explain your response). ANSWER (for 4b): The Quantum Leap Company has set up a weighted scoring matrix for evaluation of potential projects. Below are five projects under consideration. Criteria Strong Sponsor Support ( Business Strategy 10% of Sale Full From new CompetitioMarket Urgency Products Gap Weight Weight Total ld total a) th) Weight 5 4 3 2 o 1 2 $ 0 5 s 1 7 2 0 2 Project Project 2 Project 3 Project 4 Projects 6 3 6 8 0 R 9 1 s 10 6 10 10 1 & SHOW THE RESULT OF CALCULATIONS IN THE ABOVE MATRIX FOR COLUMNS a AND b. If no figures are placed in columns a and b, then the work for questions 1 and 2 will be marked with ZERO (O). 1. Using the scoring matrix above, which project would you rate highest? Lowest? ANSWER: 2. If the weight for "Strong Sponsor" is changed from 2.0 to 5.0, will the project selection change? What are the three highest weighted project scores with this new weight? ANSWER: 3. Why is it important that the weights mirror critical strategic factors? ANSWER: 4. Two new software projects are proposed to a young, start-up company. The Alpha project will cost $150,000 to develop and is expected to have annual net cash flow of $40,000. The Beta project will cost $200,000 to develop and is expected to have annual net cash flow of $50,000. The company is very concerned about their cash flow. Using the payback period, which project is better from a cash flow standpoint? Why? Required: Show calculations for payback periods. 4a. Assume that the rate of inflation is 6%, use the Net Present Value (NPV), approach to calculate the NPV for both projects. Which project would you now recommend? Why? Required: Show calculations for Net Present Values. 4b. In your estimation, which approach to select projects is better? Explain your response, giving the pros and cons of each approach. Required: You need to support your answer with arguments (explain your response)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started