Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4a. Assume your financial advisor suggest it is time to take your lifetime retirement savings of $800,000 and purchase a retirement annuity that will

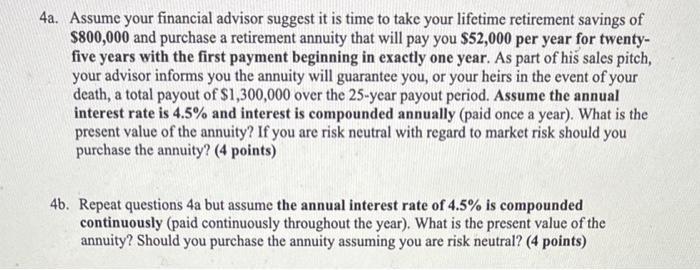

4a. Assume your financial advisor suggest it is time to take your lifetime retirement savings of $800,000 and purchase a retirement annuity that will pay you $52,000 per year for twenty- five years with the first payment beginning in exactly one year. As part of his sales pitch, your advisor informs you the annuity will guarantee you, or your heirs in the event of your death, a total payout of $1,300,000 over the 25-year payout period. Assume the annual interest rate is 4.5% and interest is compounded annually (paid once a year). What is the present value of the annuity? If you are risk neutral with regard to market risk should you purchase the annuity? (4 points) 4b. Repeat questions 4a but assume the annual interest rate of 4.5% is compounded continuously (paid continuously throughout the year). What is the present value of the annuity? Should you purchase the annuity assuming you are risk neutral? (4 points)

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the present value of the annuity we need to discount the future cash flows back to their present value using the given interest rate Lets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started