Answered step by step

Verified Expert Solution

Question

1 Approved Answer

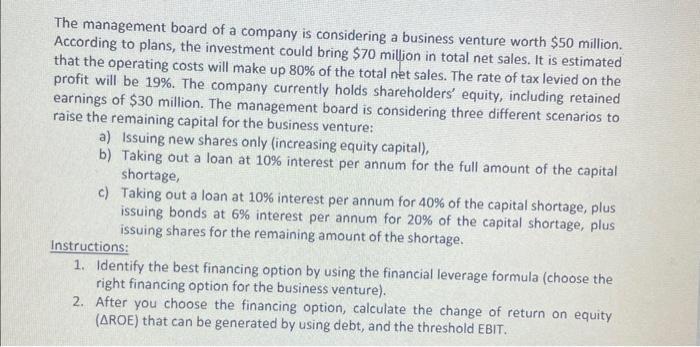

The management board of a company is considering a business venture worth $50 million. According to plans, the investment could bring $70 million in

The management board of a company is considering a business venture worth $50 million. According to plans, the investment could bring $70 million in total net sales. It is estimated that the operating costs will make up 80% of the total net sales. The rate of tax levied on the profit will be 19%. The company currently holds shareholders' equity, including retained earnings of $30 million. The management board is considering three different scenarios to raise the remaining capital for the business venture: a) Issuing new shares only (increasing equity capital), b) Taking out a loan at 10% interest per annum for the full amount of the capital. shortage, c) Taking out a loan at 10% interest per annum for 40% of the capital shortage, plus issuing bonds at 6% interest per annum for 20% of the capital shortage, plus issuing shares for the remaining amount of the shortage. Instructions: 1. Identify the best financing option by using the financial leverage formula (choose the right financing option for the business venture). 2. After you choose the financing option, calculate the change of return on equity (AROE) that can be generated by using debt, and the threshold EBIT.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To identify the best financing option for the business venture we can calculate the financial leverage for each option and choose the one that provides the highest leverage Financial leverage is calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started