Answered step by step

Verified Expert Solution

Question

1 Approved Answer

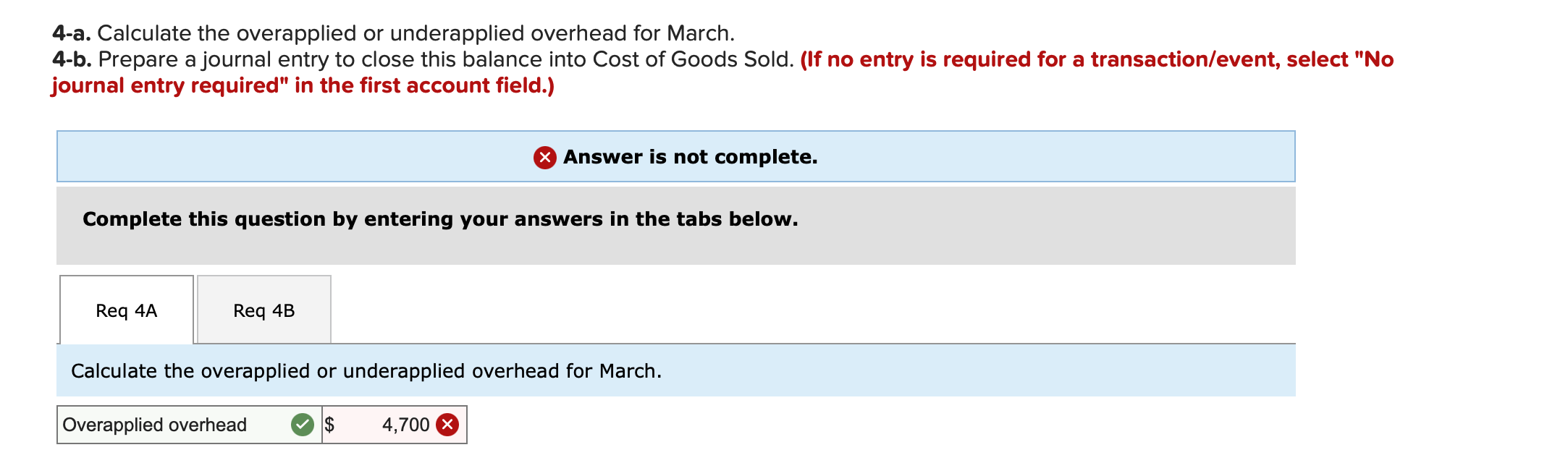

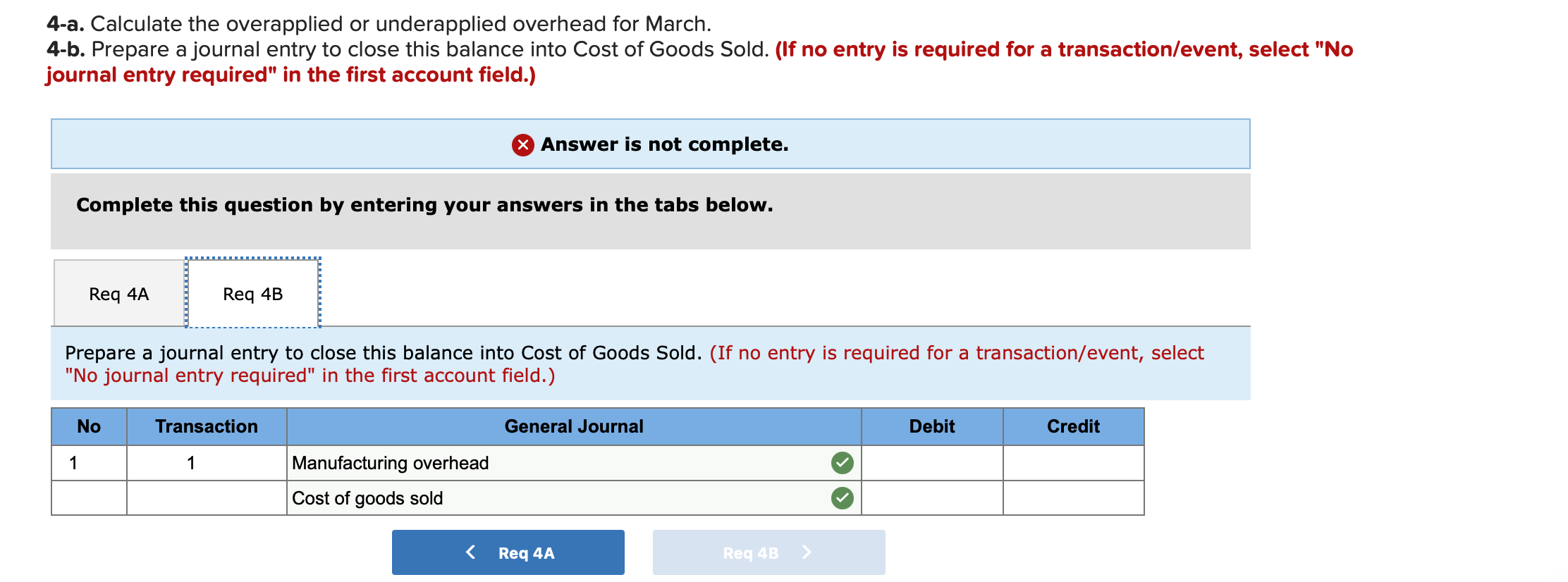

4-a. Calculate the overapplied or underapplied overhead for March. 4-b. Prepare a journal entry to close this balance into Cost of Goods Sold. (If no

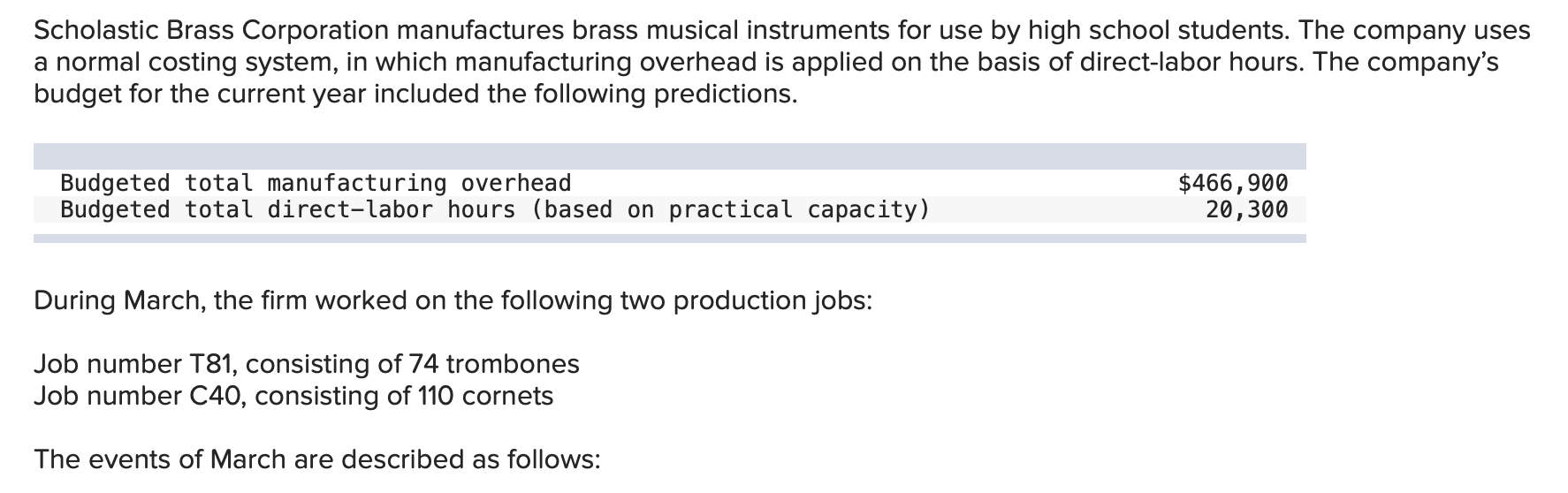

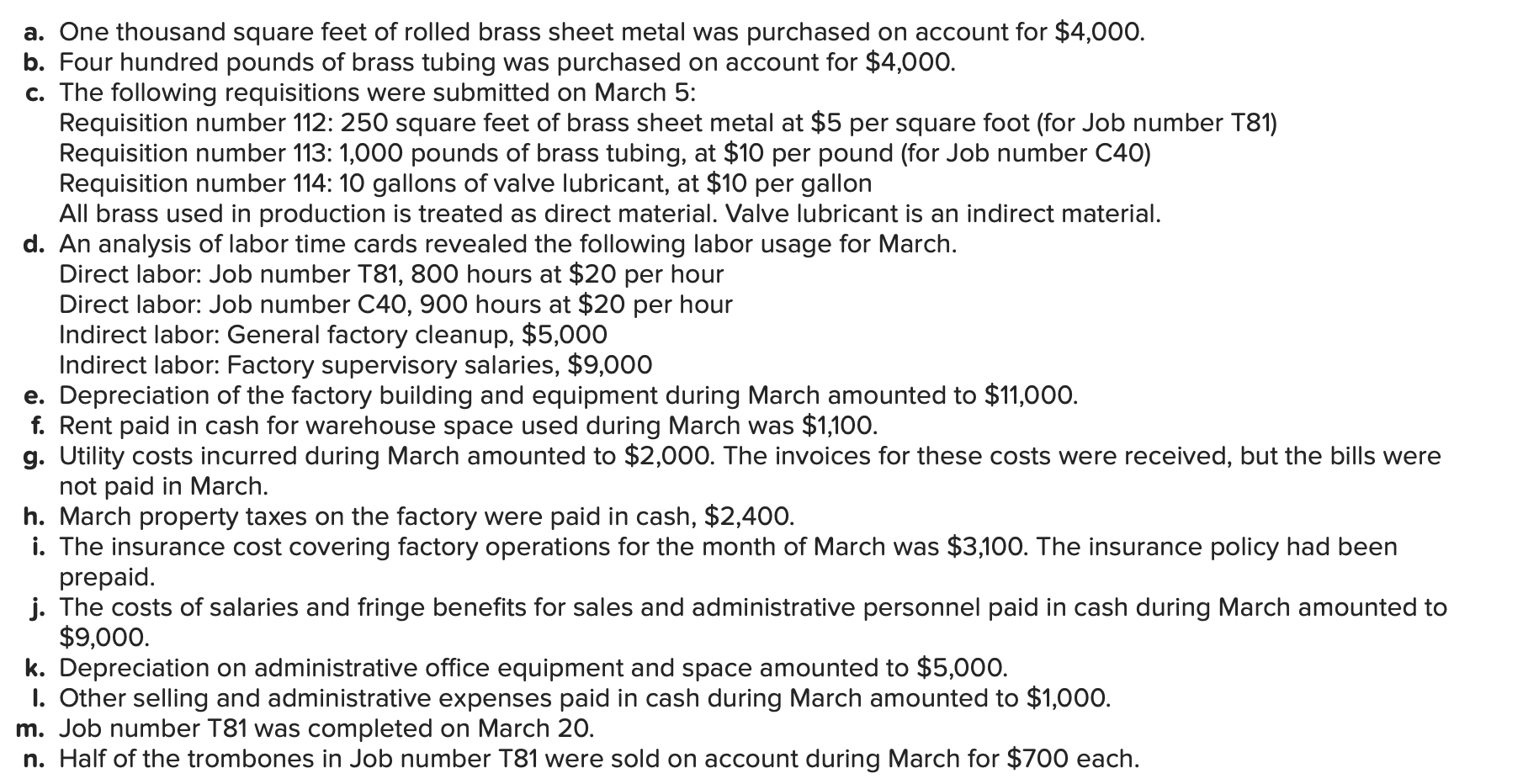

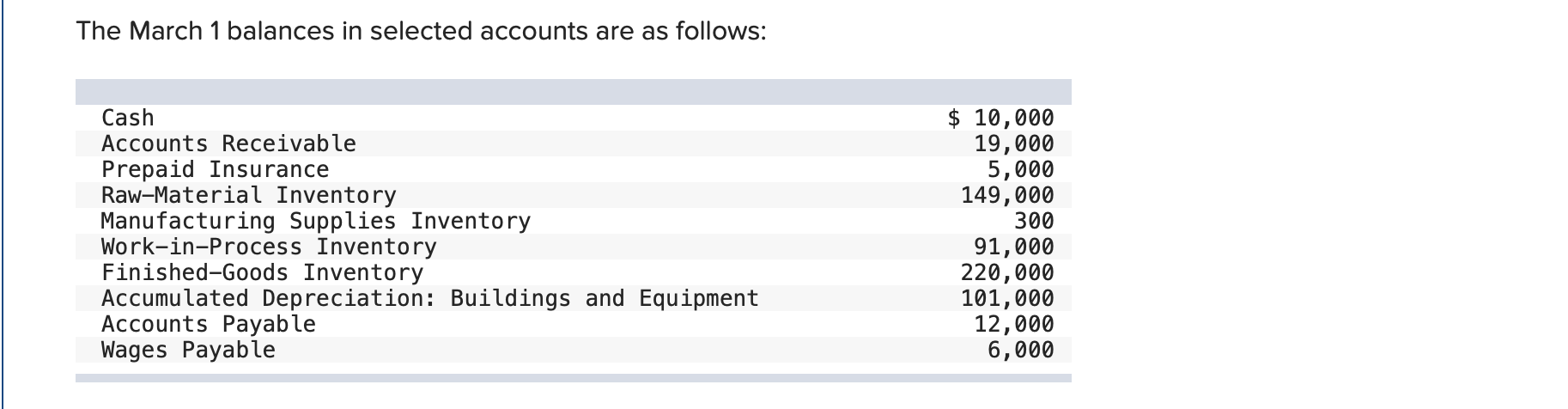

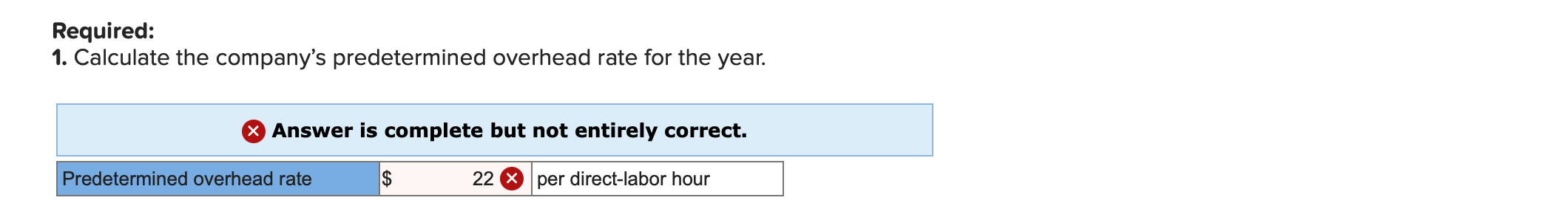

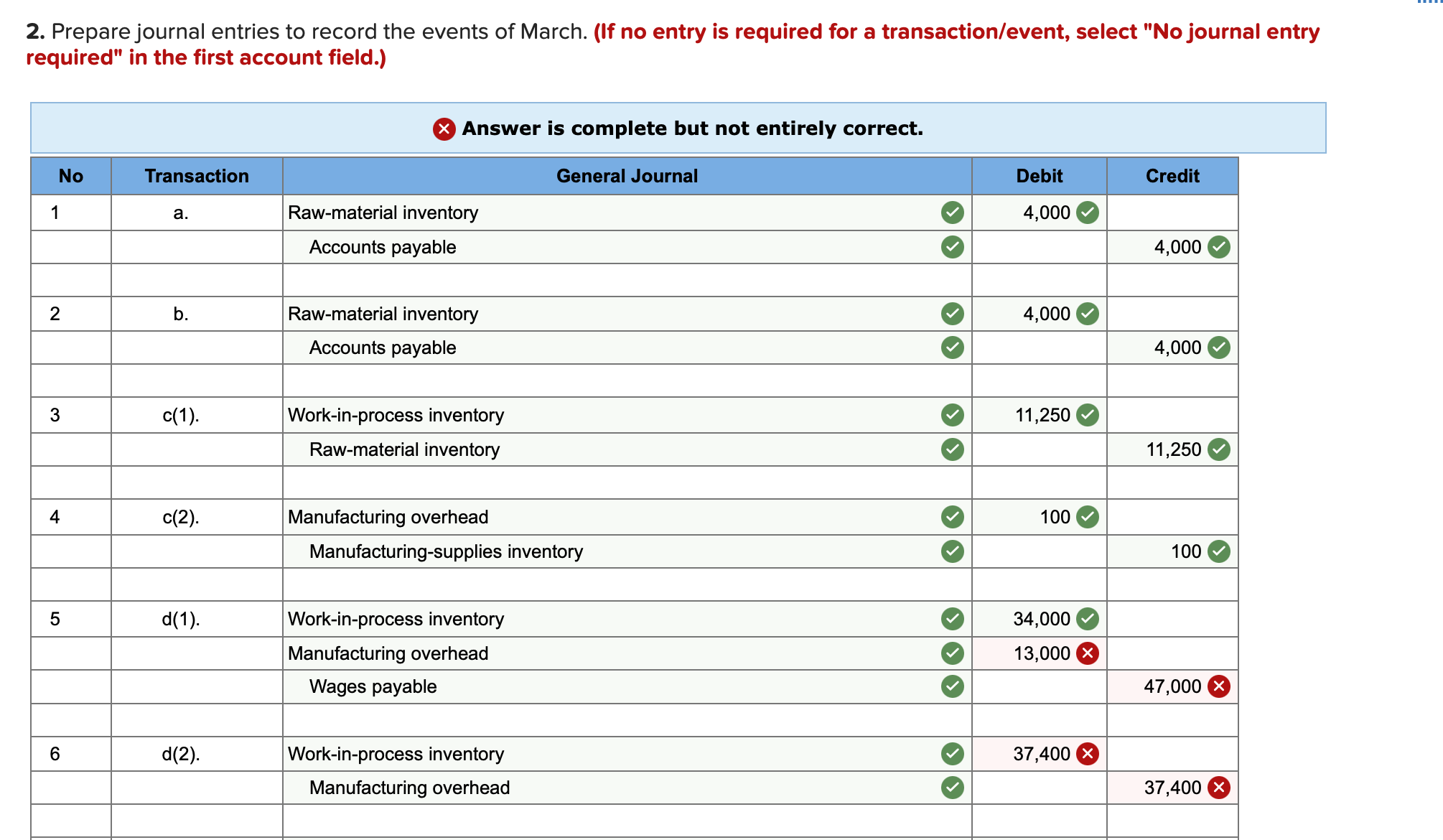

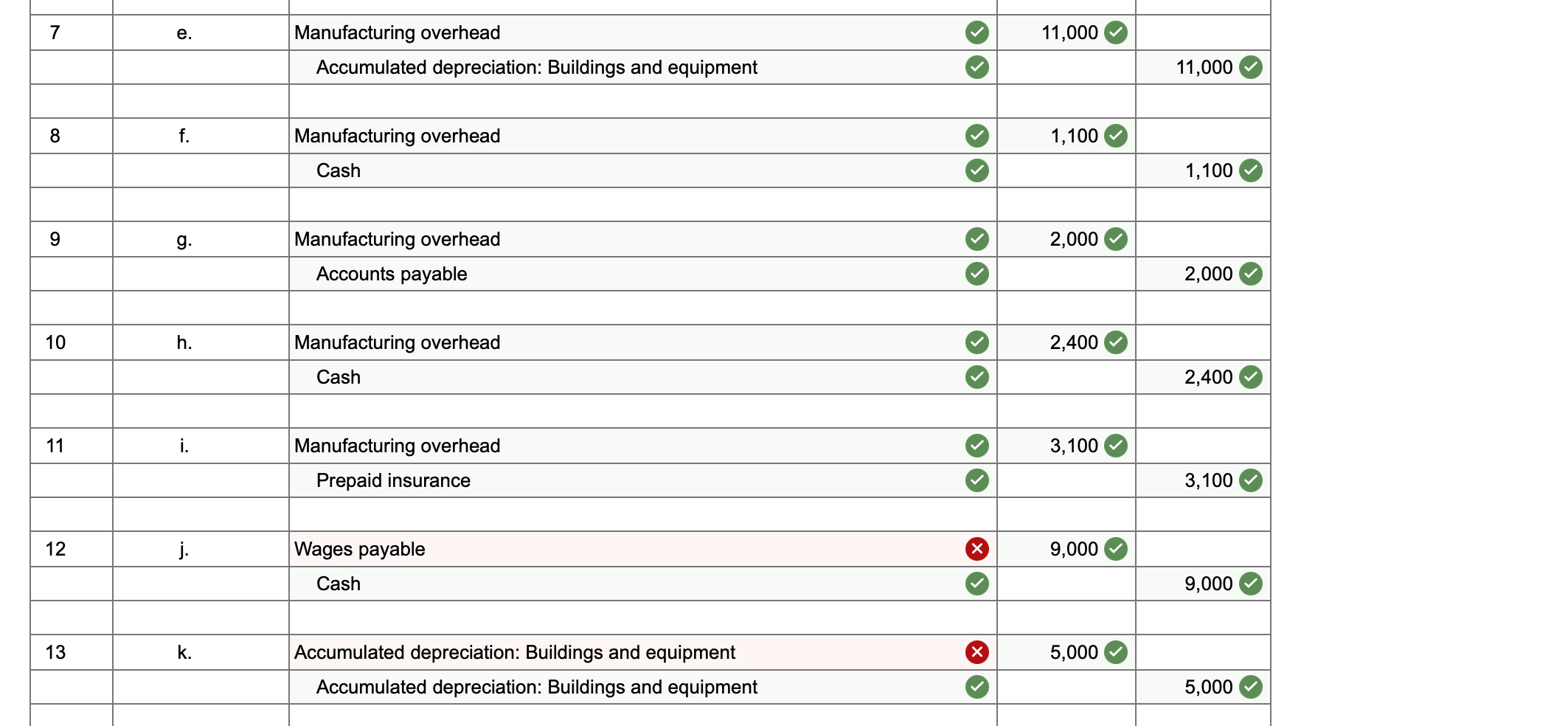

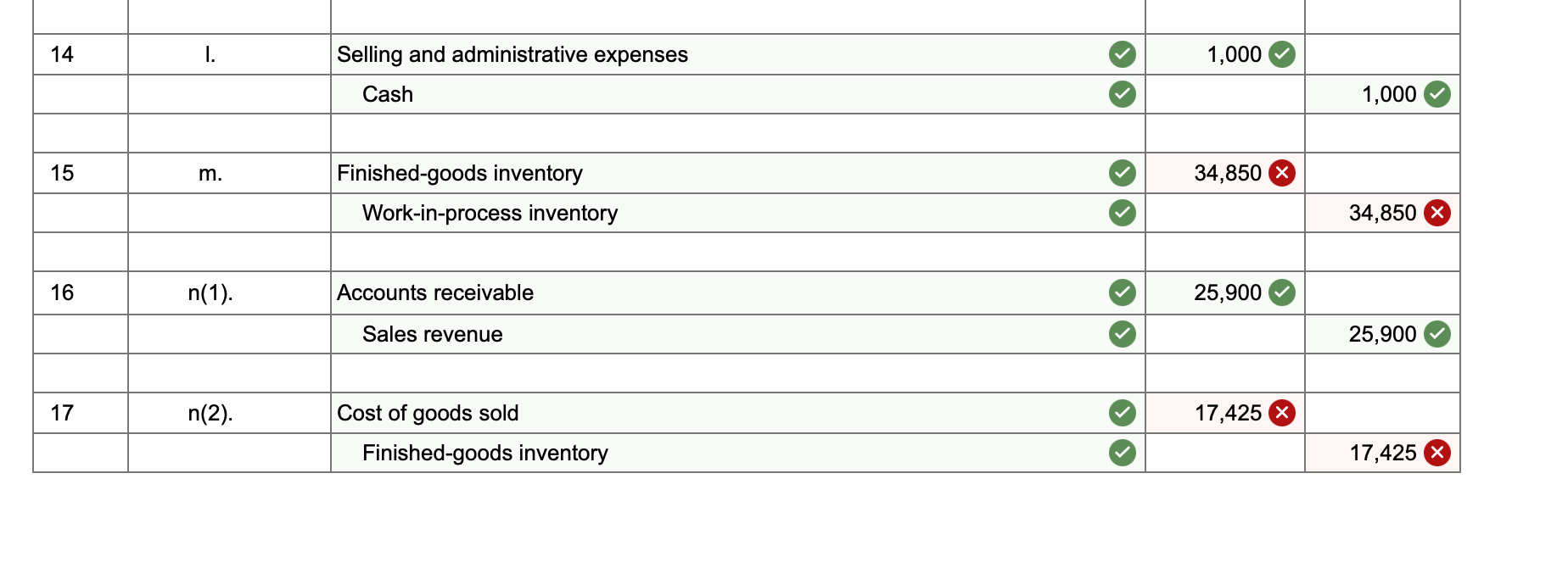

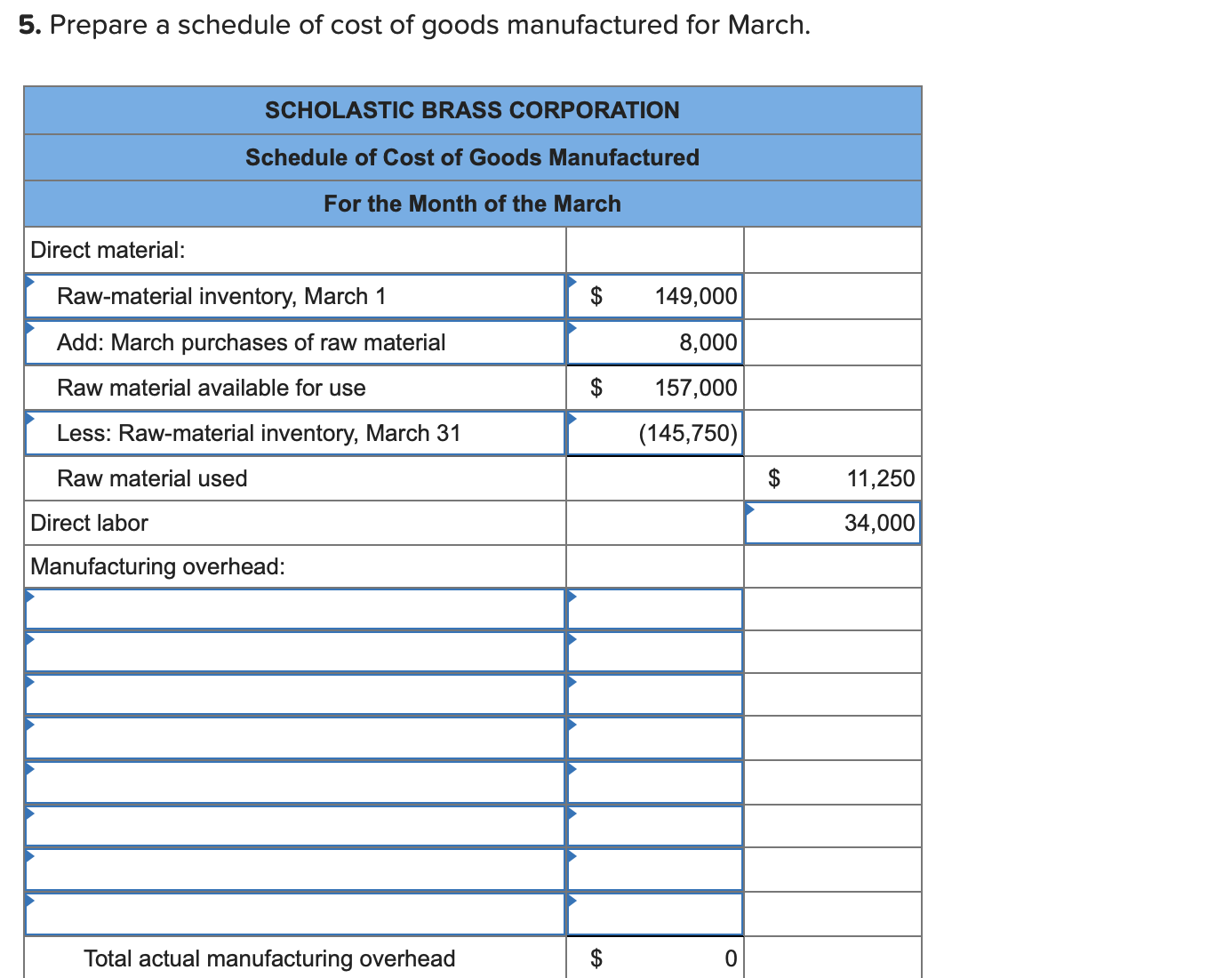

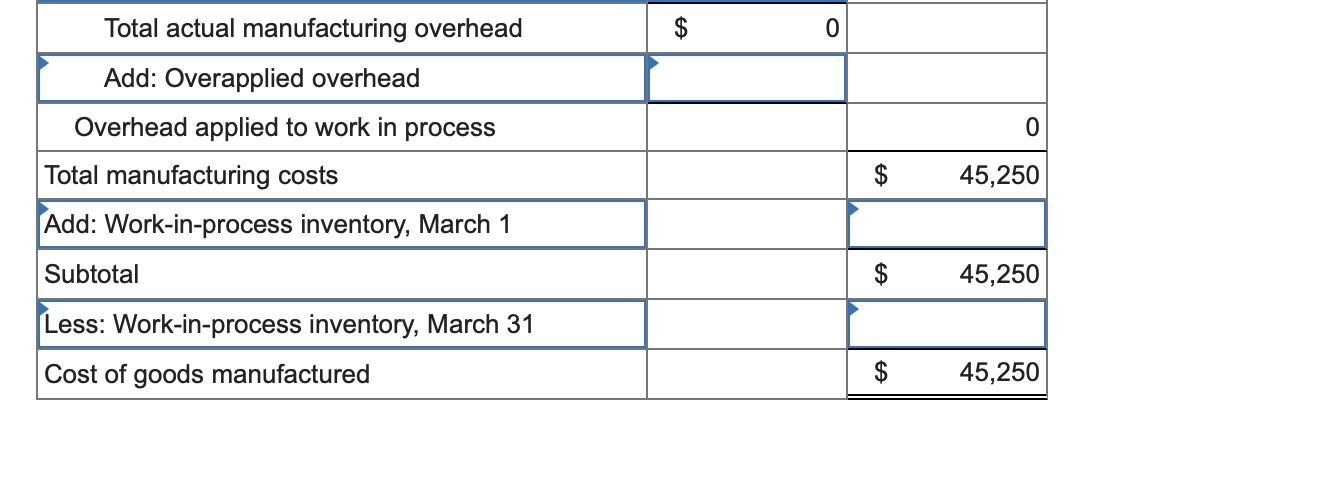

4-a. Calculate the overapplied or underapplied overhead for March. 4-b. Prepare a journal entry to close this balance into Cost of Goods Sold. (If no entry is required for a transaction/event, select " journal entry required" in the first account field.) Answer is not complete. Complete this question by entering your answers in the tabs below. Calculate the overapplied or underapplied overhead for March. Required: 1. Calculate the company's predetermined overhead rate for the year. The March 1 balances in selected accounts are as follows: Scholastic Brass Corporation manufactures brass musical instruments for use by high school students. The company uses a normal costing system, in which manufacturing overhead is applied on the basis of direct-labor hours. The company's budget for the current year included the following predictions. During March, the firm worked on the following two production jobs: Job number T81, consisting of 74 trombones Job number C40, consisting of 110 cornets The events of March are described as follows: 5. Prepare a schedule of cost of goods manufactured for March. 2. Prepare journal entries to record the events of March. (If no entry is required for a transaction/event, select "No journal ent) equired" in the first account field.) 4-a. Calculate the overapplied or underapplied overhead for March. 4-b. Prepare a journal entry to close this balance into Cost of Goods Sold. (If no entry is required for a transaction/event, select " journal entry required" in the first account field.) Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a journal entry to close this balance into Cost of Goods Sold. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. One thousand square feet of rolled brass sheet metal was purchased on account for $4,000. b. Four hundred pounds of brass tubing was purchased on account for $4,000. c. The following requisitions were submitted on March 5: Requisition number 112: 250 square feet of brass sheet metal at $5 per square foot (for Job number T81) Requisition number 113: 1,000 pounds of brass tubing, at $10 per pound (for Job number C40 ) Requisition number 114: 10 gallons of valve lubricant, at $10 per gallon All brass used in production is treated as direct material. Valve lubricant is an indirect material. d. An analysis of labor time cards revealed the following labor usage for March. Direct labor: Job number T81, 800 hours at $20 per hour Direct labor: Job number C40, 900 hours at $20 per hour Indirect labor: General factory cleanup, $5,000 Indirect labor: Factory supervisory salaries, $9,000 e. Depreciation of the factory building and equipment during March amounted to $11,000. f. Rent paid in cash for warehouse space used during March was $1,100. g. Utility costs incurred during March amounted to $2,000. The invoices for these costs were received, but the bills were not paid in March. h. March property taxes on the factory were paid in cash, $2,400. i. The insurance cost covering factory operations for the month of March was $3,100. The insurance policy had been prepaid. j. The costs of salaries and fringe benefits for sales and administrative personnel paid in cash during March amounted to $9,000. k. Depreciation on administrative office equipment and space amounted to $5,000. I. Other selling and administrative expenses paid in cash during March amounted to $1,000. m. Job number T81 was completed on March 20. n. Half of the trombones in Job number T81 were sold on account during March for $700 each. \begin{tabular}{|l|r|r|} \hline \multicolumn{1}{|c|}{ Total actual manufacturing overhead } & $ & 0 \\ \hline \multicolumn{1}{|c|}{ Add: Overapplied overhead } & & \\ \hline Overhead applied to work in process & & \\ \hline Total manufacturing costs & & $45,250 \\ \hline Add: Work-in-process inventory, March 1 & & \\ \hline Subtotal & & $45,250 \\ \hline Less: Work-in-process inventory, March 31 & & \\ \hline Cost of goods manufactured & & $45,250 \\ \hline \end{tabular}

4-a. Calculate the overapplied or underapplied overhead for March. 4-b. Prepare a journal entry to close this balance into Cost of Goods Sold. (If no entry is required for a transaction/event, select " journal entry required" in the first account field.) Answer is not complete. Complete this question by entering your answers in the tabs below. Calculate the overapplied or underapplied overhead for March. Required: 1. Calculate the company's predetermined overhead rate for the year. The March 1 balances in selected accounts are as follows: Scholastic Brass Corporation manufactures brass musical instruments for use by high school students. The company uses a normal costing system, in which manufacturing overhead is applied on the basis of direct-labor hours. The company's budget for the current year included the following predictions. During March, the firm worked on the following two production jobs: Job number T81, consisting of 74 trombones Job number C40, consisting of 110 cornets The events of March are described as follows: 5. Prepare a schedule of cost of goods manufactured for March. 2. Prepare journal entries to record the events of March. (If no entry is required for a transaction/event, select "No journal ent) equired" in the first account field.) 4-a. Calculate the overapplied or underapplied overhead for March. 4-b. Prepare a journal entry to close this balance into Cost of Goods Sold. (If no entry is required for a transaction/event, select " journal entry required" in the first account field.) Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a journal entry to close this balance into Cost of Goods Sold. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) a. One thousand square feet of rolled brass sheet metal was purchased on account for $4,000. b. Four hundred pounds of brass tubing was purchased on account for $4,000. c. The following requisitions were submitted on March 5: Requisition number 112: 250 square feet of brass sheet metal at $5 per square foot (for Job number T81) Requisition number 113: 1,000 pounds of brass tubing, at $10 per pound (for Job number C40 ) Requisition number 114: 10 gallons of valve lubricant, at $10 per gallon All brass used in production is treated as direct material. Valve lubricant is an indirect material. d. An analysis of labor time cards revealed the following labor usage for March. Direct labor: Job number T81, 800 hours at $20 per hour Direct labor: Job number C40, 900 hours at $20 per hour Indirect labor: General factory cleanup, $5,000 Indirect labor: Factory supervisory salaries, $9,000 e. Depreciation of the factory building and equipment during March amounted to $11,000. f. Rent paid in cash for warehouse space used during March was $1,100. g. Utility costs incurred during March amounted to $2,000. The invoices for these costs were received, but the bills were not paid in March. h. March property taxes on the factory were paid in cash, $2,400. i. The insurance cost covering factory operations for the month of March was $3,100. The insurance policy had been prepaid. j. The costs of salaries and fringe benefits for sales and administrative personnel paid in cash during March amounted to $9,000. k. Depreciation on administrative office equipment and space amounted to $5,000. I. Other selling and administrative expenses paid in cash during March amounted to $1,000. m. Job number T81 was completed on March 20. n. Half of the trombones in Job number T81 were sold on account during March for $700 each. \begin{tabular}{|l|r|r|} \hline \multicolumn{1}{|c|}{ Total actual manufacturing overhead } & $ & 0 \\ \hline \multicolumn{1}{|c|}{ Add: Overapplied overhead } & & \\ \hline Overhead applied to work in process & & \\ \hline Total manufacturing costs & & $45,250 \\ \hline Add: Work-in-process inventory, March 1 & & \\ \hline Subtotal & & $45,250 \\ \hline Less: Work-in-process inventory, March 31 & & \\ \hline Cost of goods manufactured & & $45,250 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started