Answered step by step

Verified Expert Solution

Question

1 Approved Answer

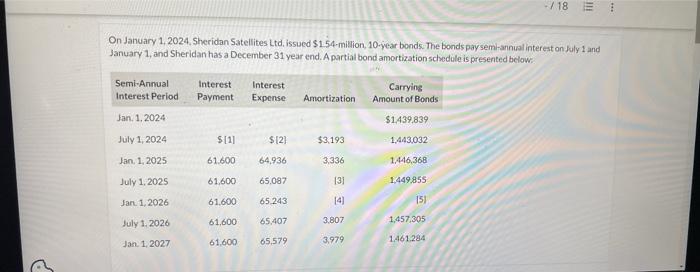

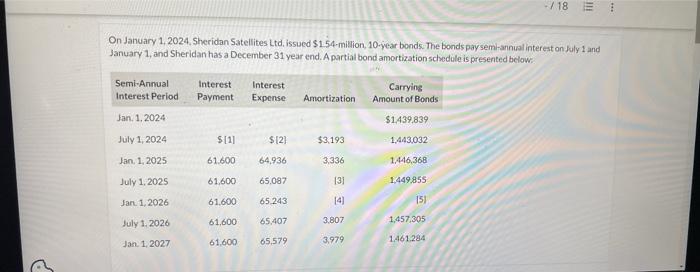

4b On January 1, 2024, Sheridan Satellites Ltd, issued $1 54 -million, 10-year bonds. The bonds pay semirannual interest on faly 1 and January 1

4b

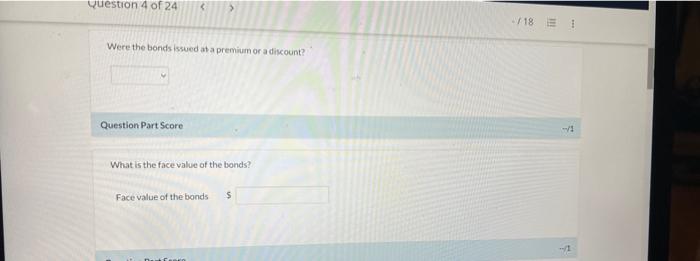

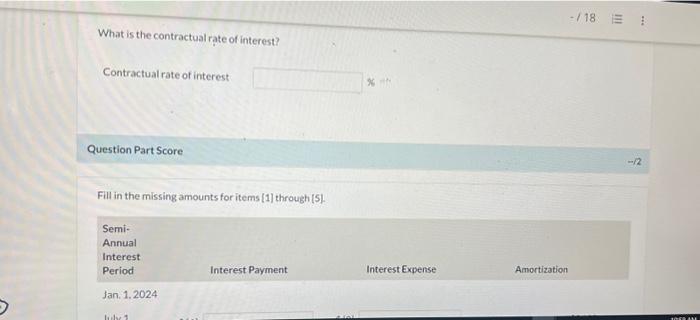

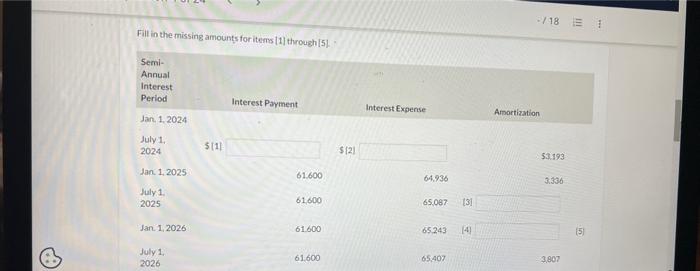

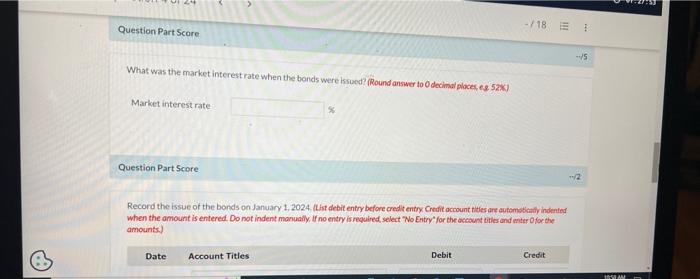

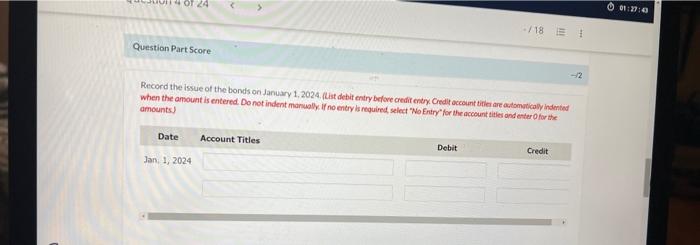

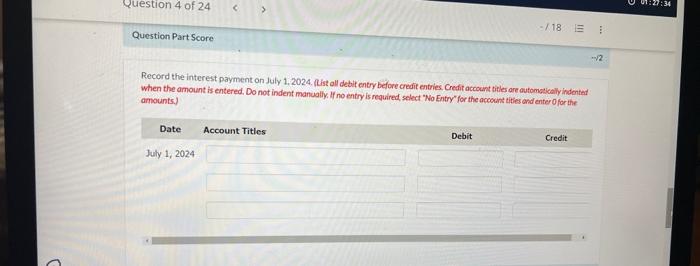

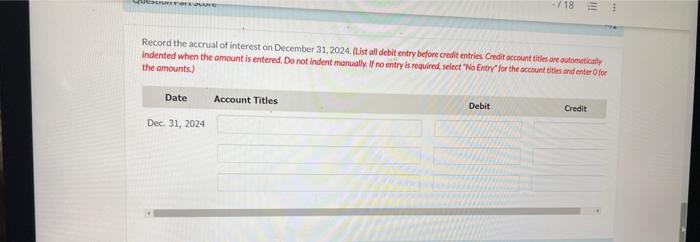

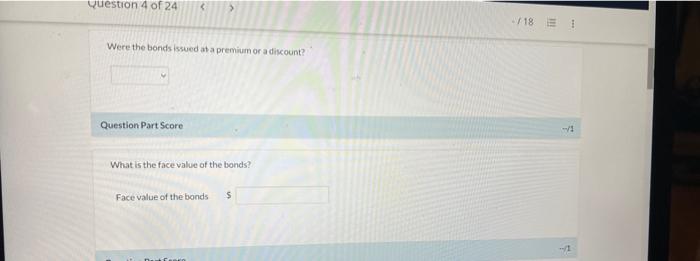

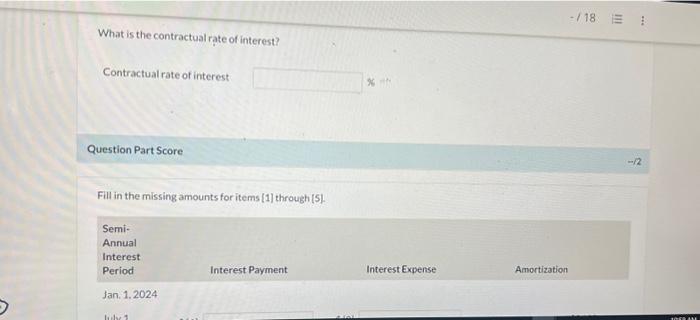

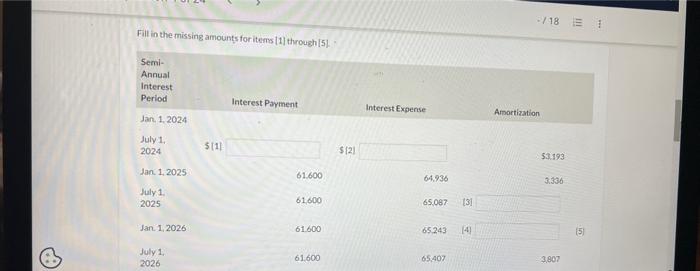

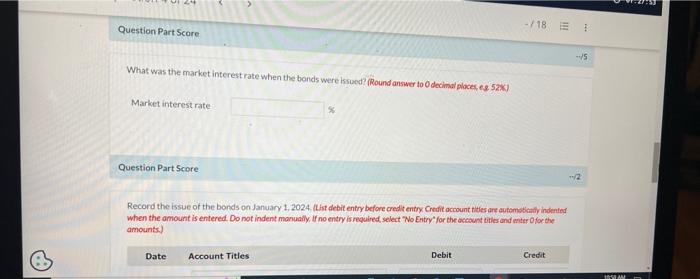

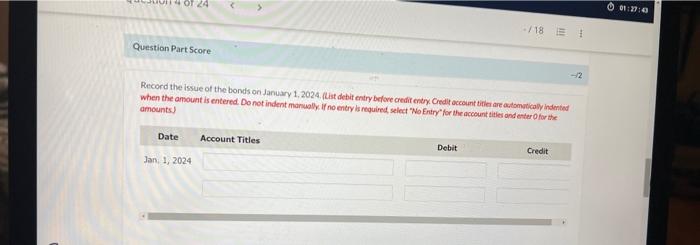

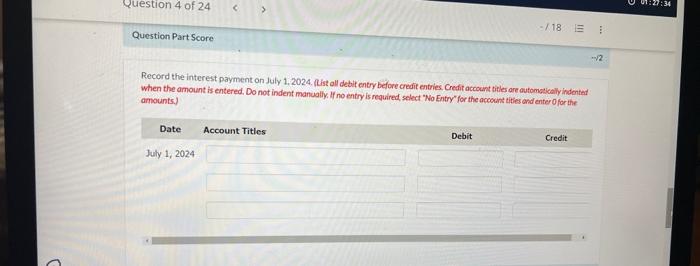

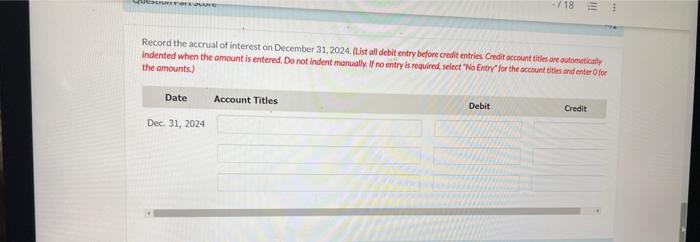

On January 1, 2024, Sheridan Satellites Ltd, issued \$1 54 -million, 10-year bonds. The bonds pay semirannual interest on faly 1 and January 1 , and Sheridan has a December 31 year end. A partial bond amortization schedule is presented below: Were the bonds issued at a premium or a discount? Question Part Score What is the face value of the bonds? Face value of the bonds What is the contractual rate of interest? Contractual rate of interest Question Part Score Fill in the missing amounts for items [1] through [5]. Fill in the missing amounts for items [1] throush |5]. What was the market interest rate when the bonds were issoed? (Round answer to O decinal plicec, es 521 Market interest rate: Question Part Score Record the issue of the bonds on January 1, 2024. (thst debit entry before credit entry Cretfit account tities are autemsticaily indented when the amount is entered. Do not indent monually, if no entry is required select "No Entry" for the account tities and miter Dfor the amounts.) Record the issuie of the bonds on January 1,2024, (List debit entry before credit entry. Credly occount titicr are aciomaticaly indentiad When the amount is entered. Do not indent manwally. If no entry ls required select "No Entry" for the account tities ond exter for the amounts) Record the interest payment on July 1,2024. #ist all debit entry before credit entries, Credit atcount titiles are outomstically indented When the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities ond enter of for the amounts.) Record the accrual of interest on December 31, 2024. (List all debit entry before credit entries. Credit occount tities are outomaticatly. indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titied and enter ofor the omounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started